Polkadot Price Follows a Negative Trend: Will DOT Breakout?

Polkadot protocol has developed into an open-source multichain protocol that gets this funky name for securing a few networks of special blockchains or market leaders to facilitate cross-chain trades, asset transfer, and promote interoperability of blockchains with each other. Polkadot is working to create a fully functional decentralized internet of blockchain, thus laying the pathway toward the Web 3.0 revolution. Since such a project hasn’t been visualized yet, the progress can be slow.

The latest market capitalization of Polkadot based on the current value remains $6,612,462,992, with 90% of DOT tokens having entered the circulation markets. The potential for its DOT token remains uncharted since Web 3.0 is still a concept, and achieving such a state can create a whole new paradigm of DOT apart from its current use as governance, staking, and bonding token.

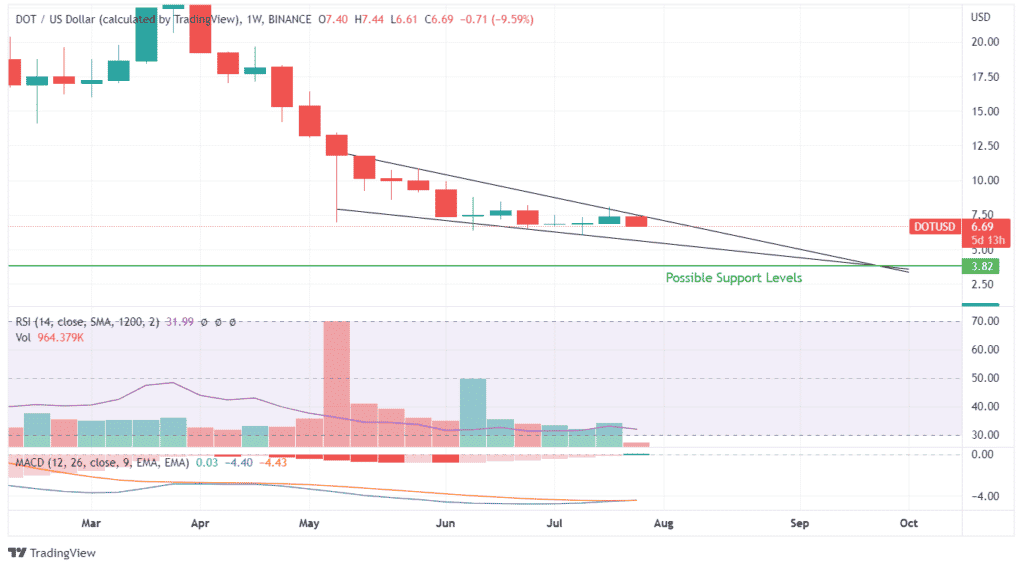

DOT token failed to surpass the 50 EMA curve, which was already in a downfall. This failure highlights the critical lack of buying momentum despite a higher RSI shown on charts. Technicals have highlighted the downtrend movement, and the trendline showcases a bearish crossover. Read our Polkadot prediction to know if it is the right time to buy the token!

DOT token has taken new dips with each swing. When prices jumped on July 13, making a peak gain in the sentiment started to shift toward the buyers. But despite making a huge spike in seven days, the failure to overcome its 50 EMA curve highlighted the doubt in buyers’ enthusiasm to push the prices down. The resultant profit booking has eroded significant wealth in the last six days, which strengthens the fear the DOT hasn’t yet made its true dip.

Simultaneously, the MACD indicator has almost created a bearish crossover which will showcase a profit booking on a much larger scale. The trendlines on the upper band indicate a decline, showcasing the failure of the DOT token to create subsequent higher highs.

The weekly price action of Polkadot highlights a long-established trend line since the beginning of May 2022 that isn’t breached so far. These trend lines intersect near $3.8, showcasing a further decline. It raises a serious flaw despite the price action not being highly negative.

Instead, the trend also showcases a consolidation between $8 and $6. The current weekly candle has completely engulfed all the positive trade of the last two weeks. RSI has also declined towards oversold zones, and MACD also indicates a downward curve despite its bullish crossover.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Pax Dollar

Pax Dollar  Enjin Coin

Enjin Coin  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD