Tornado Cash Ethereum Token Down Over 50% After Sanctions

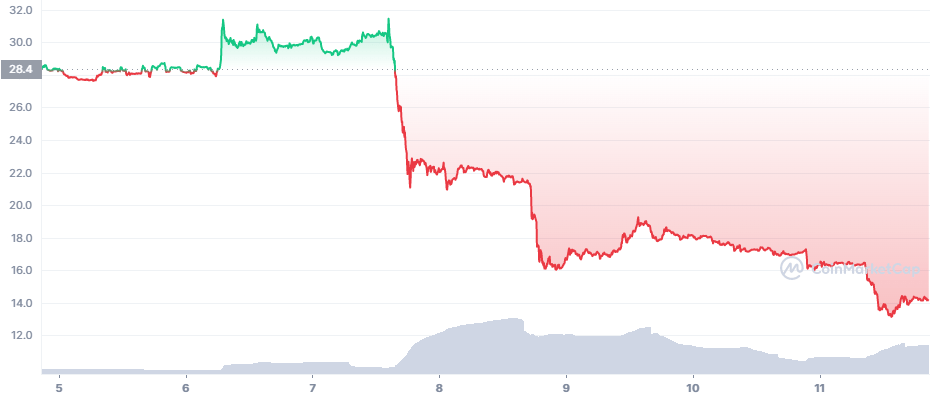

In the week following the sanctioning of the Tornado Cash website by the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC), the price of the token underpinning the system is down 56%, starting the week at a high of $31.56 and ending the week at a low of $13.09, according to CoinMarketCap.

Tornado Cash (TORN) is an ERC20 token and the native token of the Tornado Cash DAO, used to manage governance and voting. It’s currently the 691st largest cryptocurrency, with a market capitalization of $15.5 million.

After the U.S. Treasury issued its sanctions and Github took the Tornado Cash website offline by removing its repository from the site, the token price began to slide.

Launched in 2019, Tornado Cash is a blockchain protocol for sending and receiving anonymous transactions by mixing Ethereum tokens with a pool of other tokens, anonymizing the user.

In its sanctioning of Tornado Cash, the U.S. Treasury cited its use by the North Korean hacker group Lazarus Group and the laundering of over $103.8 million from the hacks of the Horizon Harmony Bridge and Nomad Token Bridge earlier this summer.

Following a debate by the Tornado Cash community, the Discord server for the group disappeared, and unknown persons took the forum on the Tornado Cash community website offline as well. At the same time, a member of the developer group behind Tornado Cash was taken into custody by law enforcement in the Netherlands.

They arrested the developer of tornado cash. ?

I repeat: a man was arrested for writing code that served as a public good for people to maintain their privacy online.

They put a man in jail because bad people used his open source code.

This cannot stand in any free society.

— RYAN SΞAN ADAMS — rsa.eth ?? (@RyanSAdams) August 12, 2022

The U.S. Treasury’s Fiscal Information and Investigation Service (FIOD) said its criminal investigation into Tornado Cash began in June 2022.

This crypto winter appears to be especially harsh for the Tornado Cash community. Coupled with the current bear market, sanctions, shutdowns, and arrests seem to have dealt a body blow to the project as holders continue to flee.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Gate

Gate  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Tether Gold

Tether Gold  Theta Network

Theta Network  Zcash

Zcash  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Decred

Decred  Polygon

Polygon  Dash

Dash  Qtum

Qtum  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Synthetix Network

Synthetix Network  Basic Attention

Basic Attention  0x Protocol

0x Protocol  Siacoin

Siacoin  Holo

Holo  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Nano

Nano  Ontology

Ontology  Waves

Waves  Status

Status  Hive

Hive  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  BUSD

BUSD  Numeraire

Numeraire  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Augur

Augur  HUSD

HUSD