The Sandbox (SAND) is Breaking out, Decentraland (MANA) Could Soon Follow

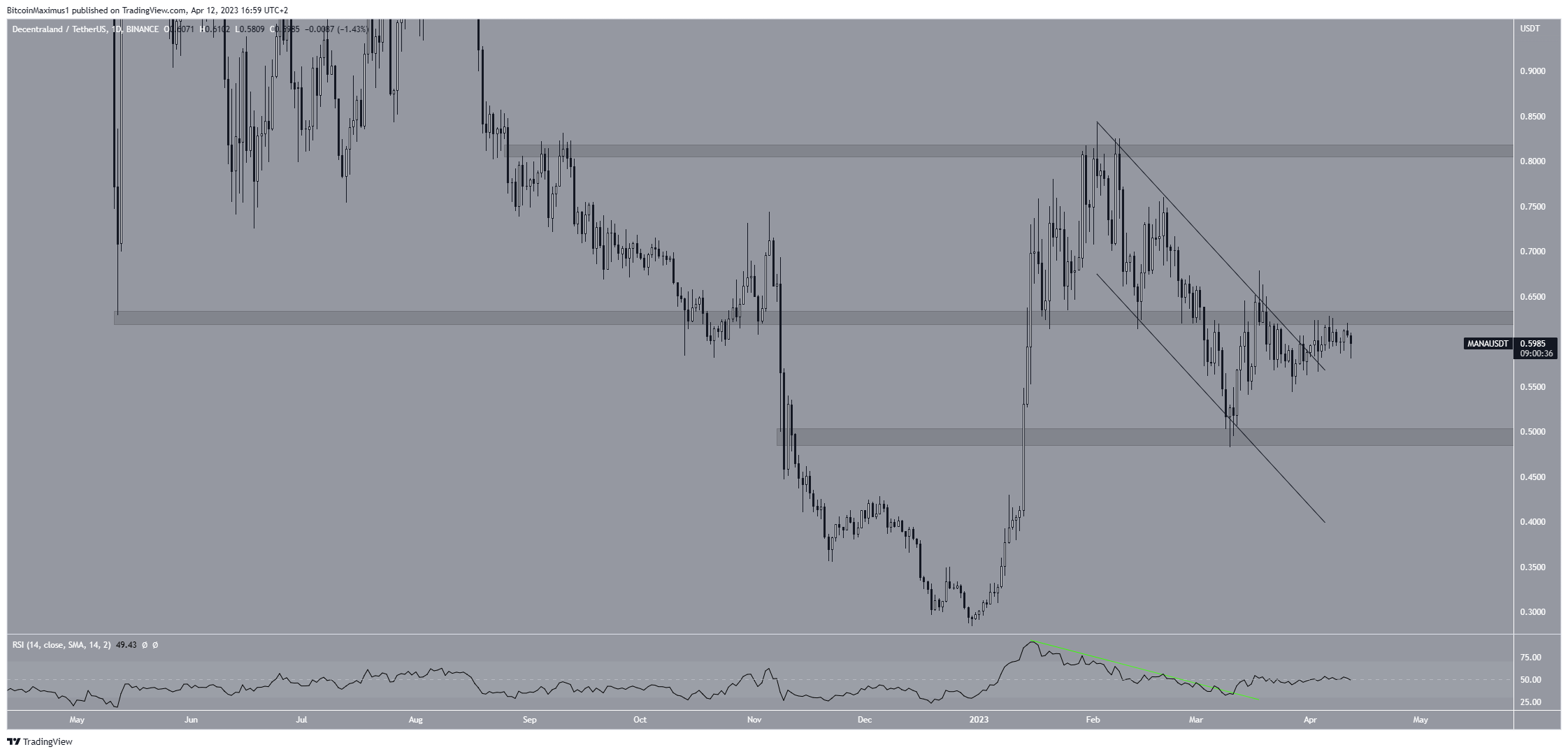

The Decentraland price had decreased inside a descending parallel channel since Feb. 2. Such channels usually contain corrective movements, meaning a bullish breakout would be expected.

On April 1, the MANA token price broke out from the channel. This succeeded a RSI breakout from its bearish divergence trendline (green line). However, the price failed to move above the $0.61 resistance area. Doing so is required for the trend to be considered bullish.

MANA/USDT Daily Chart. Source: TradingView

Even though the daily RSI has not moved above 50, the completed A-B-C correction (black) inside the channel suggests that a breakout from the $0.61 area is more likely than a rejection. In that case, the MANA price could increase to $0.82.

However, if a rejection occurs instead, a drop to the $0.50 support could follow.

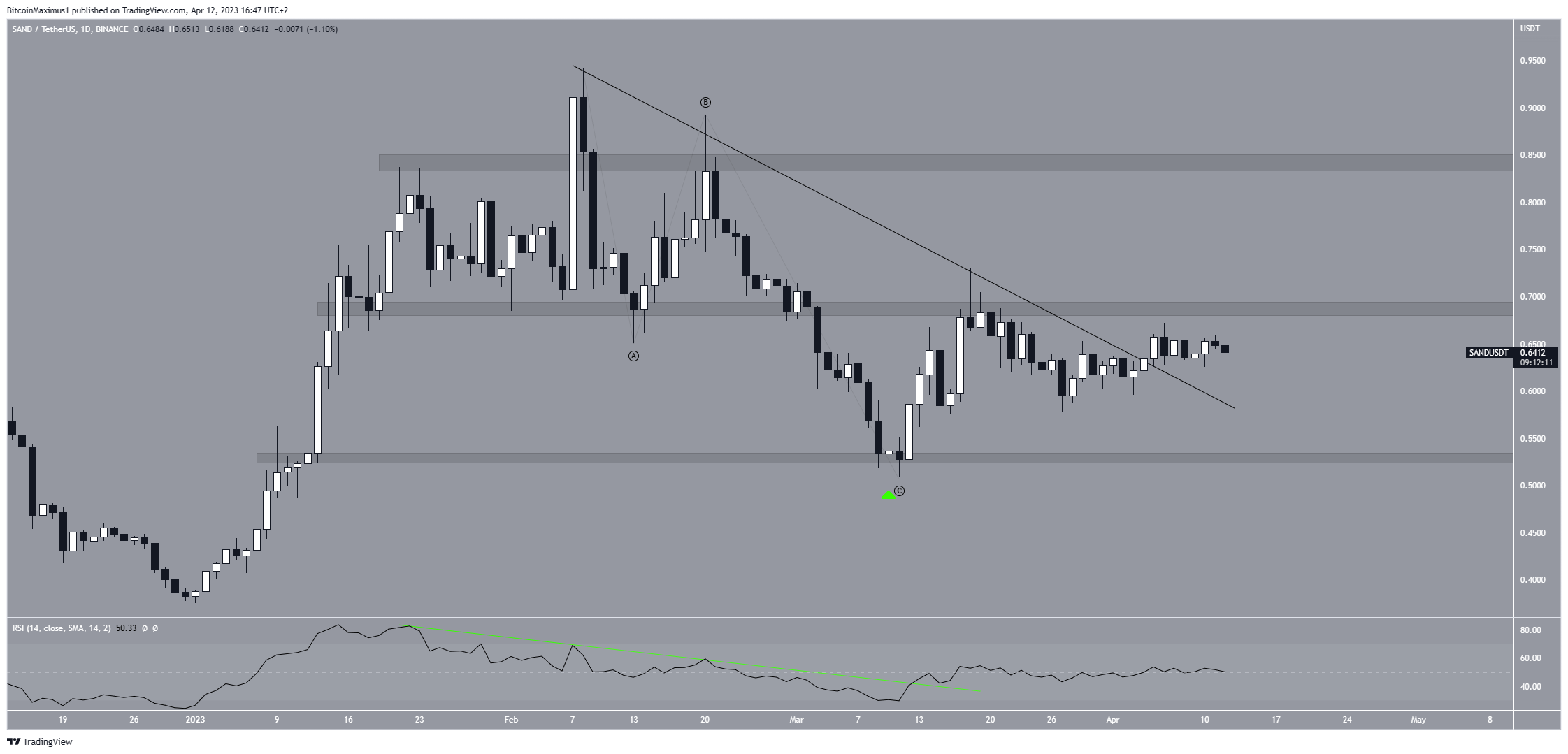

The technical analysis from the daily time frame shows that the Sandbox price has increased since March 11, when it bounced at the $0.53 horizontal support area (green icon). Shortly afterward, the daily RSI broke out from its bearish divergence trendline (green line). This is a sign that often precedes price breakouts.

As expected, the SAND price broke out from a descending resistance line on April 4. However, despite the breakout, it has yet to begin its rapid portion of the increase.

If the upward movement continues, there will be strong resistance at $0.69. This is the final resistance area before the $0.84 high. However, if the rally loses momentum, the SAND token price could fall to the descending resistance line and possibly drop to the $0.53 horizontal support region.

Similarly to MANA, the daily RSI is slightly above 50, a sign of an undetermined trend. However, the completed A-B-C correction and breakout from the resistance line make a breakout slightly more likely.

SAND/USDT Daily Chart. Source: TradingView

To conclude, SAND and MANA price trend is bullish, and an increase is expected in April. A rejection from their closest resistance areas could invalidate this bullish forecast and trigger a sharp drop.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Dai

Dai  Stacks

Stacks  Monero

Monero  Hedera

Hedera  OKB

OKB  Cosmos Hub

Cosmos Hub  Theta Network

Theta Network  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Gate

Gate  EOS

EOS  Polygon

Polygon  NEO

NEO  Tezos

Tezos  Tether Gold

Tether Gold  Zcash

Zcash  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Synthetix Network

Synthetix Network  TrueUSD

TrueUSD  Holo

Holo  Zilliqa

Zilliqa  Dash

Dash  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Enjin Coin

Enjin Coin  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Status

Status  DigiByte

DigiByte  Waves

Waves  Nano

Nano  Pax Dollar

Pax Dollar  Numeraire

Numeraire  Hive

Hive  Steem

Steem  Huobi

Huobi  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy