Bitcoin, Ethereum Technical Analysis: BTC Nears $20,000, as ETH Hits 1-Month Low

Bitcoin was trading close to $20,000 to start the weekend, as traders reacted to comments from U.S. Fed Chair Jerome Powell during Friday’s Jackson Hole summit. Powell warned that “there will be some pain ahead,” as the Fed attempts to bring the rate of inflation down. Ethereum was below $1,500 on Saturday.

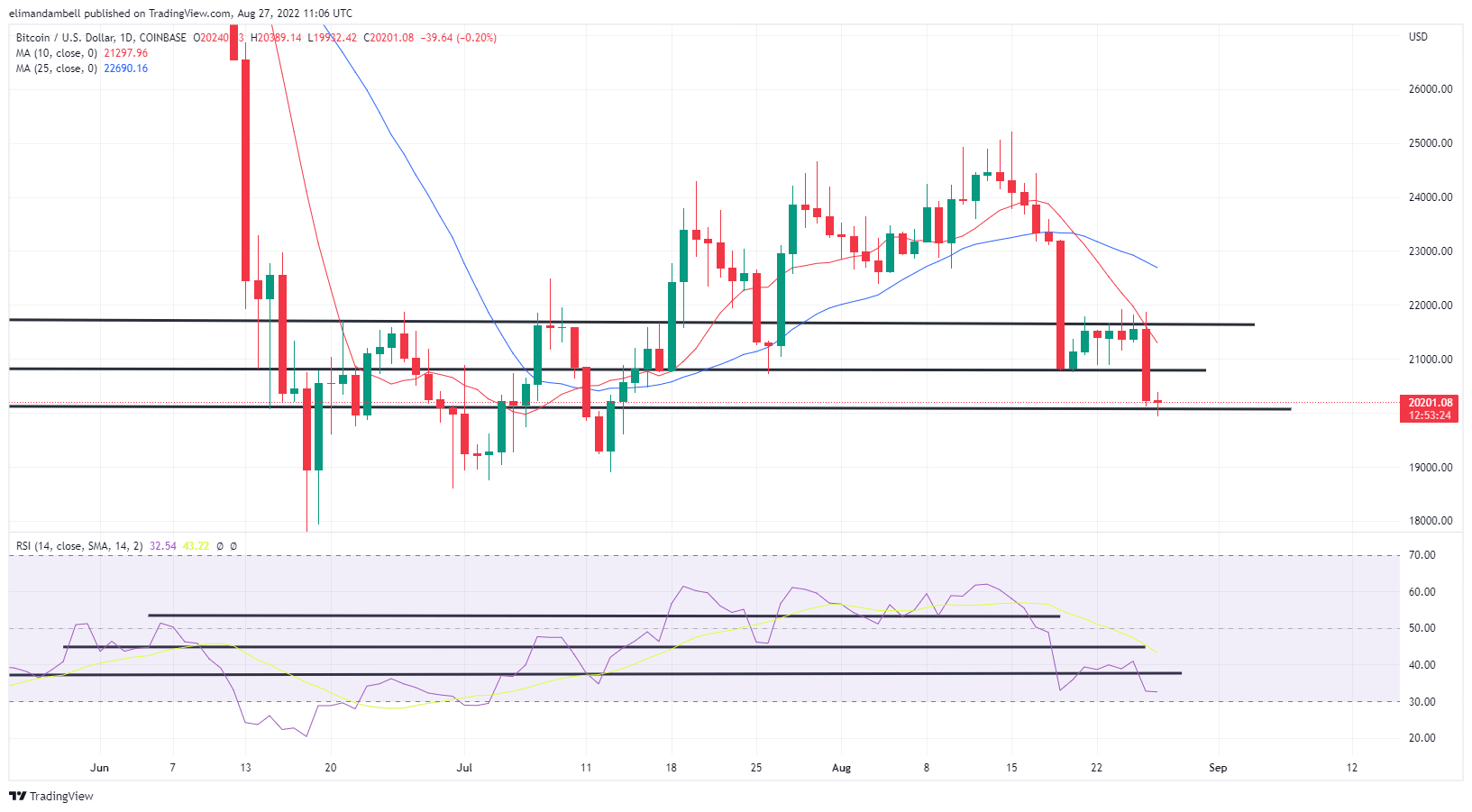

Bitcoin

Bitcoin (BTC) was trading lower for a second consecutive session, as the token dropped below $21,000 to start the weekend.

Following a high of $21,804.91, bitcoin moved closer to the $20,000 level, falling to an intraday low of $20,020.94.

The move comes as comments from United States Fed Chair Jerome Powell sent shockwaves through global financial markets.

BTC/USD – Daily Chart

Powell warned that, “there will be some pain ahead” in upcoming months, as the central bank continues its battle with inflation.

From a technical perspective, the sell-off commenced as BTC failed to sustain a breakout of its $21,600 resistance level.

Prices then went on to fall below another key level, this time at support of $20,800, on the way towards today’s low.

As of writing, the sell-off has marginally eased, however bitcoin continues to hover around what seems to be an interim floor of $20,200.

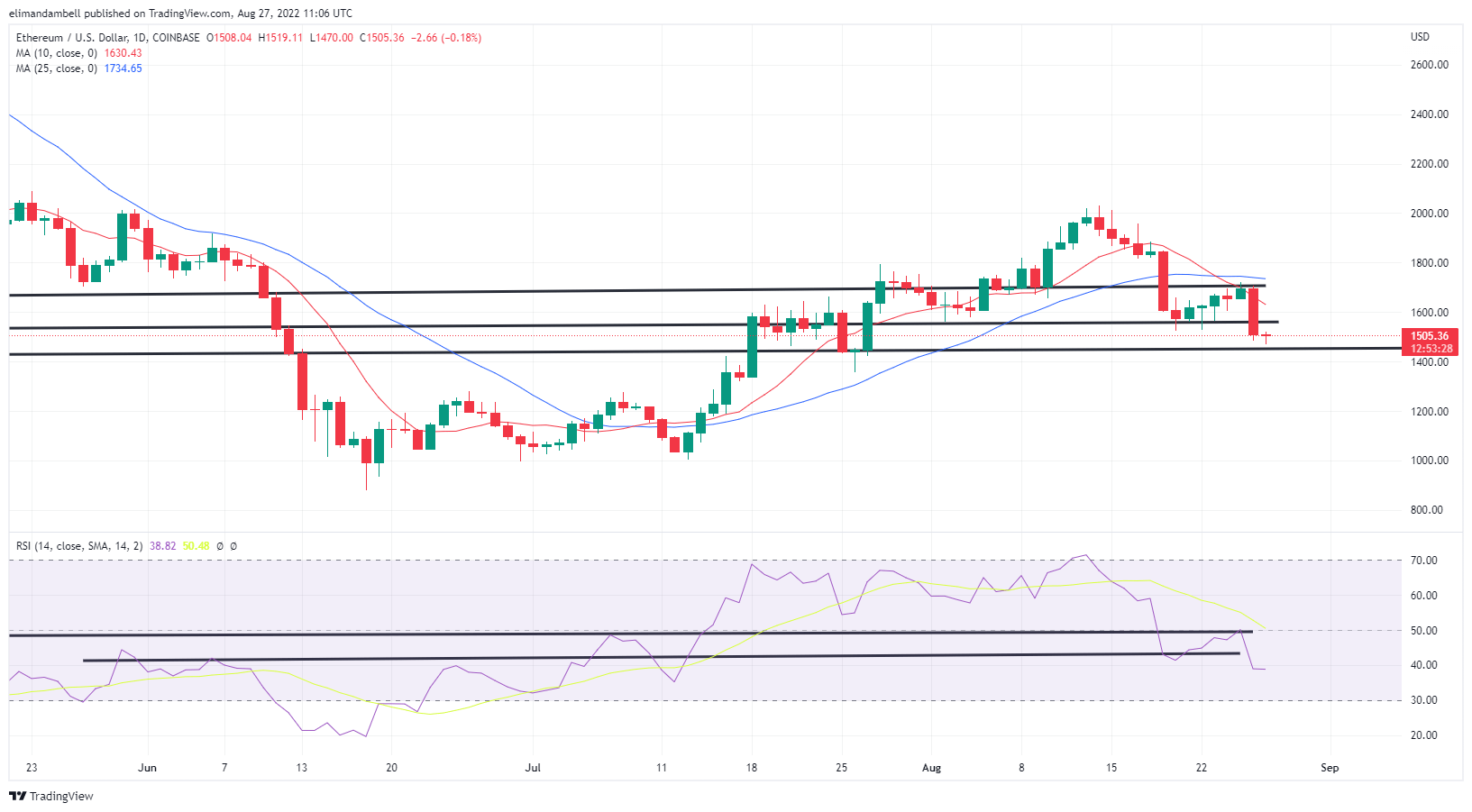

Ethereum

Like bitcoin, ethereum (ETH) also moved lower on Saturday, as the world’s second largest cryptocurrency fell under $1,500.

Saturday saw ETH/USD drop to a low of $1,477.67, which is its weakest point since July 27, a day after prices were trading below $1,400.

Today’s decline comes as ethereum fell below its long-term support level at $1,550, with bears now targeting a floor of $1,450.

ETH/USD – Daily Chart

Following this week’s downward crossover between the 10-day (red) moving average against its 25-day (blue) counterpart, many had feared that such a decline could occur.

Price strength has also now weakened to a multi-week low, with the relative strength index (RSI) tracking at a low of 38.75.

Although ETH is currently oversold, the RSI has yet to reach its support at 34, and should it reach this point, we will likely see the token trading below $1,400

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Tezos

Tezos  Dash

Dash  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD