After BUSD Was Suspended, The Stablecoin Landscape Is Changing More Interesting

BUSD enters “deflation” mode, USDT temporarily benefits the most

Looking at the entire stablecoin track, USDT, USDC, and BUSD once formed a tripartite confrontation, and the competition among the three was full of gunpowder. As a latecomer, BUSD is coming aggressively. It took only 4 years to achieve a market value of more than $20 billion, which also puts a lot of competitive pressure on the other two competitors.

Such a rapid expansion rate has also aroused doubts about the adequacy of its reserves. Bloomberg reported that Circle, the issuer of USDC, reported to NYDFS (New York Department of Financial Services) in the fall of 2022 that Binance did not have enough reserves to support it through Paxos. issued BUSD tokens, but Binance founder Changpeng Zhao did not believe this.

The NYDFS launched a regulatory action against BUSD this time. The main reason is that the packaged version of BUSD, Binance-Peg BUSD, has not been authorized. Under the “long sword” of supervision, Paxos has stopped issuing new BUSD tokens and began to destroy tokens.

Binance has also chosen to “abandon” BUSD as the main currency for transactions, and Changpeng Zhao claimed in the AMA that he has not yet considered issuing decentralized However, we are optimistic about non-dollar and algorithmic stablecoins, and we will see more stablecoins based on euros, yen, and Singapore dollars appear in the future.

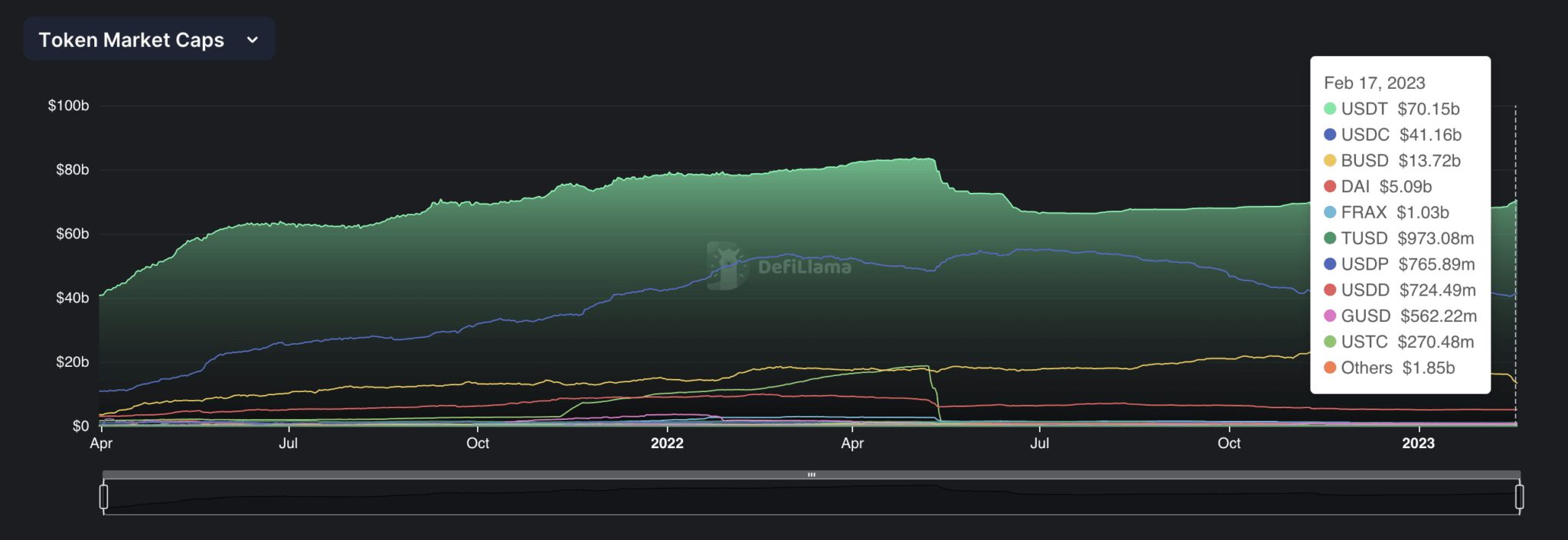

After BUSD entered the “deflation” mode of destruction, its market share began to decline at an accelerated rate. According to DeFiLlama data, as of February 17, the total market value of BUSD has dropped to approximately $13.7 billion, a drop of more than 15.1% in the past 7 days, and its market share is only 10%. Compared with the high of $23.4 billion in November 2022, BUSD has fallen by more than 41.4%.

The wiped market share of BUSD was quickly divided up, among which the leading stablecoins, USDT and USDC, increased their market value the most. According to DeFiLlama data, as of February 17, since the regulatory news came out on February 13, the total market value of USDT has risen to $70.1 billion, accounting for 51.4% of the market. The share has returned to more than 50% again.

The market value of USDC has increased by $500 million, and the market share of 30.2% has not changed much from before. From this point of view, the competitive landscape of the stablecoin market is quietly changing, and USDT temporarily benefits the most.

As Binance suspends competition on the stablecoin track, BUSD may become history, and other players will usher in the greater room for display.

As the battle for stablecoins begins, who else deserves attention?

Although the panic in the market has not been fully repaired due to the uncertainty of stablecoin regulation, stablecoins, as an important “cog” for the integration between traditional financial and encrypted markets, are still an attractive new financial deep sea. In the past few years, many new stablecoin players have come on the scene, and they have made moves to wrestle with the “predecessors” and there have even been bridges where the former waves beat the latter waves.

Although under the influence of regulation, the market value of the entire stablecoin market has been wiped out by nearly $300 million, but there are still many projects whose market value has grown against the trend.

So, apart from the old USDT and USDC in the market, which up-and-coming stars may be able to share the tens of billions of dollars in market value gap left after BUSD exits? The following will introduce some emerging stable currency projects with potential and high market value.

Source: DefiLlama

DAI

DAI is a decentralized stablecoin pegged to the value of the U.S. dollar, created and managed by the MakerDAO community, allowing users to mint over-collateralized assets through the Maker protocol. When the user wants to redeem the pledged assets, the DAI will be destroyed and a stability fee will be paid.

If the value of the pledged assets falls and the mortgage rate drops to trigger liquidation, the pledged assets will be sold at a premium and a 13% penalty and handling fee will be charged. . At present, the collateral supported by DAI includes BTC, ETH, LINK, UNI, USDC, etc. and the off-chain asset RWA.

As of February 17, the total market capitalization of DAI was $5.09 billion. Among them, about $3.25 billion is in external addresses, nearly $470 million is locked in the cross-chain bridge, $540 million is in DEX, and $370 million is in the lending agreement. From this point of view, DAI has a high degree of recognition and is an important building block of the DeFi Lego world.

Although DAI’s collateral assets are diversified, its over-reliance on USDC has laid a “hidden mine.” At the time of writing, 39.6% of the collateral is USDC. Rune Christensen, the co-founder of MakerDAO, also pointed out that this is the biggest potential for DAI.

To this end, Rune Christensen proposed an “Endgame Plan” to save DAI from being controlled by regulators, making it as unbiased as possible as a world currency like BTC and said that if the agreement cannot reach 75% of the DAI within three years Decentralized collateral threshold, he turns the DAI stablecoin into a free-floating asset.

FRAX

FRAX is a decentralized stablecoin protocol that uses a mixture of mortgages and algorithms, with a current market value of over $1.03 billion. FRAX is mainly circulated on public chains such as Ethereum, Arbitrum, Moonbeam, Fantom, Optimism, and BSC. Among them, the share on Ethereum exceeds 92.3%, and the original FRAX only supports Ethereum circulation, and the rest are cross-chain issuances by derivative issuers.

Whether minting or redeeming, users need to pledge the corresponding stablecoins and FXS according to the collateral rate of the system. For example, the current mortgage rate is 92%, which means that $1 of FRAX is backed by 92% of the collateral, and the remaining 8% is backed by the algorithm that manages the supply of FXS, and so on. During the operation of the agreement, the mortgage rate will be adjusted according to the price of FRAX, adjusted every hour, and adjusted by 0.25% each time.

In addition, in addition to FRAX, FRAX.finance also launched a stable asset FPI (FRAX price index) linked to the US Consumer Price Index, which can be understood as a stablecoin with an anti-inflation function.

Over the past few years, FRAX has indeed developed steadily and has also launched a DeFi product matrix. In addition to the FRAX stable currency, there are time-weighted average AMM Fraxswap, the lending market Fraxlend, algorithmic market-making program AMOs, encrypted native CPI stable currency FPI, and cross-chain bridge Fraxferry. Recently, as the upgrade of Ethereum Shanghai is approaching, Frax has launched frxETH, an ETH liquid pledge derivative.

USDP

Before BUSD, the earliest USD stablecoin issued by Paxos was PAX, which was later renamed USDP, approved and regulated by the New York State Department of Financial Services (NYDFS), and circulated in Ethereum and BSC, of which Ethereum accounts for 99.6% of the total. According to DeFiLlama data, as of February 17, USDP ranked seventh with a total market value of $760 million.

According to ChainEye data, USDP’s reserve net asset market value is $770 million (as of 2022.11 report), which is less than the current day’s circulation of $790 million. Except for some U.S. dollar cash, the rest of the reserve funds are U.S. treasury bills and U.S. treasury-backed reverse repurchase agreements with less risk.

TUSD

TUSD is a stablecoin issued by Trust Token and supported by Stanford Venture Fund. It is also the first stablecoin in the world to obtain the MSB license from the US government regulatory agency. It also reduces counterparty risks through a number of trust and bank partners. The underlying asset provides legal protection. Previously, TUSD and TRON also cooperated to launch the offshore RMB stable currency TCNH.

According to Chaineye data, the value of TUSD’s reserve assets (November 2022) is $810 million, exceeding the circulation of $806 million at that time. According to DeFiLlama data, as of February 17, the TUSD circulation market value was $960 million, an increase of 28% from the beginning of the year.

Currently, TUSD is circulated on public chains such as Ethereum, TRON, BSC, Avalanche, and Polygon, among which Ethereum and TRON share 55.3% and 42.1%, respectively, while native TUSD is only based on Ethereum, BSC, Tron, and Avalanche.

USTC

The algorithmic stablecoin UST, which once had a market value of tens of billions of dollars, is the predecessor of USTC. In May 2022, after the collapse of Terra, a new chain Terra 2.0 was established through community voting. The old chain was renamed Terra Classic, and the algorithmic stable currency function was retained, and UST was renamed USTC. While USTC never reverted to its $1 peg (currently at $0.027), the community is working on its re-pegging to its original value of $1.

According to DeFiLlama data, as of February 17, the market value of USTC has increased from a minimum of about $66 million after the thunderstorm to $270 million, an increase of 309%.

Recently, the Terra Classic community proposal 11324, “Re-anchoring LUNC and UST” has been approved. This proposal describes an operational framework for the LUNC community to re-bind UST from the code level, consensus level and guidelines. The ultimate goal is Restores the value lost in the May 2022 “decoupling” event.

LUSD

Liquity is a decentralized lending protocol that only allows interest-free loans against ETH. ETH is the only asset that can be used as collateral, and borrowers need to maintain a minimum collateralization ratio of 110%.

According to DeFiLlama data, as of February 17, the total market value of LUSD exceeded $220 million, an increase of 22% from the beginning of the year. LUSD is mainly circulated on chains such as Ethereum, Optimism, Arbitrum, Polygon and BSC.

sUSD

sUSD is a stablecoin fully over-collateralized by Synthetix’s project token SNX, and SNX stakers who mint sUSD can obtain the benefits of the Synthetix protocol. However, with the launch of Synthetix V3, more collateral types will be available.

According to DeFiLlama data, as of February 17, the total market value of sUSD was $120 million, an increase of 16.5% from the beginning of the year. sUSD mainly circulates on public chains such as Ethereum, Optimism, and Fantom.

agEUR

agEUR is a euro stablecoin issued by the decentralized stablecoin protocol Angle Protocol and has supported Avalanche, Ploygon and BNB Chain, etc. agEUR allows users to freely mint stablecoins or redeem collateral according to the price of the oracle machine after paying a small fee.

At the same time, the agreement has also launched a lending module, and users can borrow agEUR with assets such as wETH, MATIC or USDC. In addition, Angle will launch $agGOLD, a decentralized stablecoin pegged to one ounce of gold.

According to data from Dune Analytics, agEUR already has a place in the euro stablecoin market, with a market capitalization of over US$28.8 million and a market share of 12.2%. In addition to agEUR, there are also some euro stablecoins. PANews also wrote an article to review the issuance mechanism, scale and application of several large-scale euro stablecoins.

In addition, there are some stablecoins that have not yet been listed and are about to be launched:

GHO

GHO is an over-collateralized, USD-linked stablecoin to be launched by Aave, the leading DeFi lender. It is minted using aTokens as collateral and has officially launched on the Ethereum Goerli test network. GHO will be created by users (or borrowers) who must provide collateral (at a specific collateral rate) in order to mint GHO.

When the user repays the loan (or is liquidated), the GHO protocol will destroy the user’s GHO, and all interest generated by the GHO minter will be transferred directly to the Aave DAO treasury. GHO also introduces the concept of a facilitator, which can generate and destroy GHO tokens without trust. In addition, GHO’s borrowing rate is determined by Aave DAO, and its interest rate remains stable but may be adjusted according to market conditions.

It is worth mentioning that Stani, the founder of Aave, once hinted that GHO’s anchor assets will change in the future, “Long-term pegs to a certain currency have limitations, and you may want to change the anchor from a basic asset to the other (for various reasons), and being tied to the U.S. dollar will be a big limiting factor.” In addition, the decentralized lending protocol Centrifuge recently proposed in the Aave community to introduce real-world assets (RWA) into Aave and use them as collateral for the native stablecoin GHO.

crvUSD

crvUSD is a stablecoin issued by Curve Finance. The core feature of crvUSD is that it is collateralized by LP tokens and uses a new liquidation mechanism LLAMMA (Lending-Liquidation Automated Market Maker Algorithm) to solve the bad debt problem caused by the liquidation of collateralized debt positions, which is sold in a curvilinear manner Stablecoin collateral to protect against sudden drops in the value of the collateral.

In addition, crvUSD also has functional features such as liquidity intervals and EMA oracles.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Stacks

Stacks  Dash

Dash  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur