Institutional Investors Short $BTC While Betting on $XRP, $ADA, and Multi-Asset Products

Institutional investors have, throughout the month of September, added to bets against the flagship cryptocurrency Bitcoin ($BTC) by buying up products shorting BTC, while also betting on products offering exposure to $XRP, $ADA, and multiple assets.

According to CryptoCompare’s latest Digital Asset Management Review report, for the first time in two years, the average daily volumes for all exchange-traded products (ETPs) on the report dropped below $100 million after falling nearly 80% from this year’s high recorded in January.

The report details that institutional investors looking to gain regulated exposure to the digital asset space are “likely to turn to the growing number of crypto investment products” such as those contained in the report, and adds that these make “crypto more accessible to investors because they can be traded on traditional stock exchanges.”

Per the report Short Bitcoin Products, which “correspond to the inverse (-1x) of the daily performance of the Bitcoin futures index” saw a rise in their assets under management in September, with the ProShares Short Bitcoin Strategy ETF (BITI) seen an AUM rise of 43.9% to $98.8 million, while the 21Shares Short Bitcoin ETP (SBTC) saw an increase of $18.9 million.

CryptoCompare’s report adds:

As macro-conditions worsen and the price of major crypto assets continues their downward trend, investors will likely move towards short bitcoin products to profit or to hedge their cryptocurrency holdings. 21Shares SBTC were the only exchange-traded product that saw positive 30-day returns this month, rising 5%.

Products offering investors exposure to Ethereum endured “one of their most challenging months with all products dropping more than 10%” over the last 30 days, even after the cryptocurrency’s network moved from Proof-of-Work to Proof-of-Stake.

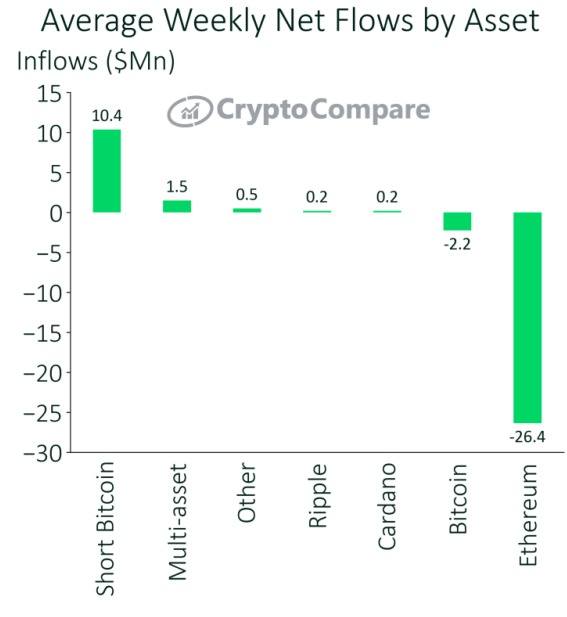

Meanwhile, institutional investors have been betting on the broader cryptocurrency market, with multi-asset investment products seeing $1.5 million in average weekly net flows, and $XRP investment products seeing $200,000, the same amount of average weekly net flows as Cardano ($ADA) investment products saw throughout September.

Source: CryptoCompare

$BTC and $ETH investment products saw average weekly net flows of -$2.2 million and -$26.4 million, respectively. As for product types, assets under management in trust products, dominated by Grayscale, fell 12.5% to $17.3 billion, equivalent to 76.9% of total assets under management for cryptocurrency investment products.

The assets under management represented by exchange-traded funds (ETFs) dropped in September to $2.25 billion, down 21%, while exchange-traded notes (ETNs) and exchange-traded commodities (ETCs) experienced falls of 10.5% and 16.5% respectively to $1.24 billion and $1.69 billion.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Stacks

Stacks  Algorand

Algorand  Cosmos Hub

Cosmos Hub  OKB

OKB  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Huobi

Huobi  Status

Status  Waves

Waves  Lisk

Lisk  Numeraire

Numeraire  Hive

Hive  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom