ATOM Technical Analysis: Uncertainty Rises Above 200-Day EMA

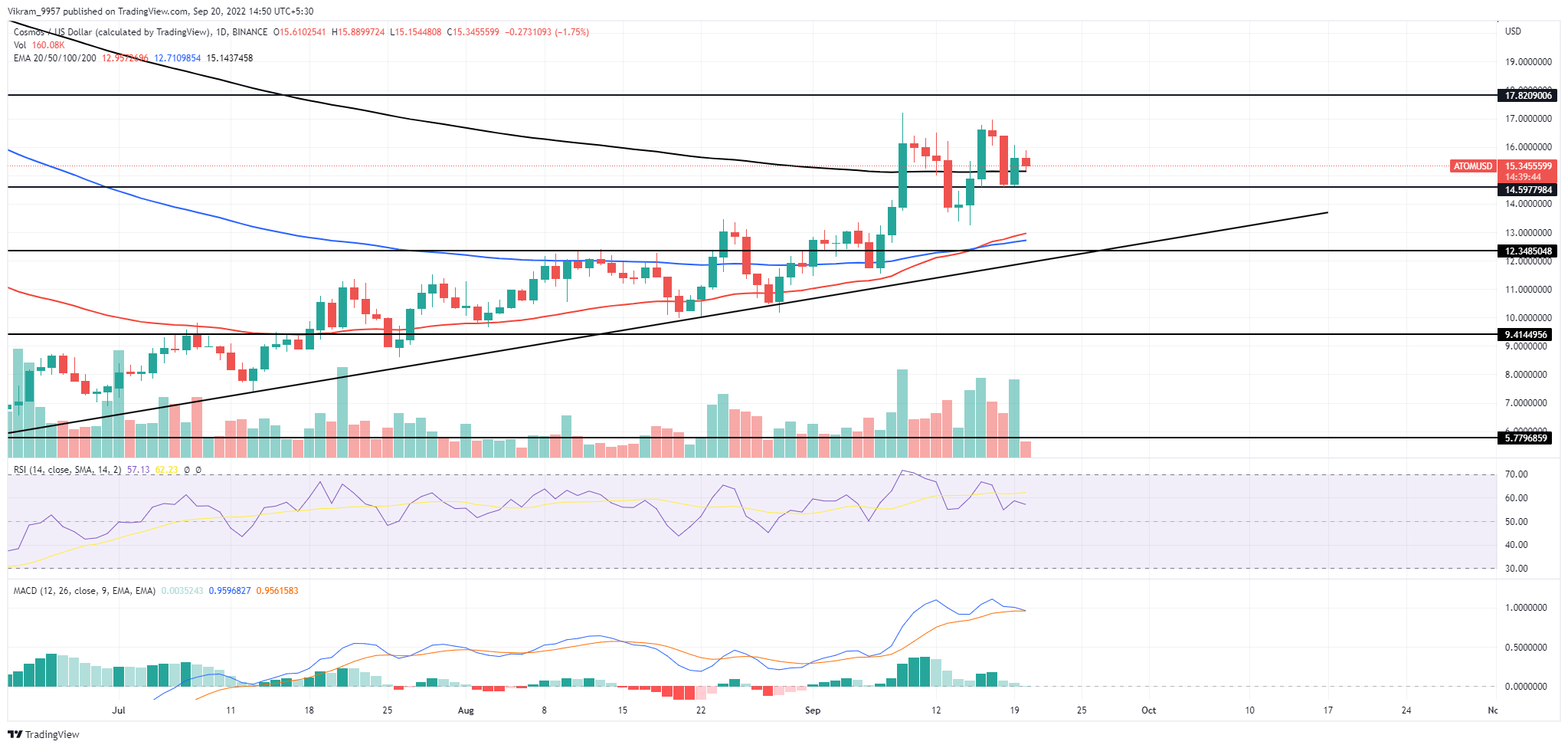

The ATOM technical analysis shows the buyers reclaiming dominance over the 200-day EMA and the $15 mark. But will the uptrend sustain this month? The ATOM price action bullish reversal rally from a long-coming support trendline in the daily chart resulting in a price jump above the 200-day EMA. Furthermore, the rise in intraday trading volume supports the bull cycle, projecting a potential trend continuation to $20. However, the increased selling pressure above the EMA warns of a downfall.

Key Points:

- The Cosmos prices show higher price rejection above the 200-day EMA.

- The market value sustains above the $15 mark for now.

- The intraday trading volume in Cosmos is $616 Million.

Source-Tradingview

ATOM Technical Analysis

The ATOM price displays a bullish reversal from the crucial daily support trendline resulting in a 48% jump over the past three weeks. The bullish rally beats the 50-day EMA and influences a crossover between the 50 and 100-day EMAs to regain positive alignment. However, the price faced increased selling pressure above the $15 mark resulting in a retracement to $14.5 twice this fortnight. Currently, the prices display a bullish attempt to sustain above the 200-day EMA and the $15 mark. With sustained selling, the ATOM price will tumble 13.2% and retest the neckline support of the double bottom pattern. A bearish breakdown from this support will accelerate the bearish momentum and offer a breakdown attempt from the long-coming support. However, until the ATOM price sustains above the rising trendline, the market participants can maintain a bullish outlook.

Technical Indicator

A bearish divergence in daily RSI slope bolsters the formation of a double bottom pattern, and its crossover below the mean line will encourage prolonged correction. Moreover, the bearish crossover between the MACD and signal lines signals a selling opportunity. Therefore, the technical indicators display a rising bearish sentiment. As a result, the ATOM technical analysis provides a selling opportunity. Resistance levels- $0.42 and $0.50 Support levels- $0.36 and $0.30

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Monero

Monero  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Numeraire

Numeraire  Siacoin

Siacoin  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Pax Dollar

Pax Dollar  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Augur

Augur  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond