Are You Missing Out? 6 Highlights From CoinGecko’s Q1 Crypto Report

The first quarter of 2023 has been significant for the crypto industry, with the market making a strong comeback after a turbulent end of 2022. According to Coingecko’s first-quarter report, the crypto market has outperformed traditional assets, with Bitcoin leading the charge.

Crypto – The Best Performing Sector Of The Global Economy

The first quarter of 2023 has been an exciting time for the cryptocurrency market, as it started strong with a 48.9% gain in the overall market cap. According to the Coingecko report, the total market capitalization of cryptocurrencies increased from $800 billion to $1.2 trillion in just three months, showing a remarkable recovery from the 2022 turbulence.

Along with the growth in market cap, the Coingecko report also highlights the increase in average daily trading volume, which rose by 30% quarter-over-quarter. The report notes that the trading volume peaked in early March, coinciding with the banking crisis that saw several banks collapse due to insolvency.

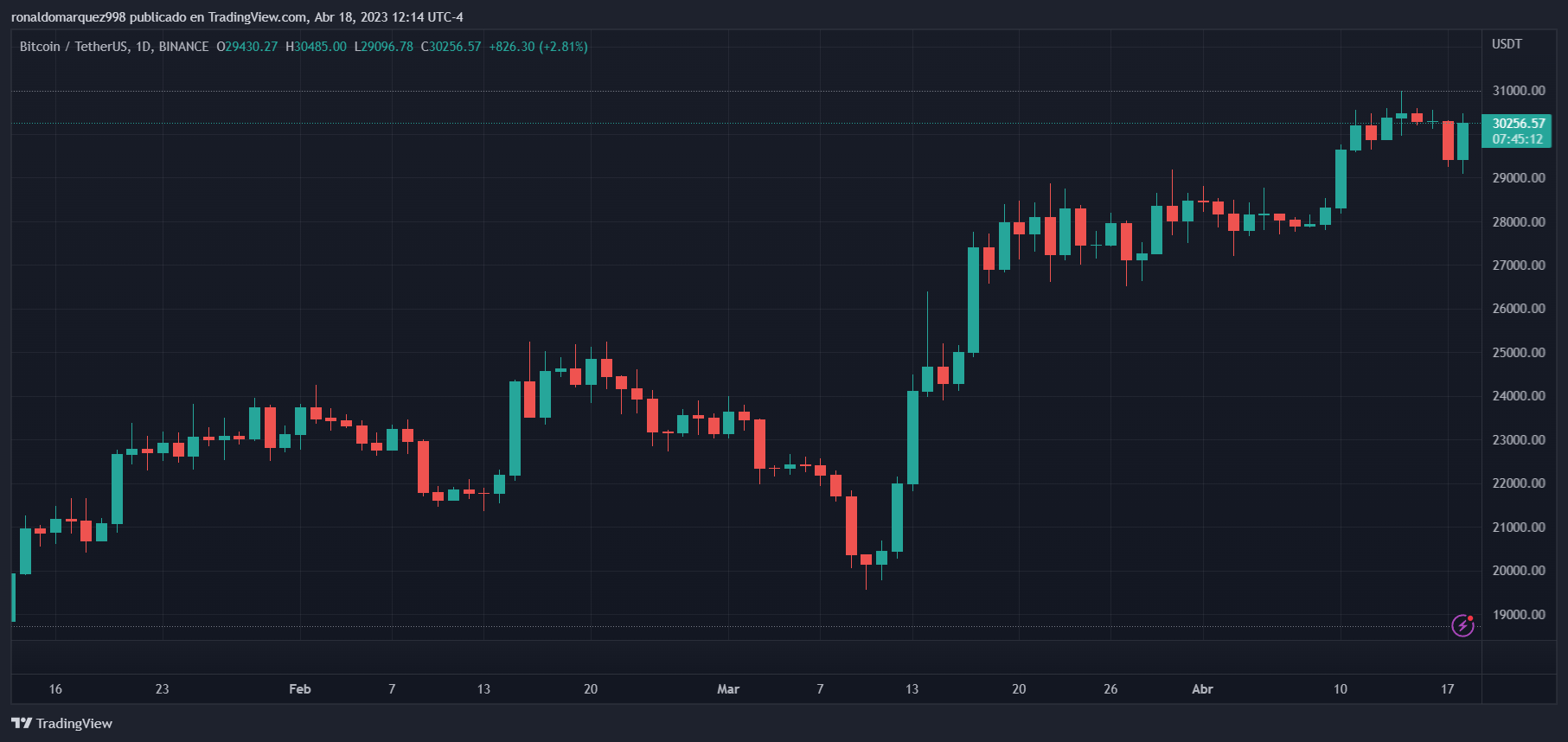

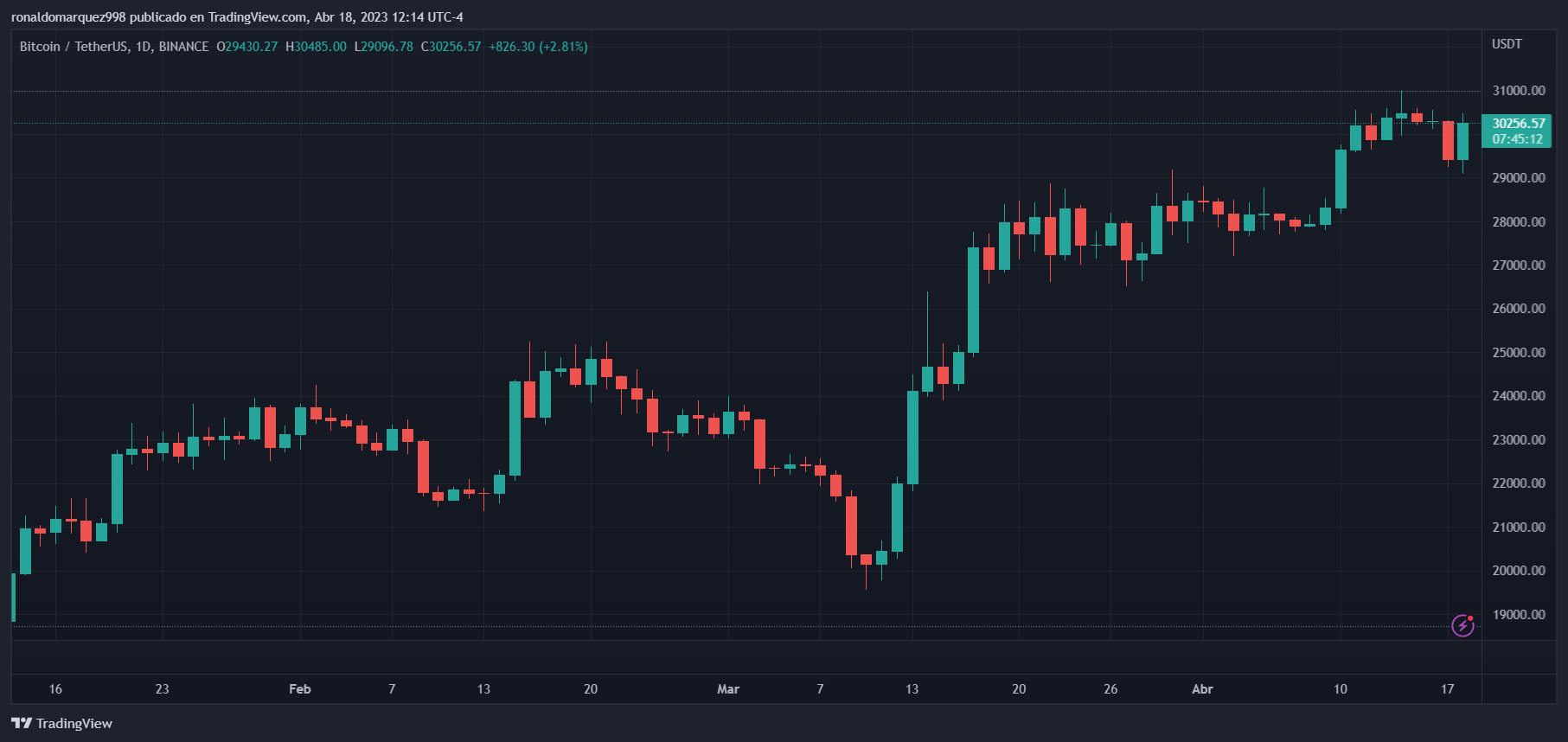

On the same note, Bitcoin, the largest cryptocurrency by market capitalization, has outperformed traditional assets like gold and the S&P 500, with a gain of over 70% during Q1 2023. The report attributes this success to several factors, including the increasing acceptance of Bitcoin as a legitimate investment asset and its growing adoption by institutions and retail investors.

Another report highlight is the resurgence of non-fungible tokens (NFTs), which saw a significant increase in trading volume during Q1 2023. NFTs are unique digital assets verified on a blockchain, making them unique and valuable. The report suggests that the resurgence in NFT trading volume results from increased interest and adoption of decentralized applications (dApps) and gaming.

The Coingecko report also notes the growing popularity of decentralized finance (DeFi) protocols, which have seen a surge in adoption and usage during Q1 2023, fueled by liquid staking, which led to a rise of 65% for the DeFi market.

DeFi protocols are built on blockchain technology and offer users a decentralized alternative to traditional financial services. The report suggests that the growth of DeFi is due to the increasing demand for decentralized services and the potential for high returns.

Increased Demand For Stablecoins And DEXs

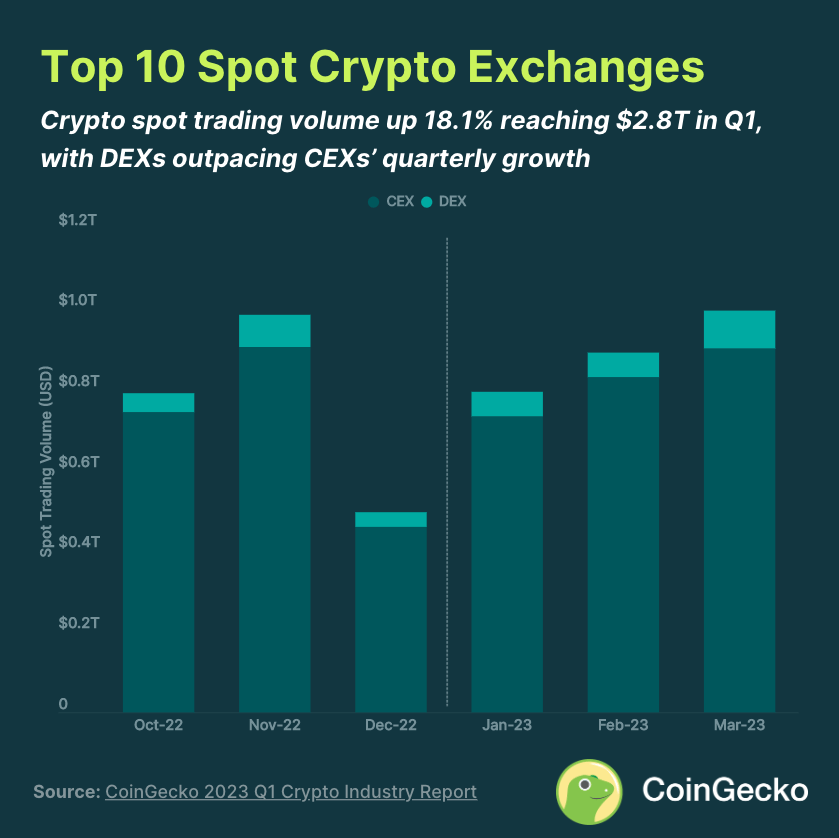

The first quarter of 2023 has seen a surge in crypto spot trading volume, with an 18.1% increase compared to the previous quarter. According to Coingecko, the total spot trading volume reached $2.8 trillion, a significant increase from the previous quarter’s volume.

Interestingly, the report notes that decentralized exchanges (DEXs) outpaced centralized exchanges (CEXs) in growth, with DEXs experiencing a larger increase in trading volume than their centralized counterparts. This trend indicates the growing popularity of DeFi protocols, which offer users a more decentralized and transparent alternative to traditional financial services.

Despite the increase in trading volume, the report notes that the monthly trading volume has yet to reach the heights of the first half of 2022, where the average monthly trading volume exceeded $1 trillion. However, the report suggests that this is likely due to the market correction and turbulence that occurred in the latter half of 2022, which decreased trading activity.

Furthermore, The first quarter of 2023 has seen a shakeup in the stablecoin market, as the top 15 stablecoins shed $6.2 billion in market capitalization. According to Coingecko, stablecoins such as USDC and BUSD experienced the largest declines in market cap, while Tether (USDT) gained dominance with a 20.5% increase in market cap.

Overall, the Coingecko Q1 Crypto Industry Report paints a positive picture of the cryptocurrency market, with a strong market cap and trading volume gains. As the industry continues to grow and evolve, it will be interesting to see how these trends develop and what new opportunities and challenges arise.

Featured image from Unsplash, chart from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur