5 cryptocurrencies with the best upside potential in the week ahead

Bitcoin’s (BTC) volatility has shrunk further this week and it is on track to form an inside-bar pattern on the weekly chart. Although the bulls are finding it difficult to clear the overhead hurdle in the $30,000 to $31,000 zone, a positive sign is that they have not ceded ground to the bears.

It is not only cryptocurrencies, even the S&P 500 Index has been oscillating inside a range for the past few days. This indicates that markets are awaiting a trigger to start the next directional move.

Crypto market data daily view. Source:Coin360

While the short-term price action is uncertain, analysts are getting bullish for the long term. Trader Titan of Crypto highlighted a potential signal on the Bollinger Bands monthly chart, which projects a rally to $63,500 in about a year.

While most major cryptocurrencies gave up some ground over the past week there are still some pockets of strength. Let’s analyze the charts of five cryptocurrencies that may turn up in the short term.

Bitcoin price analysis

Bitcoin turned down sharply from the resistance line of the symmetrical triangle pattern on May 6, indicating that the bears are not willing to let the bulls through. A minor positive is that the bulls have been buying the dips to the support line of the triangle as seen from the long tail on the day’s candlestick.

BTC/USDT daily chart. Source: TradingView

The flattish 20-day exponential moving average ($28,819) and the relative strength index (RSI) near the midpoint do not signal a clear advantage either to the bulls or the bears.

If the price breaks below the triangle, it will suggest that bears are trying to seize control. The BTC/USDT pair may first fall to $26,942 and then to $25,250.

On the other hand, a break and close above the triangle will suggest that the bulls have absorbed the supply. That may start a rally to $32,400 where the bears are again expected to mount a strong defense.

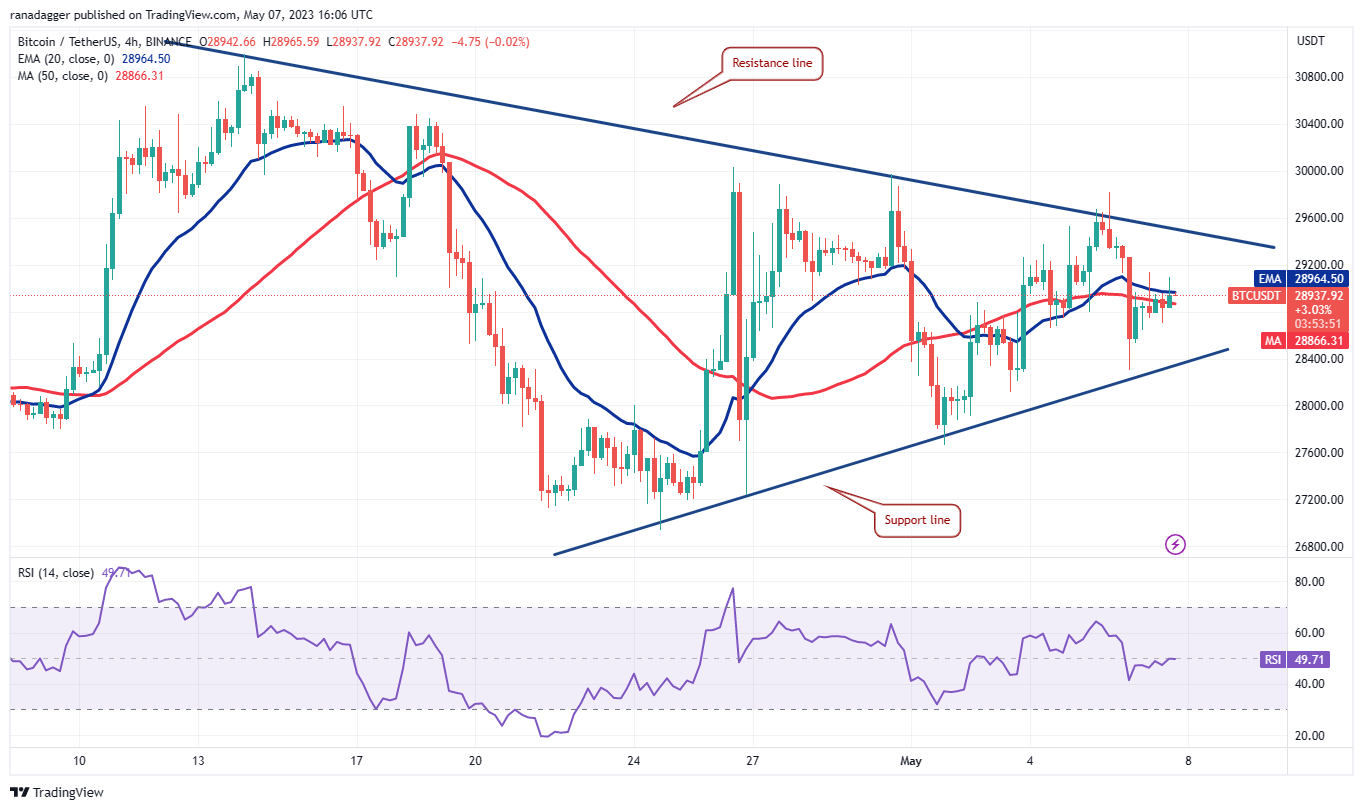

BTC/USDT 4-hour chart. Source: TradingView

Buyers nudged the price above the triangle but the long wick on the candlestick shows that the breakout turned out to be a bull trap in the near term. BTC price turned down sharply and plunged to the support line of the triangle.

The bounce off this level has reached the moving averages, which is a key short-term level to watch out for. If Bitcoin’s price turns down from the current level, it will raise the chances of a break below the support line.

Contrarily, if buyers kick the price above the moving averages, the pair may rise to the resistance line. The bulls will have to drive and sustain the price above this level to start an up-move.

Ether price analysis

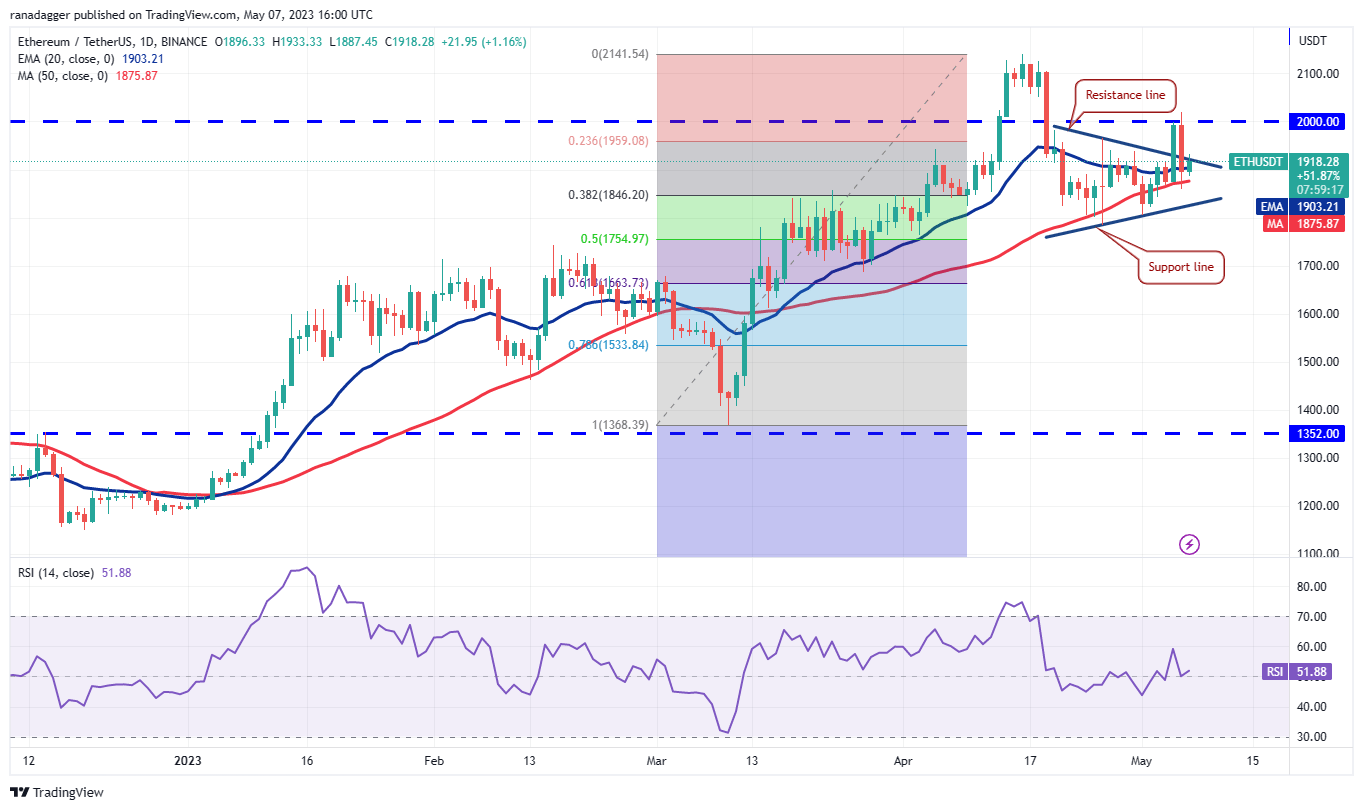

Ether (ETH) faced a strong rejection above the psychological resistance at $2,000 on May 7. This indicates that the bears have not given up and they continue to protect the overhead resistance levels.

ETH/USDT daily chart. Source: TradingView

The 20-day EMA ($1,903) has flattened out and the RSI is near the midpoint, indicating that the ETH/USDT pair may remain range-bound in the near term. The boundaries of the range could be between $2,000 and $1,785.

A consolidation just below the local high is a positive sign. It shows that the bulls are in no hurry to book profits, increasing the possibility of a break above $2,200.

On the contrary, if the price plunges below $1,785, it will suggest that bears have seized control. That could start a fall to $1,619.

ETH/USDT 4-hour chart. Source: TradingView

The 4-hour chart shows that the bears could not build upon the break below the 50-simple moving average. This shows that the selling pressure reduces at lower levels. The bulls are trying to stage a recovery by sustaining the price above the 20-EMA. If they can pull it off, the pair will again try to retest the crucial resistance at $2,000.

On the contrary, if ETH price turns down from the current level and breaks below the 50-SMA, it will suggest that the bears are in command. That could sink the pair to the support line.

Monero price analysis

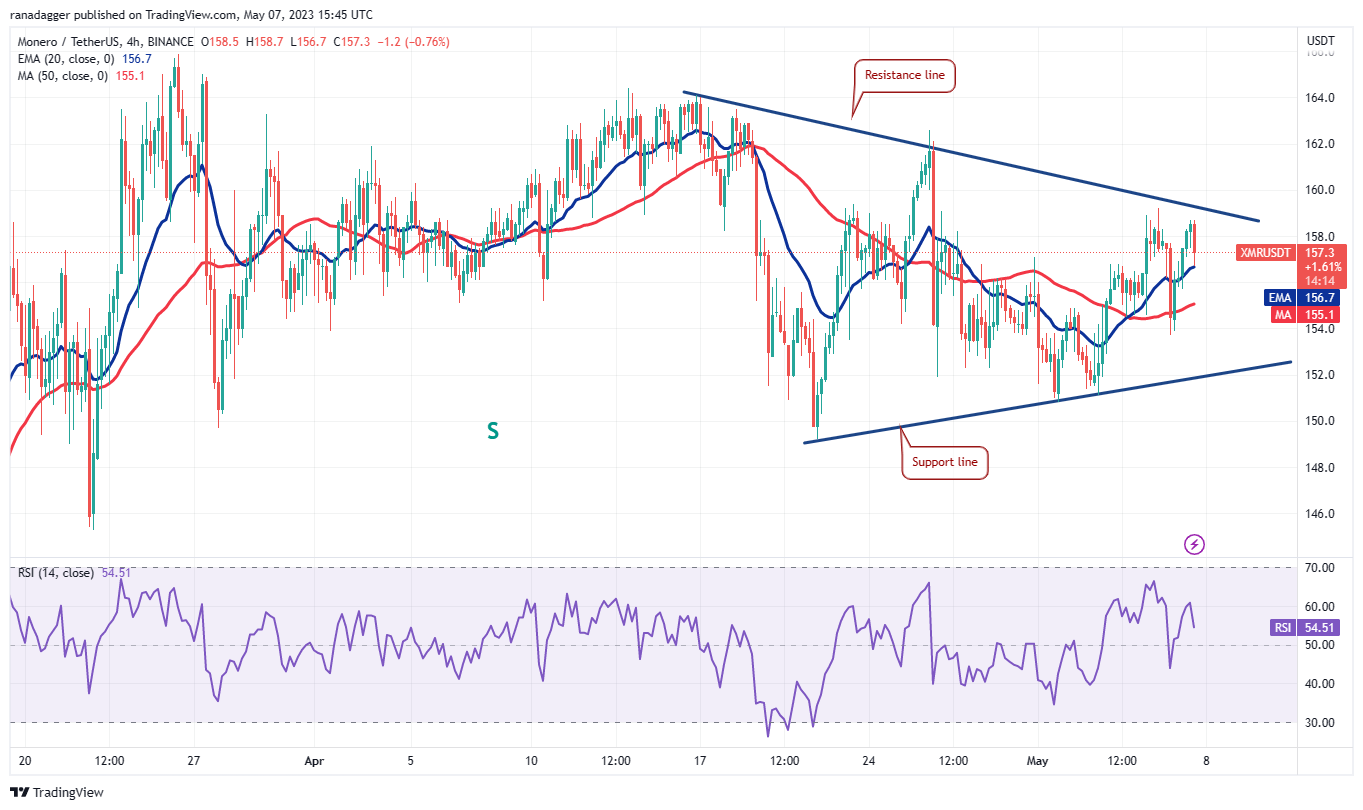

Monero (XMR) is trying to stay above the moving averages, indicating that the bulls are attempting a comeback.

XMR/USDT daily chart. Source: TradingView

The flattish 20-day EMA ($156) and the RSI just above the midpoint indicate a balance between supply and demand. If buyers thrust XMR price above the neckline of the inverse head and shoulders pattern, the advantage will tilt in their favor.

The XMR/USDT pair may then start a new up-move. There is a minor resistance at $181 but if that is crossed, the pair may reach $187.

Instead, if the price turns down from the current level or the neckline, it will suggest that the bears remain active at higher levels. The sellers will then try to yank the price below the $149-support, opening the door for a decline to $130.

XMR/USDT 4-hour chart. Source: TradingView

The 4-hour chart shows that the price rebounded off the 50-SMA but the bulls could not pierce the resistance line. This shows that the bears are selling on rallies. If the price snaps back from the 20-EMA, it will suggest that the sentiment is turning positive and traders are buying on dips.

The bulls will then make another attempt to clear the overhead hurdle. If they manage to do that, the pair could first rise to $162 and then to $164.

Alternatively, if the price turns down and breaks below the 50-SMA, it will suggest that bears are in control. That will increase the likelihood of a retest of the support line.

Related: The Ethereum Foundation just sold $30M in Ether — But will ETH price fall this time?

OKB price analysis

OKB (OKB) is trading inside a large symmetrical triangle pattern. Generally, in this setup, traders buy near the support line and sell near the resistance.

OKB/USDT daily chart. Source: TradingView

The bears are trying to maintain OKB price below the 50-day SMA ($45.57) while the bulls are attempting to reclaim the level. If the price turns up from the current level or rebounds off the support line, it will suggest demand at lower levels.

If buyers shove the price above the 20-day EMA ($46.87), it will suggest that the OKB/USDT pair may prolong its stay inside the triangle for some more time.

Contrary to this assumption, if bears sink the price below the triangle, it will suggest that the setup has behaved as a reversal pattern. That could start a new downtrend which is likely to pull the pair to $37.

OKB/USDT 4-hour chart. Source: TradingView

The 4-hour chart shows that the bulls are trying to defend the horizontal support near $44.35 but they have not been able to propel the price above the moving averages. This suggests that every minor relief rally is being sold into. If the price turns down from the current level and plummets below $44.35, the pair may slump to $41.70.

Conversely, if the price rises above the moving averages, it will signal accumulation at lower levels. The pair could first rise to $49.50 and thereafter attempt a rally to $53.

Rocket Pool price analysis

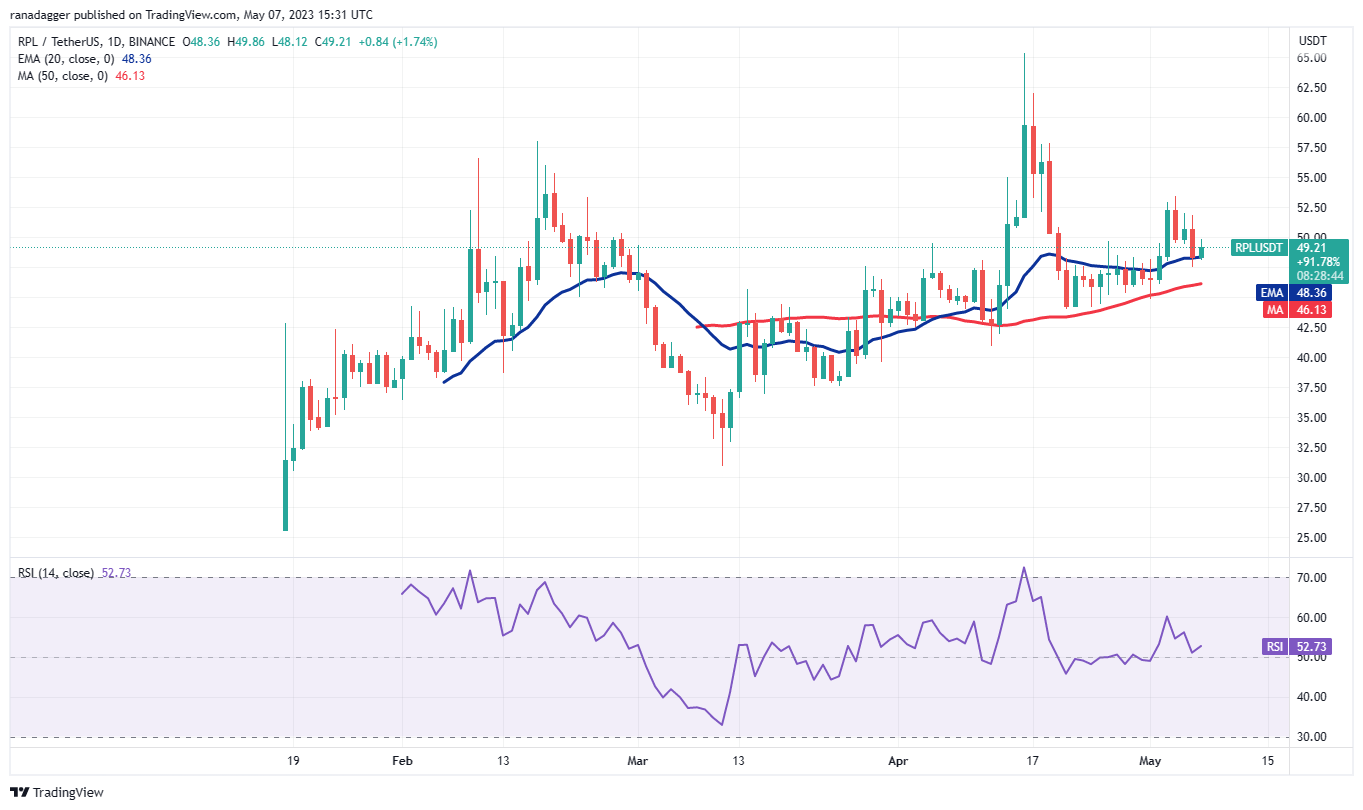

Rocket Pool (RPL) is looking strong as it is trading above the moving averages. This shows that the bulls are buying on dips.

RPL/USDT daily chart. Source: TradingView

The bulls will have to propel the price above the overhead resistance at $53.45 to signal that the corrective phase may be over. The RPL/USDT pair may thereafter attempt a rally to $58.

Another possibility is that RPL price rises from the 20-day EMA ($48.36) but turns down from $53.45. That will indicate a possible range-bound action between the 50-day SMA ($46.13) and $53.45 for some time.

A break and close below the 50-day SMA will be the first indication that the bears are in command. That will open the doors for a potential decline to $37.

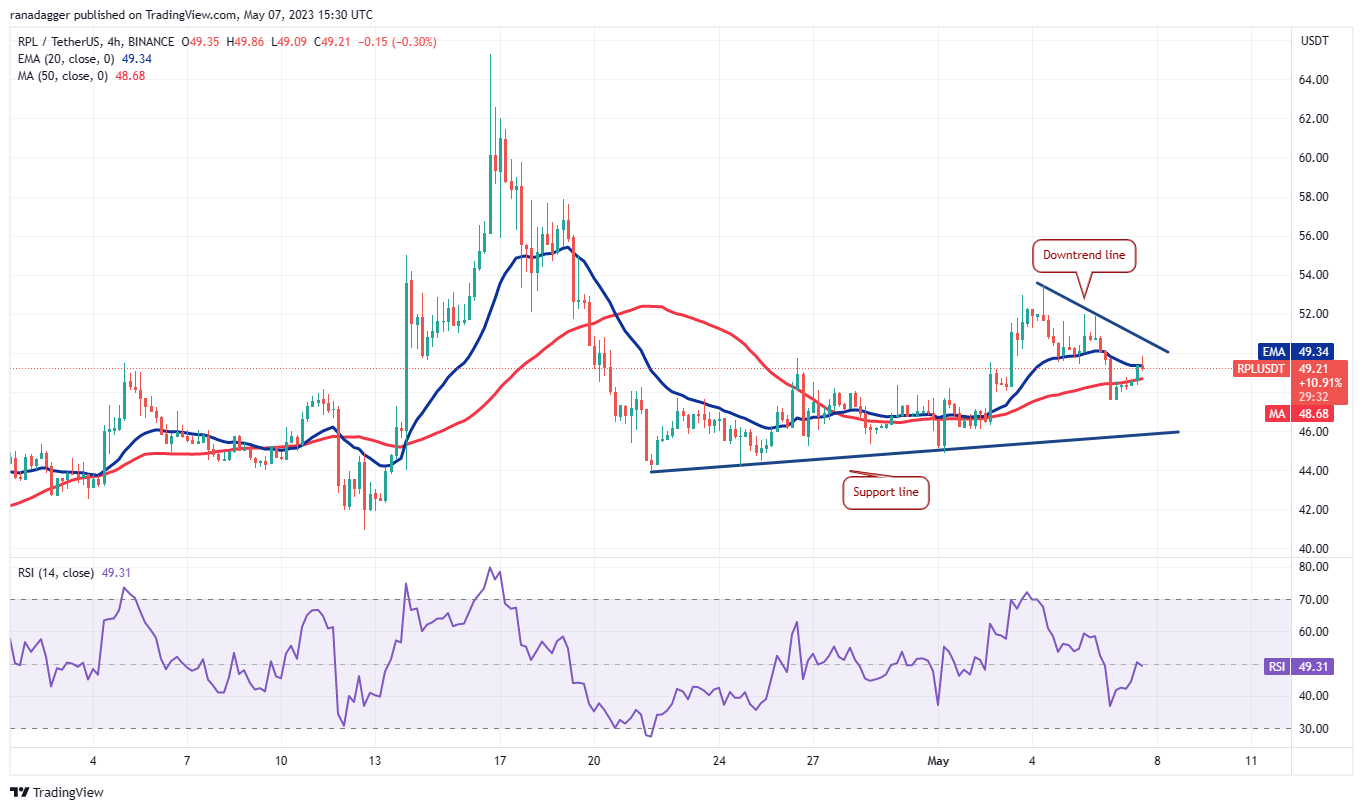

RPL/USDT 4-hour chart. Source: TradingView

The 4-hour chart shows that the bears are trying to sustain the price below the 20-EMA while the bulls are trying to push the price above it. If buyers succeed, the pair may rise to the downtrend line. This is the key short-term level to watch for. If this resistance is overcome, the pair may rally to $53.45.

Contrarily, if the price turns down from the current level and breaks below the 50-SMA, the price risks dropping to the support line. The bulls are likely to defend this level fiercely.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Monero

Monero  Litecoin

Litecoin  Zcash

Zcash  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Numeraire

Numeraire  Siacoin

Siacoin  Holo

Holo  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Pax Dollar

Pax Dollar  BUSD

BUSD  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Augur

Augur  Bitcoin Gold

Bitcoin Gold  Ren

Ren  HUSD

HUSD