Alarming Sign for XRP: Is Major Correction Imminent?

XRP, the popular cryptocurrency associated with blockchain company Ripple, is showing ominous signs of a potential market correction.

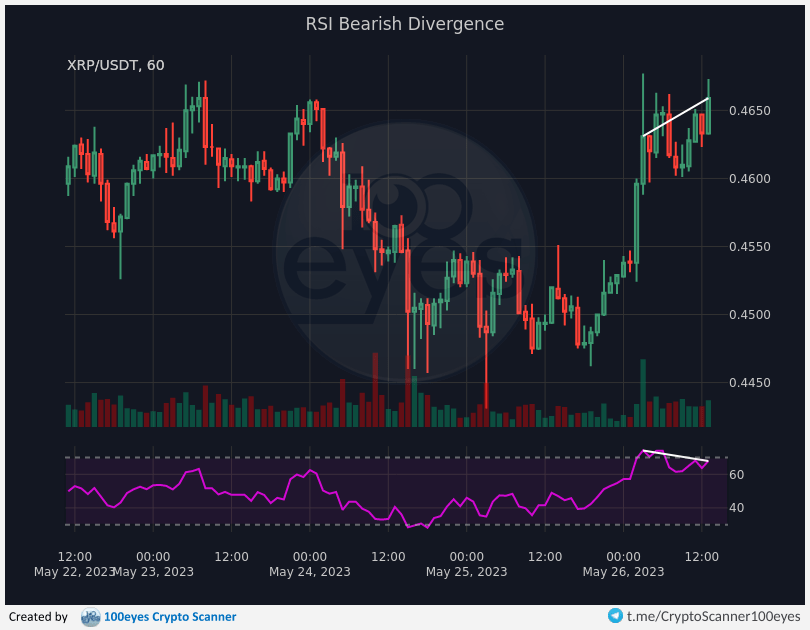

This follows the detection of what analysts term a bearish divergence, according to the popular 100eyes Crypto Scanner on Twitter.

In technical analysis, a bearish divergence occurs when the price of an asset such as XRP reaches a new high, but the relative strength index (RSI), a momentum indicator, fails to achieve a corresponding new high and shows a decrease.

This divergence between the asset’s price and its RSI is often interpreted as a sign that the bullish momentum is weakening, potentially leading to a price correction or even a full-blown bearish trend.

The price of XRP as of May 23 is sitting at $0.46 after recording a minor increase of 3.3% in the last 24 hours.

Adding to the uncertainty around XRP’s price trajectory, Evai CEO Matthew Dixon recently predicted a significant price drop for the digital asset, potentially falling as low as $0.34, before a significant rebound above $0.60. Dixon, known for his use of the Elliot Wave Theory, suggests that this volatility could offer high-risk high-reward trading opportunities.

As reported by U.Today, Ripple CEO Brad Garlinghouse recently predicted a speedy resolution to the SEC case. The resolution of the case, which has been a considerable overhang for Ripple, could sway the price of XRP in a significant manner. Hence, in the upcoming weeks, XRP’s path seems fraught with both potential setbacks and opportunities.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur