Uniswap (UNI) Price Recovery Halts: What’s the Outlook?

On May 24, Uniswap (UNI) price dropped below $5 for the first time in 2023. After a shortlived rebound effort, critical on-chain data are now showing early signs of another impending retracement. But can the bulls put up a fight?

Last week’s crypto market resurgence saw the UNI price rebound toward $5.2, but the bears have seized control again. Uniswap transaction volumes are still down compared to figures recorded in mid-May.

With crypto whales now taking hawkish positions on UNI, what are the chances of a potential recovery in the coming days?

Uniswap Whales Take a Cautious Approach

Crypto whales are making fewer bets on UNI. Even during the recent price resurgence, the whales remained unconvinced, as shown by the decline in their trading activity.

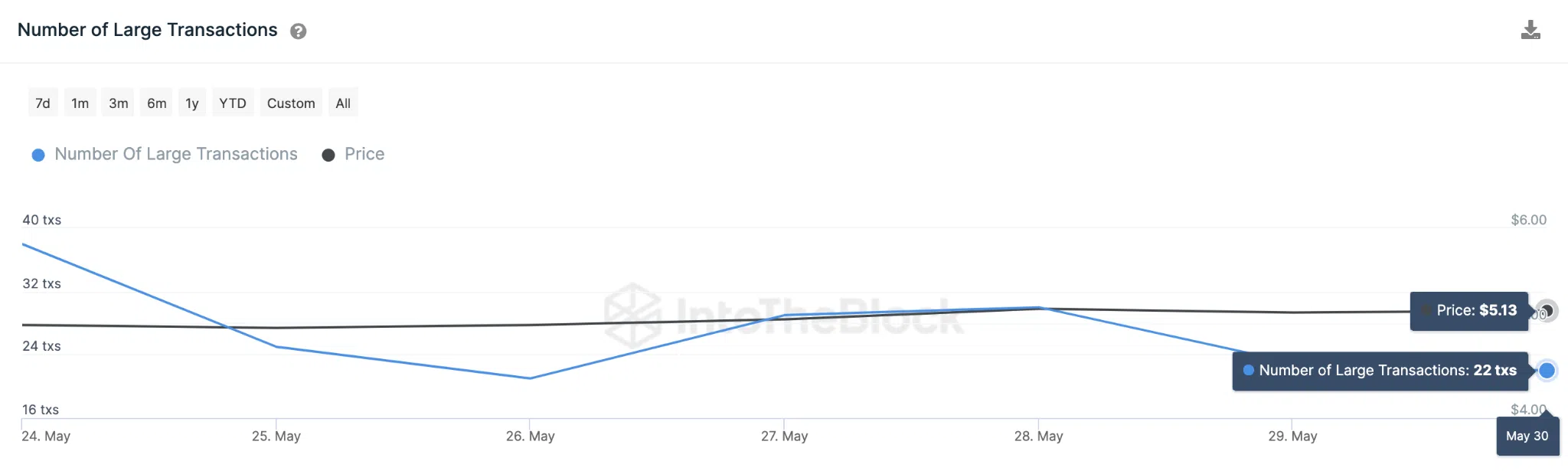

IntoTheBlock’s chart below shows that Large Transactions involving UNI have dropped by 21% in the past week. On May 24, whales performed 38 transactions exceeding $100,000. But at the close of May 30, only 22 counts of such transactions were recorded.

Uniswap (UNI) Price Prediction, May 2023 – Whales Transactions. Source: IntoTheBlock

The Large Transactions metric evaluates the level of whale activity by aggregating the number of confirmed transactions that exceed $100,000 in value. When it drops significantly, it signals low confidence among whale investors.

Considering the overwhelmingly bearish sentiment surrounding Uniswap, it appears that large institutional investors have taken a hawkish position as they wait for the downtrend to blow over.

Moreso, whale transactions provide much-needed liquidity to the market. Hence, this decline in market liquidity could push UNI traders to lower their prices to have their orders filled.

Bearish Traders are Looking to Sell 1.2 Million UNI Tokens

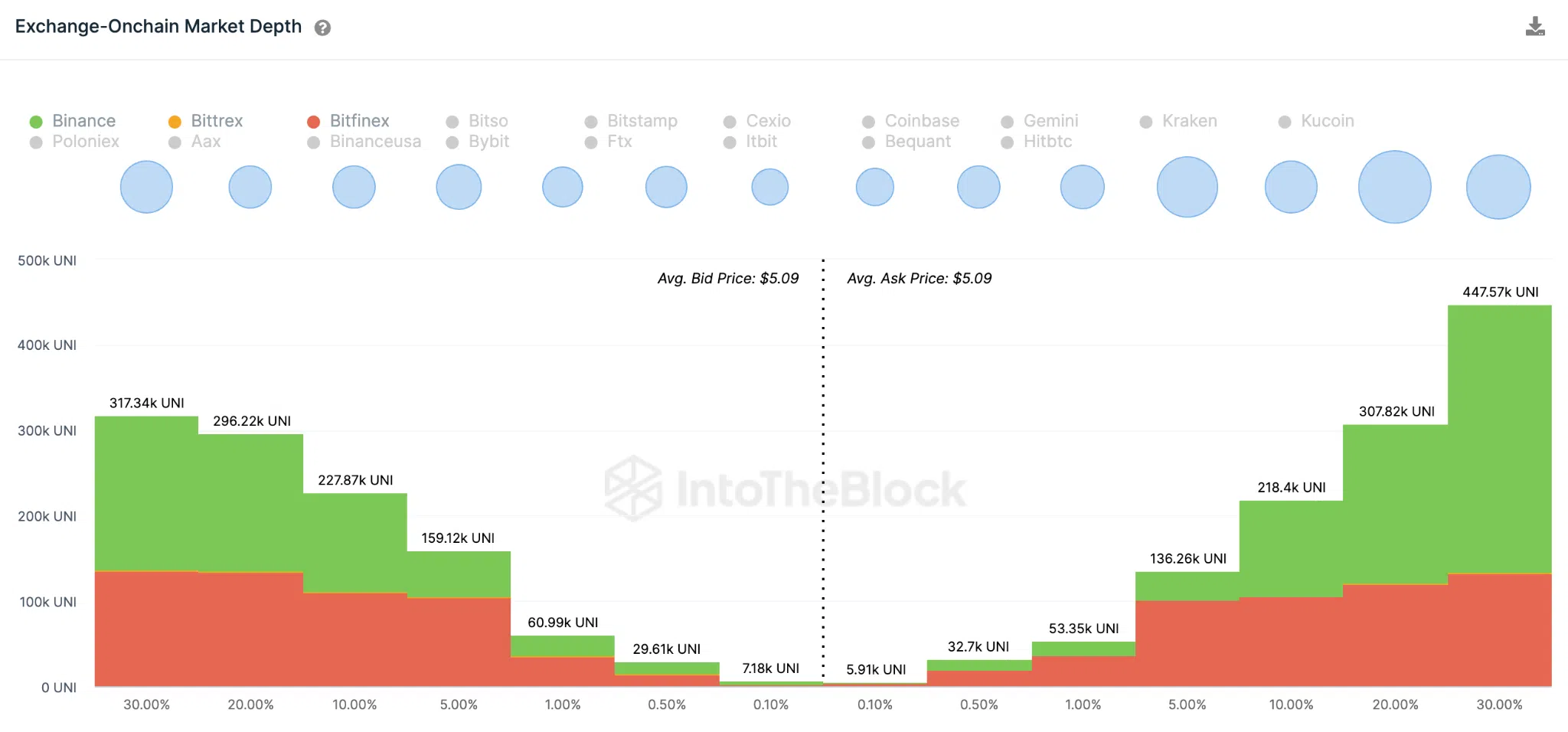

Furthermore, bearish Uniswap traders are looking to offload a sizeable amount of tokens around the current prices. The Exchange on-chain Market depth chart shows an aggregate of the total buy/sell orders placed by UNI holders across various exchanges.

As things stand, UNI holders have placed 1.2 million UNI tokens up for sale. Meanwhile, buyers have only placed orders for 1.1 million tokens.

Uniswap (UNI) Price Prediction, May 2023 – Aggregate Exchange Order Books. Source: IntoTheBlock

When the volume of tokens supplied on the market exceeds demand, it signals that the market sentiment is largely bearish.

Currently, there is a demand shortage for more than 100,000 UNI. This means sellers may have to lower prices to fill their orders quickly.

Where could Uniswap (XLM) price be in the coming years?

Checkout BeInCrypto’s in depth price prediction article below:

Uniswap (UNI) Price Prediction 2023/2025/2030

In conclusion, the decline in whale transactions and rising sell-wall could have a negative impact on UNI prices in the coming days.

UNI Price Prediction: Impending Retracement to $4.50?

Considering the slowing demand and bearish activity among Uniswap whales, a decline toward $4.50 seems the most likely UNI price prediction. Although, IntoTheBlock’s In/Out of The Money Around Price (IOMAP) data suggests that UNI will have initial support around the $5 zone.

As seen below, 2,580 investors that bought 2.48 million UNI at an average price of $5 could put up a good fight.

However, if the bearish momentum prevails, the price could slide further toward $4.53 as predicted.

Uniswap (UNI) Price Prediction, May 2023 – IOMAP. Source: IntoTheBlock

Conversely, the bulls could invalidate the bearish UNI price prediction if it manages to break above the critical $5.20 resistance zone.

But a looming sell-wall from the 5,380 investors that purchased 10.77 million UNI at an average price of $5.17 will likely prevent that.

Although unlikely, UNI could still rally toward $5.86 if the bulls breach that resistance level.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Tezos

Tezos  Dash

Dash  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Pax Dollar

Pax Dollar  Enjin Coin

Enjin Coin  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD