Polkadot Price Analysis: Are DOT Bears Strong Enough to Push it Below $5?

- 1 Polkadot recently announced partnership with Stellar to increase liquidity.

- 2 Technical indicators of DOT are favoring downside momentum. It has seen a drop of 1.77% in the intraday session.

Polkadot is a next-generation blockchain which uses sharding and facilitates crosschain transfer of various data sets and assets. Polkadot is designed to facilitate seamless interoperability between different ecosystems. It was developed by the Web3 Foundation. It was founded by Dr Gavin Wood. It can support multiple parallel chains which have unique features and characteristics. Polkadot has a sharded multichain network which gives it immense capacity in terms of scalability. The Polkadot main network has an average blocktime of 12s. DOT is also called 0 layer metaprotocol as it defines the format of layer 1 blockchains also called Para Chains.

On March 28, Polkadot announced a major partnership with stellar. The parntersip aims to increase liquidity and establish connection through the Space Walk bridge. It is also expected to increase the transaction speed of the network.

DOT has a market cap of $7.2 billion with a market dominance of 0.17%. DOT has an ROI of 122%. Volume of the asset price declined by 6% in the intraday session. The Volume to market cap ratio of DOT indicates a consolidation phase in the price movement.

DOT Bears Are Tightening Their Grip

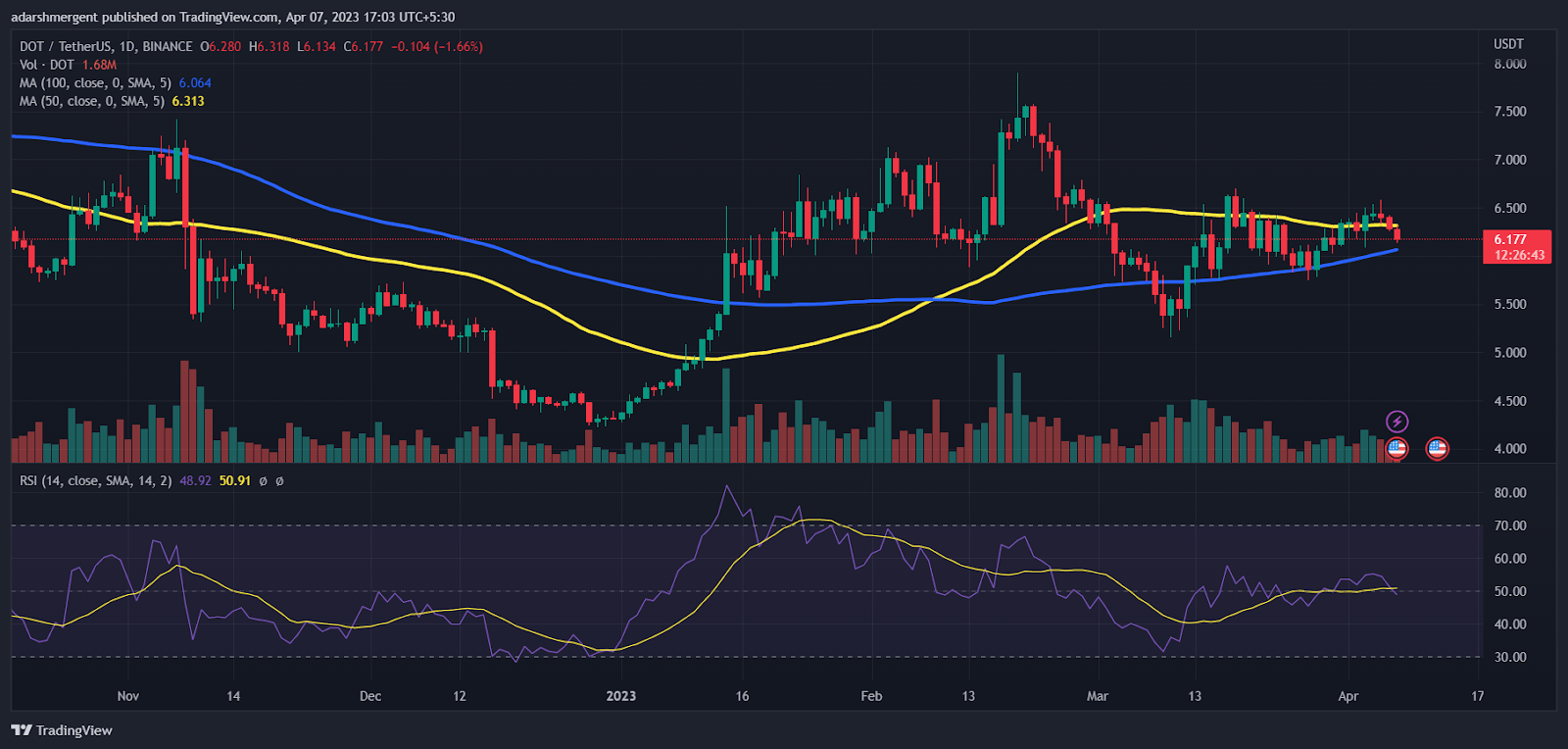

Source: Tradingview

Polkadot price action shows a prolonged tussle between the bulls and bears. It is currently down by more than 50% from its 90-day high. It is currently trading near the $6.2 level with a small drop in the intraday session. DOT has been forming strong bearish candle in the daily chart. The downside trend of Polkadot can see a halt near $5.25. Meanwhile, the resistance for the upside trend can be seen near $8. DOT has seen a negative crossover in the 50 DMA and could produce a downrend anytime. Also, the 100 DMA is near the $6 level which can act as a threshold for the price,

The RSI for DOT is near 50 with a downward slope. The overall momentum of RSI depicts a consolidated trend in price.

Conclusion

Late March, Polkadot partnered with Stellar to enhance their liquidity. DOT price action recently produced a negative crossover. The price is below the 50 day MA and right above the 100 day MA.

Technical Levels

Major Support:$5.5

Major Resistance:$8

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only, and they do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  LEO Token

LEO Token  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Dai

Dai  OKB

OKB  Gate

Gate  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Stacks

Stacks  Theta Network

Theta Network  Tether Gold

Tether Gold  Tezos

Tezos  Zcash

Zcash  IOTA

IOTA  TrueUSD

TrueUSD  Polygon

Polygon  NEO

NEO  Dash

Dash  Zilliqa

Zilliqa  Synthetix Network

Synthetix Network  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  DigiByte

DigiByte  Decred

Decred  Holo

Holo  Ravencoin

Ravencoin  Siacoin

Siacoin  Enjin Coin

Enjin Coin  NEM

NEM  Ontology

Ontology  Waves

Waves  Nano

Nano  Hive

Hive  Status

Status  Lisk

Lisk  Pax Dollar

Pax Dollar  Huobi

Huobi  Steem

Steem  Numeraire

Numeraire  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Gold

Bitcoin Gold  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  HUSD

HUSD