Polygon price analysis: MATIC falls at the $0.88 hurdle to initiate downtrend

Polygon price analysis has turned bearish over the past 24 hours, as price fell more than 4 percent on the daily chart. Bulls failed to consolidate on earlier momentum that had targeted the $0.95 price point and a daily close below $0.88 could bring further downtrend for MATIC. A hammer pattern is forming on the 24-hour chart for Polygon that suggests buying from lower levels with overall market sentiment set to bearish. Short term support for MATIC is set at $0.86 as price exited a breakout range similar to July 18, 2022 that gave a bullish momentum of up to $0.97.

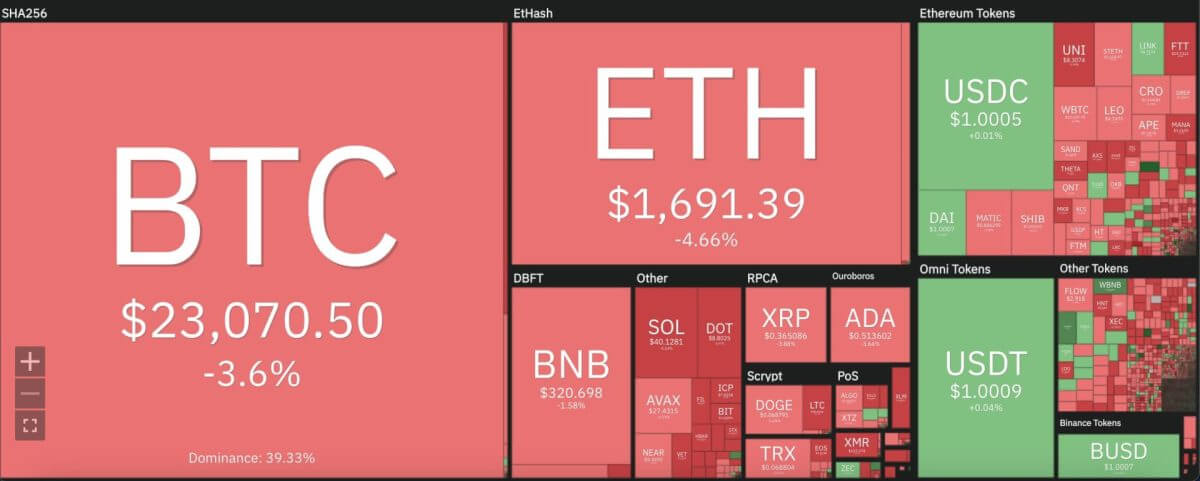

The larger cryptocurrency market also turned bearish over the past 24 hours, led by Bitcoin’s 3.5 percent decline at the $23,000 mark. Ethereum also fell further from its pursuit of the $2,000 mark, moving 5 percent down to $1,600. Among leading Altcoins, Cardano lowered 4 percent to $0.51, while Ripple dropped the same percentage to sit at $0.36. Dogecoin recorded a minor downtrend to move down to $0.06, whereas Solana and Polkadot receded 5 percent each, to move as low as $40.12 and $8.80, respectively.

Polygon price analysis: Cryptocurrency heat map. Source: Coin360

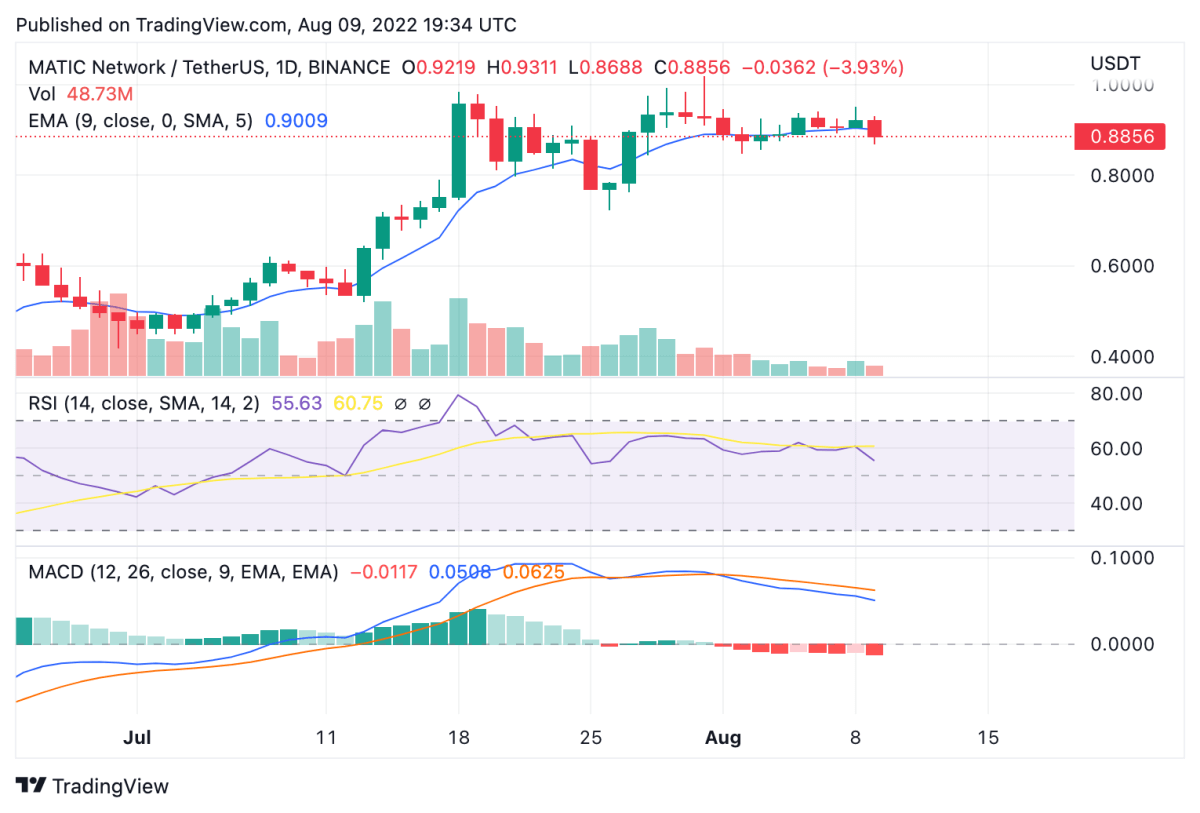

Polygon price analysis: Inverted hammer pattern appears on 24-hour chart

On the 24-hour candlestick chart for Polygon price analysis, price can be seen forming a swift downtrend after an extended period of stagnancy around the $0.86 mark. Price has traded along a bullish line from lows of $0.41 observed on June 30, 2022. Since then, MATIC formed a double top pattern around the $0.88 mark which indicates that a close below this point could trigger losses down to $0.79. Over the last 24 hours, the daily chart formed an inverted hammer pattern, indicating the bearish movement in the market.

Polygon price analysis: 24-hour chart. Source: Trading View

Price has moved below the 9 and 21-day moving averages, but remains in touch with the crucial 50-day exponential moving average (EMA) at $0.89. Furthermore, the 24-hour relative strength index (RSI) shows a distinct decline in market valuation over the past 24-48 hours after falling down to 55.83 from 60.78. Trading volume over the past 24 hours dropped by 5 percent, indicating lower buying at current price. Moreover, the moving average convergence divergence (MACD) curve can be seen forming lower lows to move further below the neutral zone in a bearish divergence.

In conclusion, traders will be looking to wait for MATIC to form an extended consolidation around the $0.88-$0.90 mark to set a bullish challenge to revisit the $0.97 mark. A daily close towards $0.86 support could trigger downtrend to as low as $0.79.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD