What the Regulators Said at DC Fintech Week

Hey folks. I’m in Washington, D.C., this week for DC Fintech Week. I’m going to highlight some statements or comments that stood out to me, but on a personal note I wanted to say it was great to meet so many of you (and shoutout to those of you who said you read this newsletter – I appreciate each and every one of you!).

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

‘Ugly baby’

The narrative

DC Fintech Week is an annual policy conference organized by Georgetown University School of Law’s Chris Brummer. It’s a substantive conversation, but I enjoy going as much for the people I meet at the event as I do for the talks themselves.

Why it matters

I always say I go to events at least partly for the actual discussions and partly to meet fellow attendees. Here’s what the speakers at the event had to say this year.

Breaking it down

Acting Comptroller of the Currency Michael Hsu opened day one, comparing crypto user interfaces to the iPhone’s development, but warning that this may trick people into thinking crypto services are similar to traditional financial services.

“In layman’s terms, until crypto matures and appropriate guardrails and gates are put in place, it would be wise to limit the scope of activities commingled within a single crypto firm – a limit on the PD [probability of default] – and to limit integration of crypto and TradFi – a limit on the LGD [loss given default],” Hsu said.

Commodity Futures Trading Commission Chair Rostin Behnam said the regulator’s case against Ooki DAO pretty much had to happen, calling it “egregious and so obvious” during a one-on-one with Brummer.

«It was hardly decentralized,” Behnam said of the DAO. “There were a few individuals who were very much at the center.»

(Side note: This is basically what I guessed the CFTC would say, lol.)

Ooki DAO has since geofenced U.S. users but it’s unclear whether the DAO or its members have found counsel to respond to the CFTC, which it has some time to do, after a judge ruled late Wednesday that LeXpunK Army and the DeFi Education Fund can participate and argue about how the CFTC serves notice to the DAO’s members.

Custodia Bank founder Caitlin Long took aim at the Federal Reserve over BNY Mellon’s announcement that it would offer custody services for crypto.

Custodia would add a filing to its ongoing lawsuit against the Federal Reserve Bank of Kansas, which has sat on Custodia’s application for master account access for over a year, Long said. The filing came the next day.

Eun Young Choi, the director of the U.S. Department of Justice’s crypto enforcement team, said crypto mixers are a challenge but have not “slowed us down.” This raised my eyebrows because we’ve heard quite a bit about the risks of anonymity in crypto potentially boosting wrongdoers.

There are three possible explanations: 1) the DOJ has a way around mixers; 2) the DOJ is running its own mixer as a honeypot; or 3) Director Choi is just saying this to throw off the folks using mixers.

Fed Vice Chair for Supervision Michael Barr warned that banks tokenizing things might be a bit concerning, but also provided some insights as to why it might take (some) regulators a while to write policy.

“The range of options available for dealing with emerging technologies and those benefits are solid,” Barr said. “One of them is just risk identification, so we can enunciate to the world that we see a set of risks and that they should be looked at carefully. And that has an actual effect on behavior.”

He went on to add that regulators who write rules too quickly may find that they’ve fallen behind the actual technology or area they’re overseeing.

Rep. Patrick McHenry, the ranking Republican member of the House Financial Services Committee, said the long-anticipated stablecoin bill may happen within the next few months, but there’s still some ongoing disagreements around regulatory oversight and how the assets are to be stored.

“We agree on all the components of what the asset is,” he said. “We’ve come up with a pretty ugly baby. It is a baby, nonetheless.”

Biden’s rule

Changing of the guard

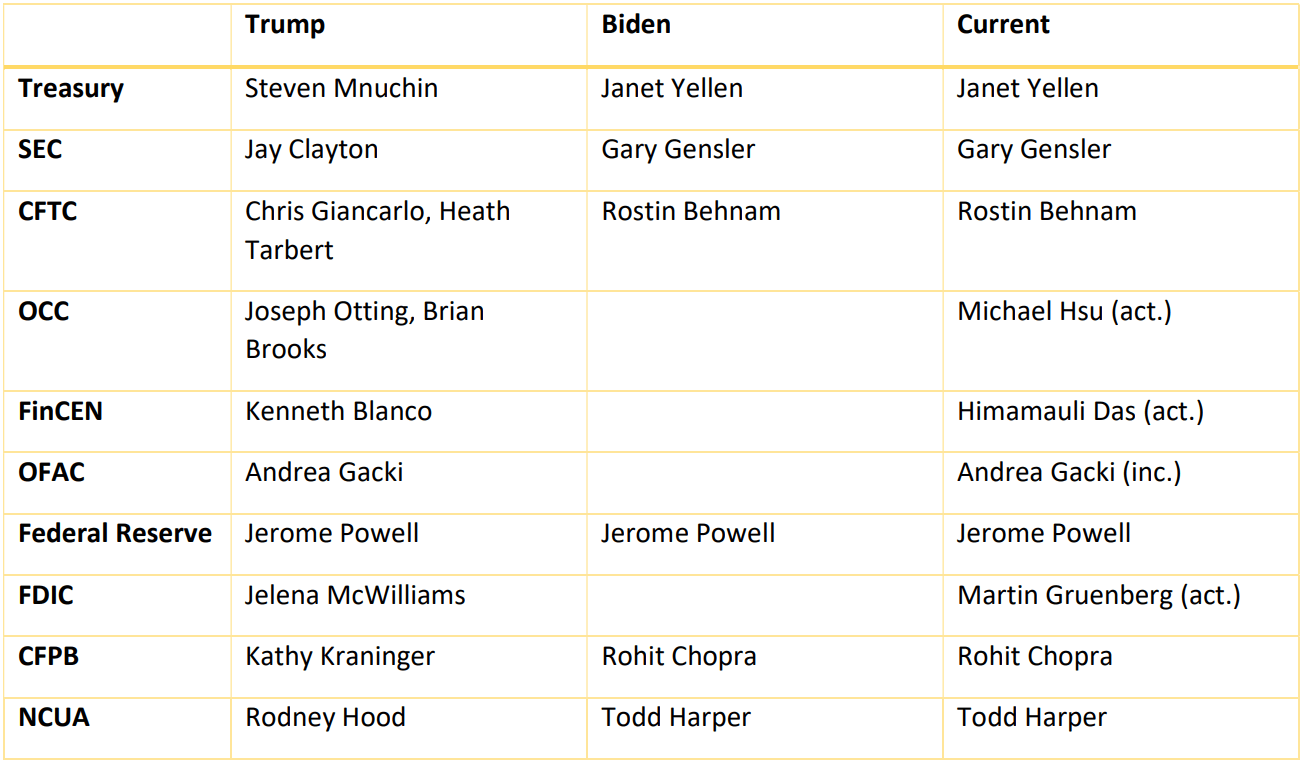

Key: (nom.) = nominee, (rum.) = rumored, (act.) = acting, (inc.) = incumbent (no replacement anticipated)

N/A

Outside CoinDesk:

- (The New York Times) Airbus and Air France are (finally) facing the families of the 228 victims of Air France flight 447 in court. The flight was a regularly scheduled one from Brazil to France which crashed in the Atlantic Ocean after its static ports iced over in a storm. For more information, here’s the final report from France’s Bureau d’Enquêtes et d’Analyses pour la sécurité de l’aviation civile, its aviation accident investigator.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Gate

Gate  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Tether Gold

Tether Gold  Theta Network

Theta Network  Zcash

Zcash  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Ravencoin

Ravencoin  Dash

Dash  Decred

Decred  Zilliqa

Zilliqa  Qtum

Qtum  Synthetix Network

Synthetix Network  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Status

Status  Siacoin

Siacoin  Holo

Holo  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Nano

Nano  Ontology

Ontology  Waves

Waves  Hive

Hive  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Numeraire

Numeraire  BUSD

BUSD  NEM

NEM  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Augur

Augur