QNT Price Analysis: Will Bears Seize Control Back In QNT Price?

- 1 The QNT price is currently trading at $115.7 while seeing a change of 18% in 24-hour trading volume.

- 2 Quant is observing a decline of 0.075% in the last 7 days.

After making the predicted bullish rally from its previous support level, QNT price surged by 18% in the last 7 days. Though observing the present price action the QNT token is forecasting a substantial decline of its value within the near future. The price is at present trading below crucial 200 EMA and MA resistance levels on the daily time frame though it recently gave a positive breakout through all the faster-moving averages.

The current price of QNT is $115.7, its market capitalization saw a slight surge, and the present value is around $1.4 Billion ranked 35 from 5,223 cryptocurrencies.

An Ominous Fall In Bullish Sentiments

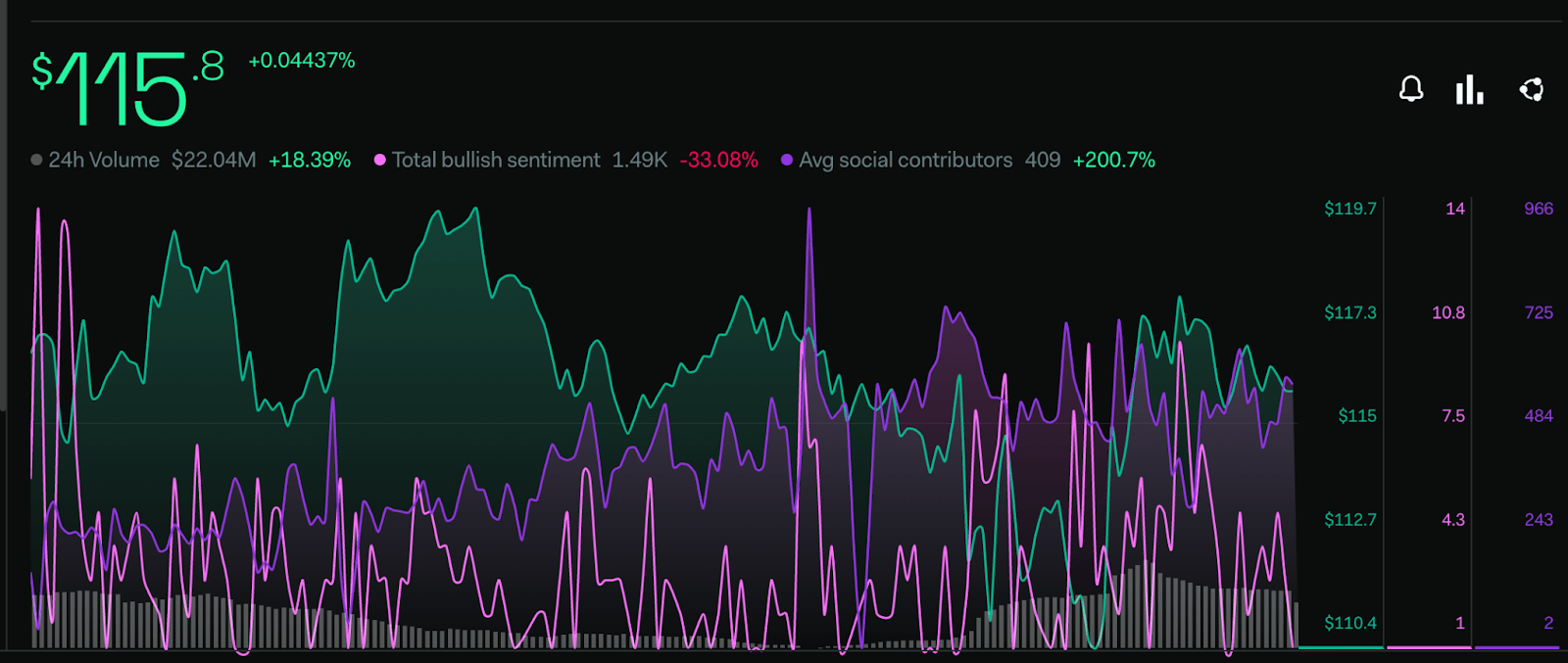

Source: QNT/USDT by LunaCrush

Previously positive sentiments of the investors are taking a negative turn at present as per LunarCrush. The total bullish sentiment metric has declined by 33.08% within the last 7 days though there is a rapid surge in the spam volume which is an ominous indication regarding the social media metrics of the token.

In the previous analysis, the price reached the 200 EMA resistance level hence it was estimated that the price can take a negative reversal from the point. The analysis may stand true as the price is making a downward curve often observed before a bear turn.

Technical Analysis of QNT Price (Daily Timeframe)

Presently, the price is trading near a critical rejection level, it projects a potential possibility of further decline if the bears succeed in regaining prominence, according to LunarCrush.

The 200 EMA is acting as a crucial rejection level to the QNT price. The current support level for the price is around $108 and its major support level is at $100. The resistance point for QNT is near $120 and its major resistance is at $130.

The RSI line is giving a pessimistic interception to the 14 SMA after taking rejection from the supply zone. The RSI line is currently moving around 56.13 points, while the 14 SMA is providing resistance at nearly 55.84 points.

Conclusion

As per the analysis, the price is taking a reversal from the 200 EMA key level. The price may soon follow the oscillators’ lead which is taking resistance from the oversold levels on the daily time frame indicating a bearish correction.

Technical levels

Support – $90 and $100

Resistance – $120 and $130

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only, and they do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  TrueUSD

TrueUSD  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD