Bitcoin, Ethereum Technical Analysis: BTC Back Above $19,000 Ahead of FOMC Meeting

Bitcoin was trading marginally higher ahead of Wednesday’s United States FOMC meeting, where it is expected that the Federal Reserve will increase interest rates. As inflation continues to remain at elevated levels, many anticipate the Fed will raise rates by over 75 basis points. Ethereum was also up, after briefly falling below $1,300 on Monday.

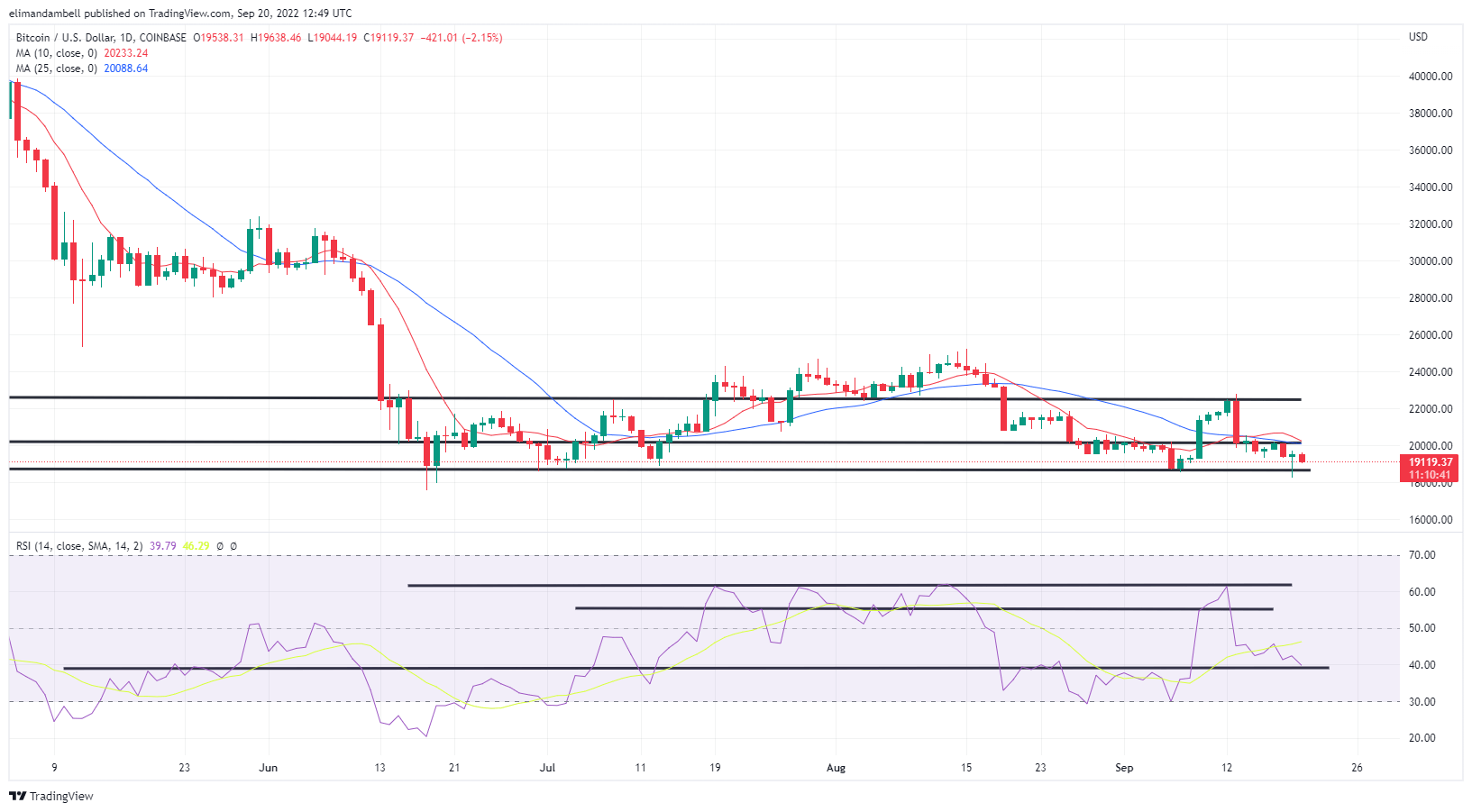

Bitcoin

Bitcoin (BTC) was marginally higher on Tuesday, as markets began to prepare for tomorrow’s Federal Open Market Committee (FOMC) meeting.

BTC/USD hit an intraday high of $19,639.48 earlier in today’s session, as prices rebounded from losses to start the week.

The move came as bulls rejected an attempt to move below yesterday’s floor of $18,645, instead using this as a point of reentry.

BTC/USD – Daily Chart

Looking at the chart, today’s gains have seen the 14-day relative strength index (RSI) move away from yesterday’s bottom below the 38.00 point. The RSI is currently tracking at 39.69.

The next step for bulls would be to recapture the $20,000 level, however the current level of market volatility will make this no easy feat.

As of writing, the token is trading at $19,117.06, as earlier gains have somewhat diminished, prior to the rates decision.

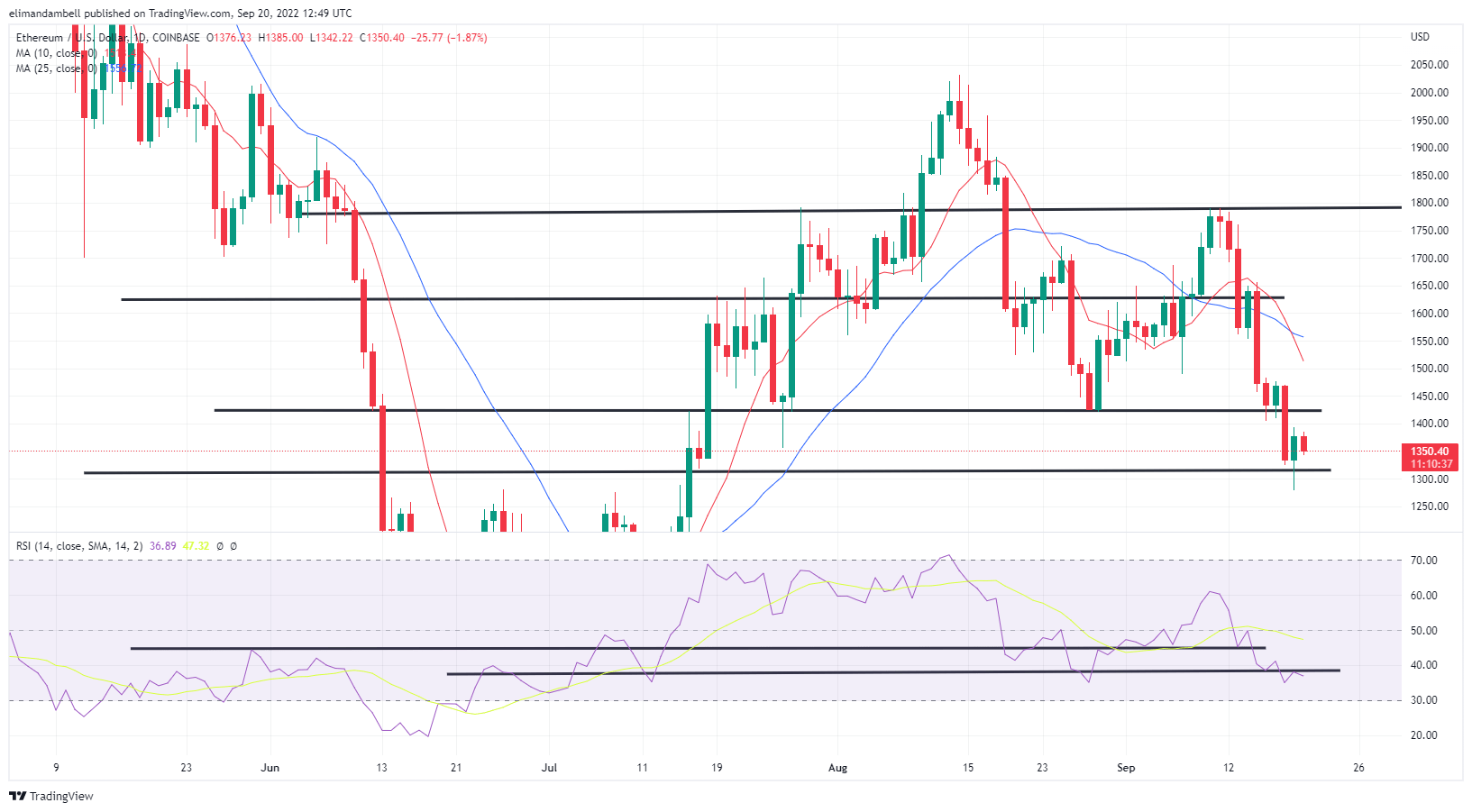

Ethereum

Similar to bitcoin, ethereum (ETH) also attempted to move higher on Tuesday, following a move to a two-month low during yesterday’s session.

ETH/USD, which hit a bottom of $1,287.72 to start the week, rose to a peak of $1,388.27 earlier in the day.

Like with BTC earlier, ethereum bulls reentered the market following a move below a key support point, in this instance the floor of $1,315.

ETH/USD – Daily Chart

Although the 14-day RSI is currently in bearish or oversold territory, many still believe that further declines could come.

As of writing, the index is tracking at 36.90, however a support level of 34.60 could be a target for some traders.

A downward cross of moving averages is another reason why some expect a potential move below $1,000 could be ahead.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Monero

Monero  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Augur

Augur  Bitcoin Gold

Bitcoin Gold  Bitcoin Diamond

Bitcoin Diamond  Ren

Ren