Arweave Price Analysis: When will AR Recover back inside the Consolidation Phase?

- Arweave price is trying to recover itself back inside the consolidation phase.

- AR crypto is trading below 20, 50, 100 and 200-days Daily Moving Average.

- The pair of AR/BTC is at 0.0005058 BTC with an intraday gain of 0.53%.

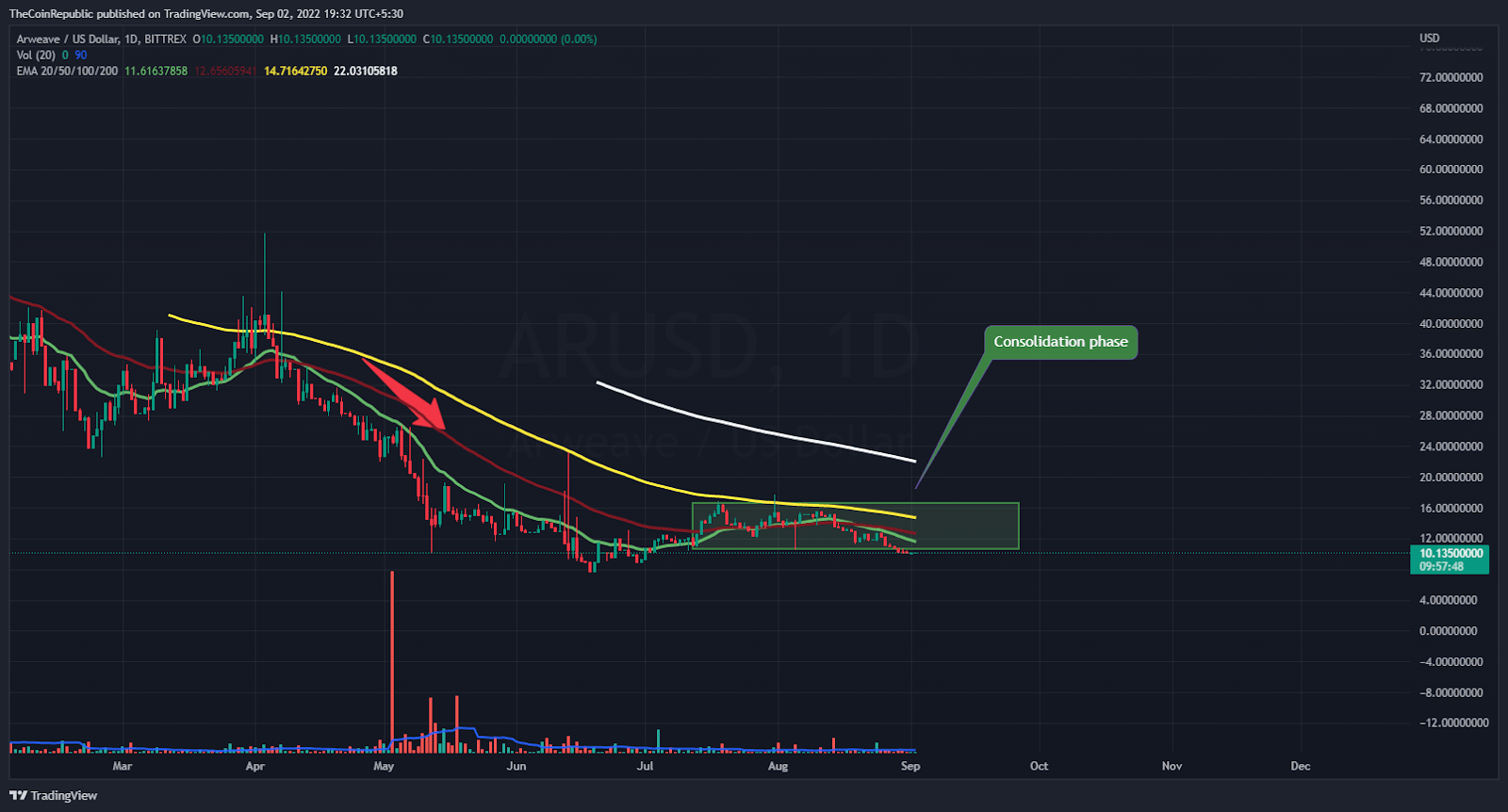

The price of Arweave is obviously increasing as shown by the daily price chart. The token’s price started to fall on April 7 and ended up at $43 that day. The currency is clearly moving upward and dedicated to breaking out of the consolidation, even though it is now trading toward the higher trendline. Bulls must maintain control of the region’s outside border, which is denoted by a horizontal range, before investors in AR can buy. The price of the AR coin appears to be extremely committed to exiting the consolidation phase. In order to follow the top trendline of the consolidation phase, AR must increase its customer base. Currency in AR has always cost between $10.85 and $16.50.

Arweave’s projected price is currently $10.13, and yesterday had a market value increase of 2.16%. During the intraday trading session, there was a 10.44% reduction in transaction volume. This shows that pressure is being applied to the daily chart of the AR currency by short sellers. Volume to market cap ratio is 0.03568.

Source: AR/USD by TradingView

In addition to attempting to increase demand, the price of the AR currency is attempting to maintain the upward trend visible throughout the daily price chart. The token needs to hold its present level in order for AR to advance upward and get nearer to the top trendline of the consolidation phase. The token must leave the consolidation phase in order to record its recovery phase. Volume shift, which is now below average, needs to be increased in the bulls’ favor.

What do Technical Indicators suggest about AR?

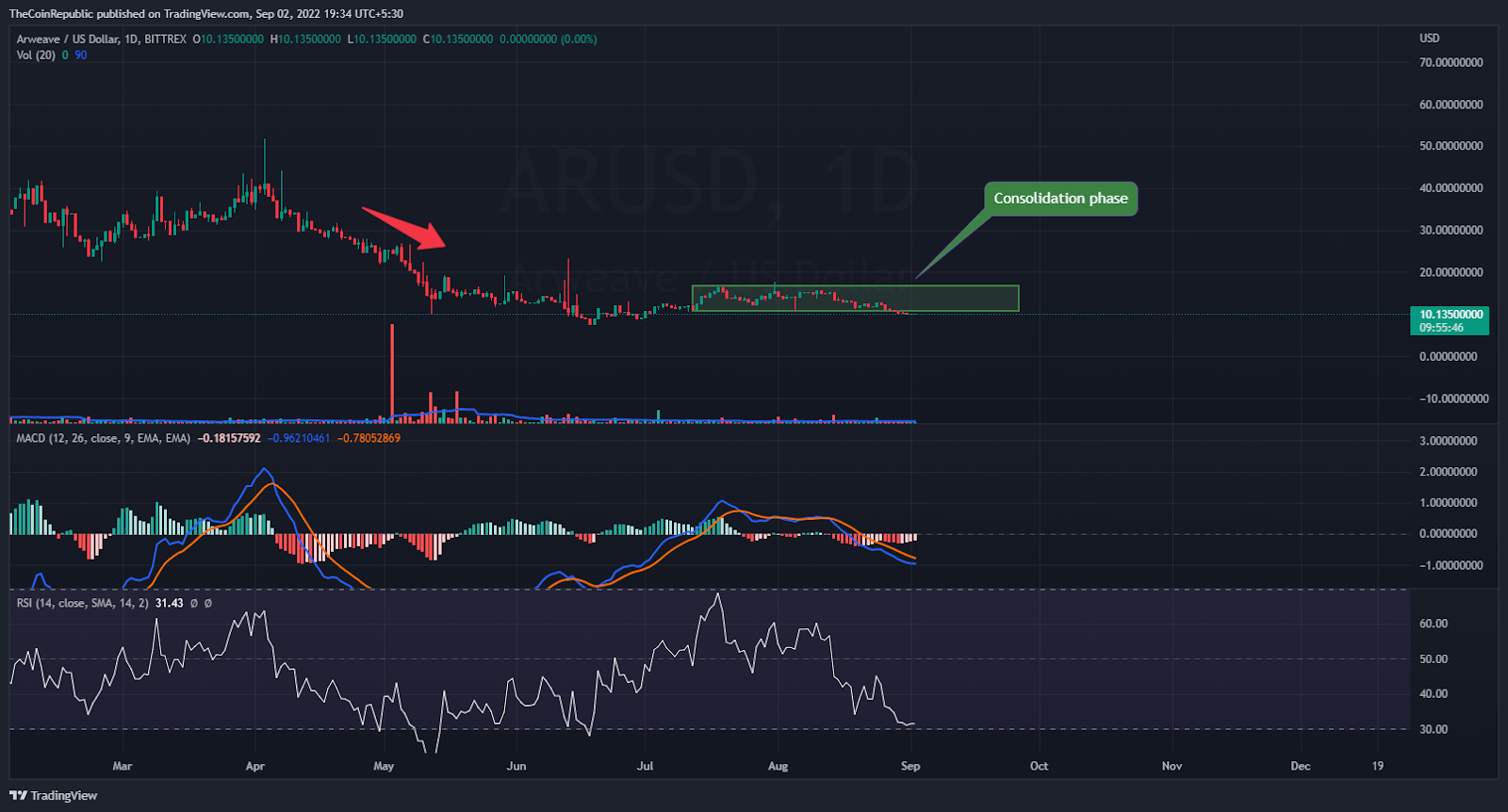

Source: AR/USD by TradingView

The AR currency’s pricing is now attempting to remain constant. The AR currency is permitted to leave the consolidation phase as long as purchasers take part in the transaction. The present bullish ascent of the AR currency, however, could be stopped by bears by bringing the token back toward the lower trendline. According to technical indicators, the AR currency is heading downwards.

The momentum of the downturn for AR coin is displayed by the relative strength index. At 31, the RSI is just beginning to enter oversold territory. According to the MACD, there is a bearish momentum for the AR currency. The MACD line is lower than the signal line following a negative crossover. Investors in AR need to keep an eye on the daily chart for any changes in trend.

Conclusion

The price of Arweave is obviously increasing as shown by the daily price chart. The token’s price started to fall on April 7 and ended up at $43 that day. The currency is clearly moving upward and dedicated to breaking out of the consolidation, even though it is now trading toward the higher trendline. Bulls must maintain control of the region’s outside border, which is denoted by a horizontal range, before investors in AR can buy. The token must leave the consolidation phase in order to record its recovery phase. Volume shift, which is now below average, needs to be increased in the bulls’ favor. According to technical indicators, the AR currency is heading downwards. The MACD line is lower than the signal line following a negative crossover. Investors in AR need to keep an eye on the daily chart for any changes in trend.

Technical Levels

Support Levels: $9.50 and $8.95

Resistance Levels: $10.65 and $12.00

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only, and they do not establish the financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Algorand

Algorand  Gate

Gate  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur