MATIC Can Bounce Back If It Remains Above Bullish Order Block

MATIC is trying to recover on its daily chart, as it appreciated by 3% in the same time frame. The past week for the altcoin was negative as it lost more than 9% of its value. The broader market has also remained considerably volatile in the past few weeks, with Bitcoin falling into the $23,000 price zone.

Due to this, most major altcoins have also struggled to break past their immediate price ceilings. Likewise, the technical outlook of MATIC has also maintained a bearish outlook, but the chance of recovery cannot be ruled out.

Related Reading: Aave Declines, Vitals Levels To Keep An Eye On

Demand for the altcoin fell, but if buyers exert a slight push, MATIC could witness increased accumulation in the near term.

At the moment, it is important that MATIC remain above its immediate support level. By doing so, the coin will gain some stability, and bulls could start to take control.

The market capitalization of MATIC also fell, indicating that the number of sellers had increased at the time of writing.

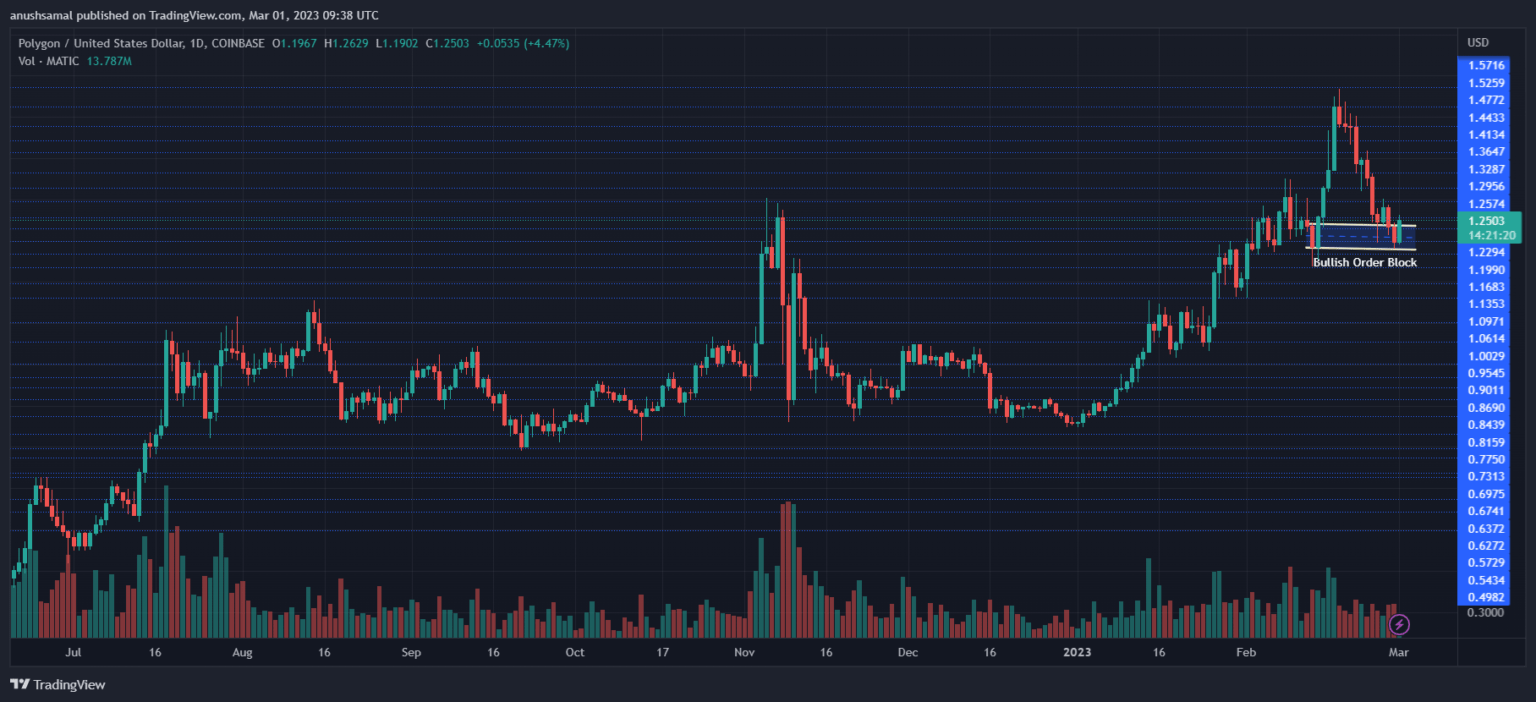

MATIC Price Analysis: One-Day Chart

The altcoin was trading at $1.26 at press time. The immediate resistance for MATIC was $1.29. If the altcoin is to recover, it needs to remain above the bullish order block. A bullish order block starts where the last bearish candle ends before the price starts to depict a turnaround.

The bullish order block stretched from $1.20-$1.22. This range has acted as a support region for the altcoin. MATIC has to trade above this range in order for the bearish thesis to be invalidated.

A fall from the $1.20 mark will take the coin straight to $1.17. This would cause the bears to gain strength. The amount of MATIC traded in the last session was green, which indicated that buyers might be attempting to return to the market.

Technical Analysis

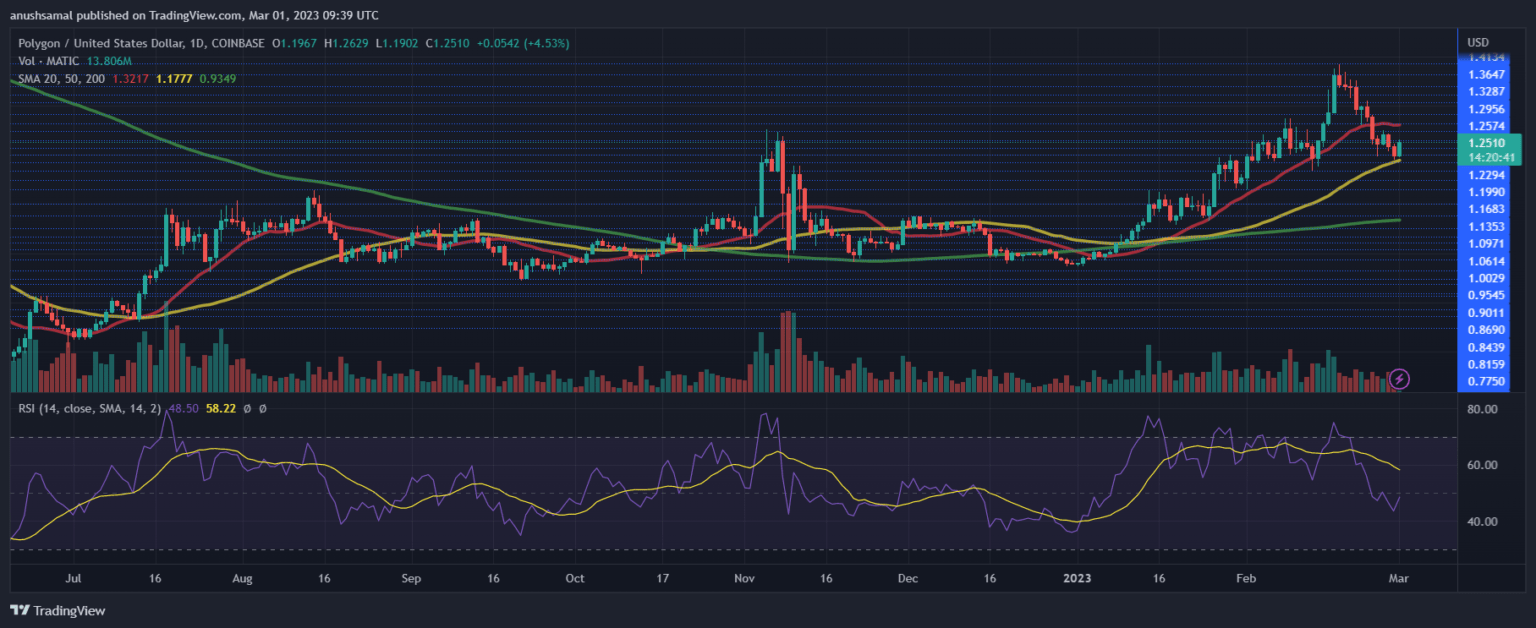

Although buying pressure was low, the altcoin began to show signs of recovery. The Relative Strength Index was still below its neutral zone, which meant that sellers had the upper hand. Although that was the case, buyers were trying to re-enter the market.

For buyers to take control, MATIC has to trade above $1.29. On the same note, MATIC’s price dropped below the 20-Simple Moving Average line (SMA) as sellers were still driving the price momentum on the chart.

Since the price was above the 50-SMA (yellow) line, it indicated that bullish momentum could slowly build up over successive trading sessions.

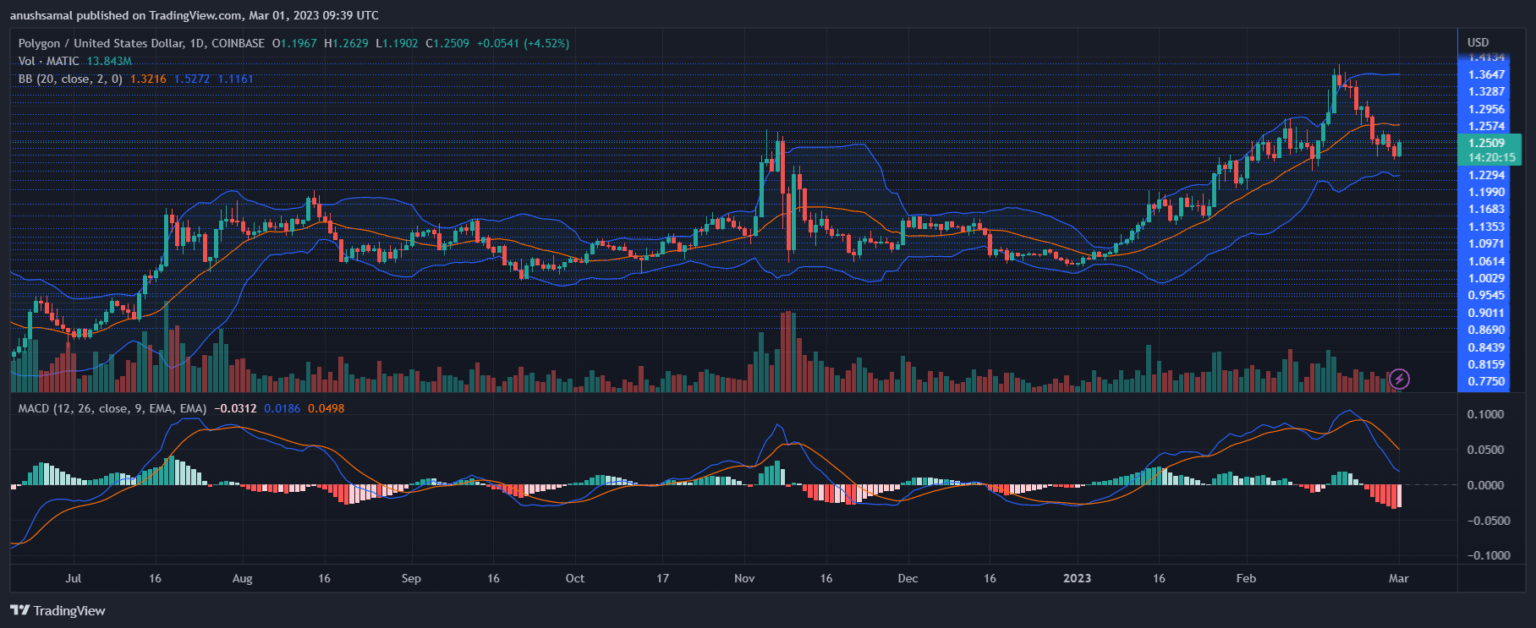

Other technical indicators have also pointed towards bearish signals. The Moving Average Convergence Divergence, which indicates the price momentum and the trend reversal had formed red histograms, which were the sell signals for the altcoin.

Related Reading: A Breakout Past This Level Can Make Fantom Touch $1

However, the red histograms were declining in size, which implied that the price was trying to recover. Bollinger bands measure the price volatility and fluctuation on the chart.

The bands were apart and parallel, indicating that there could be an incoming fluctuation. The subsequent trading session is crucial for MATIC’s price.

Featured Image From UnSplash, Charts From TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  TrueUSD

TrueUSD  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond  Ren

Ren  HUSD

HUSD