Algorand Breaks Below $0.2324 as Bearish Stress Overwhelms Market

Algorand token (ALGO) reveals that the cryptocurrency has been facing a downward trend today as the bears are in control of the market and are likely to maintain their momentum. The bears have caused a decrease in the price up to the $0.2324 level. Resistance for ALGO/USD pair is seen at the $0.2390 and $0.2394 levels. If the resistance level is breached, it could lead to a further increase in price. On the other hand, if the bulls fail to breach the resistance level, it could lead to a further decrease in price.

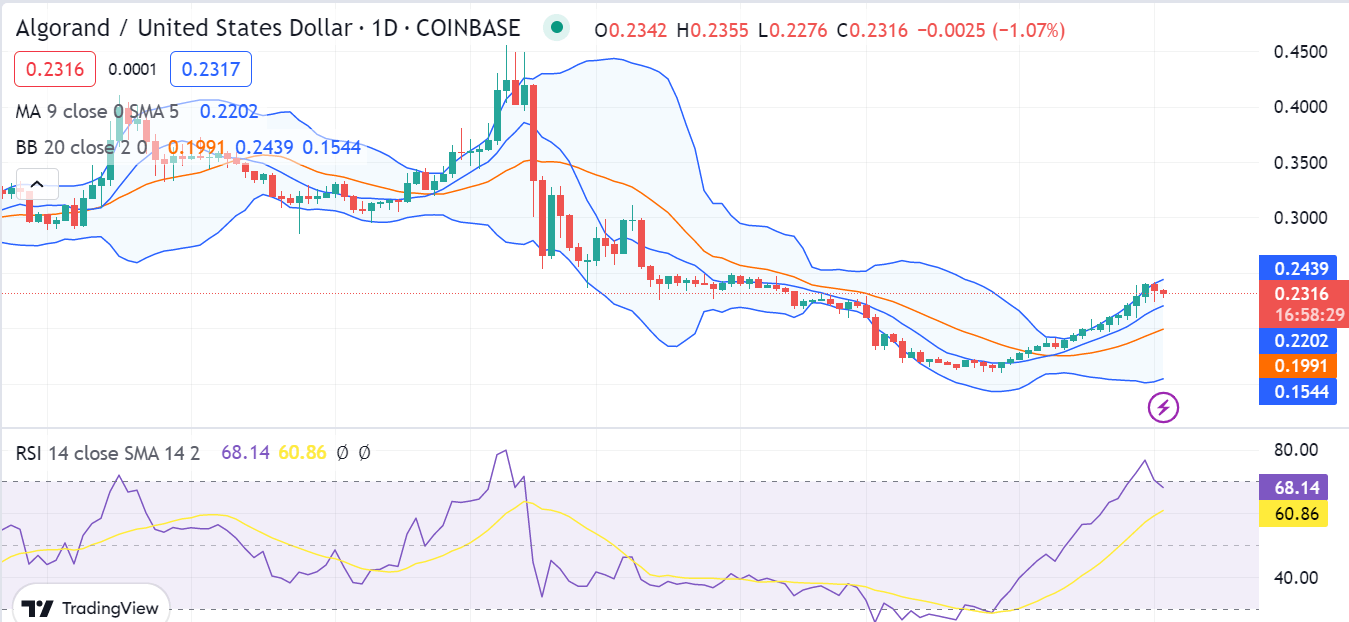

Looking at indicators on the daily chart, the market demonstrates a negative signal as the price moves downward. The bears are pulling down the price levels and they are still succeeding in maintaining it as the price has gone down to $0.2324 at the moment. The MA 50 and the MA 200 are both bearish as they are both below the current market price. This indicates that the bears are in control of the market.

ALGO/USD 1-day chart: TradingView

The Relative Strength Index (RSI) is currently at 60.86, showing a sign that the market is slightly increasing. Moreover, the width of the Bollinger bands is increasing, suggesting that further downtrends are taking place as the volatility increases. The upper band of the Bollinger Bands indicator is touching the $0.2439 point, whereas their lower band is present at a $0.1544 margin. This confirms that the bears are in control of the market, and they are likely to maintain their momentum.

The 4-hour price chart reveals the market’s trend has been bearish in the last few days. As a result, the market has decided on a negative approach. The less volatile market may be unfavorable for the bears, as they now have good chances of maintaining their movement and depreciating the value of ALGO even more. However, this will prove to be quite disadvantageous for the bulls.

In conclusion, the Algorand token price is currently facing a bearish trend as the bears are in control of the market. Traders should be cautious before entering any trades and look for bearish signals before making a decision.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Dash

Dash  Algorand

Algorand  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur