Avalanche Price At Critical Support Level: What Direction Lies Ahead?

Despite the lingering bearish sentiment in the market, the Avalanche (AVAX) price has shown some upward movement. AVAX is hovering around a significant support line that has historically propelled its price in previous months. AVAX has experienced a slight 0.1% downward movement on the daily chart, while the weekly chart reflects a loss of approximately 2% in value.

Related Reading: Polkadot Experiences Correction After Reaching $5.54: What’s Next In Store?

Technical indicators for Avalanche indicate a bearish influence, with demand and accumulation remaining low. For buyers to regain confidence in the market, AVAX must maintain its support level and attempt to break through its resistance level. The appreciation of Bitcoin has also influenced altcoins, prompting some attempts at price increases.

However, if Bitcoin’s price falls below the $27,500 mark, it is unlikely that Avalanche will be able to surpass its next price ceiling. On the other hand, if AVAX manages to break through the overhead resistance, it may experience a rally. The decrease in the AVAX market capitalization suggests that selling pressure still exists in the market.

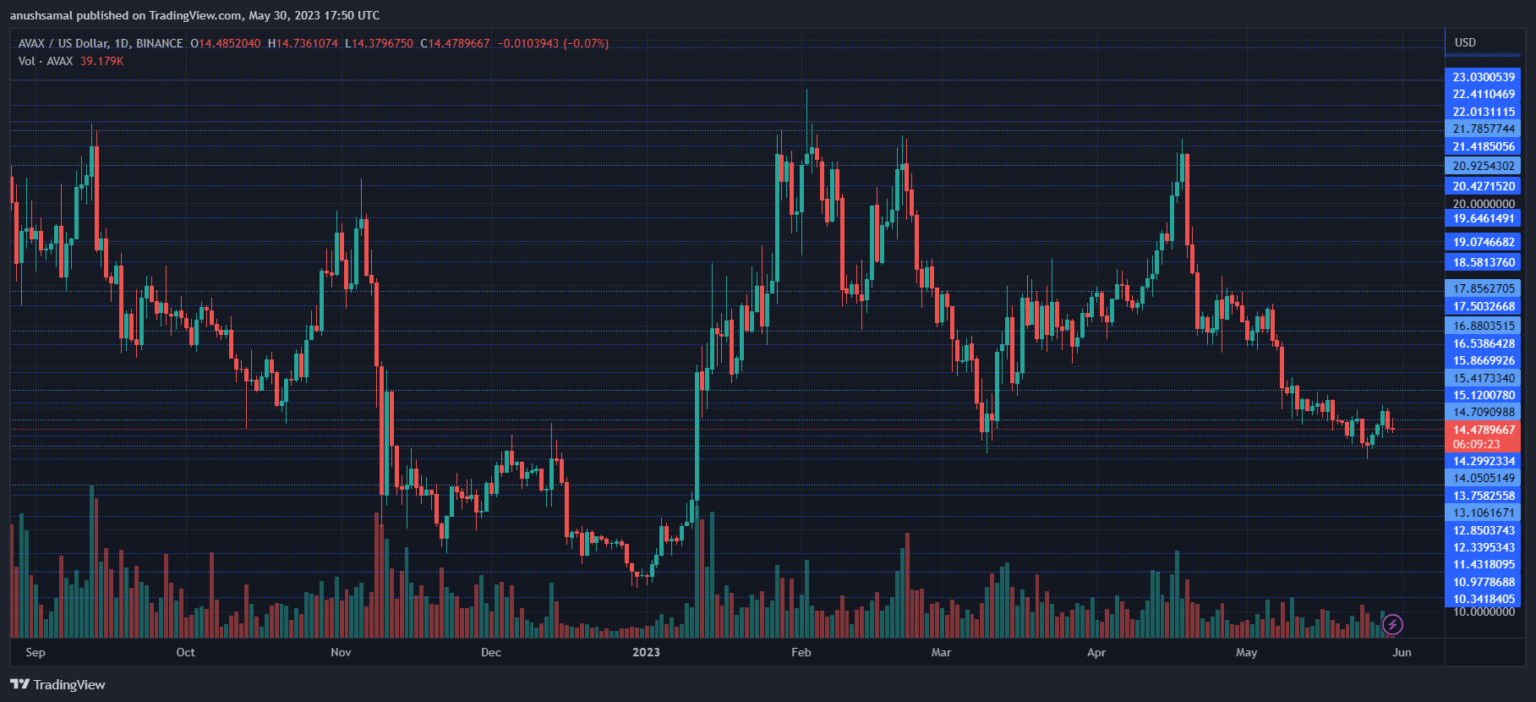

Avalanche Price Analysis: One-Day Chart

At the time of writing, AVAX was priced at $14.48. If sellers do not exert further pressure, the altcoin will likely make gradual progress on its chart.

The immediate overhead resistance for AVAX is set at $14.70, and surpassing this level could pave the way for further upward movement toward $15 and beyond. On the other hand, a decline from the current price level could bring AVAX down to $14 and potentially lower.

However, if buyers step in and provide a slight push, AVAX bulls can strengthen their position in the market. The trading volume of AVAX in the last session was in red, indicating that selling strength was influencing the price action.

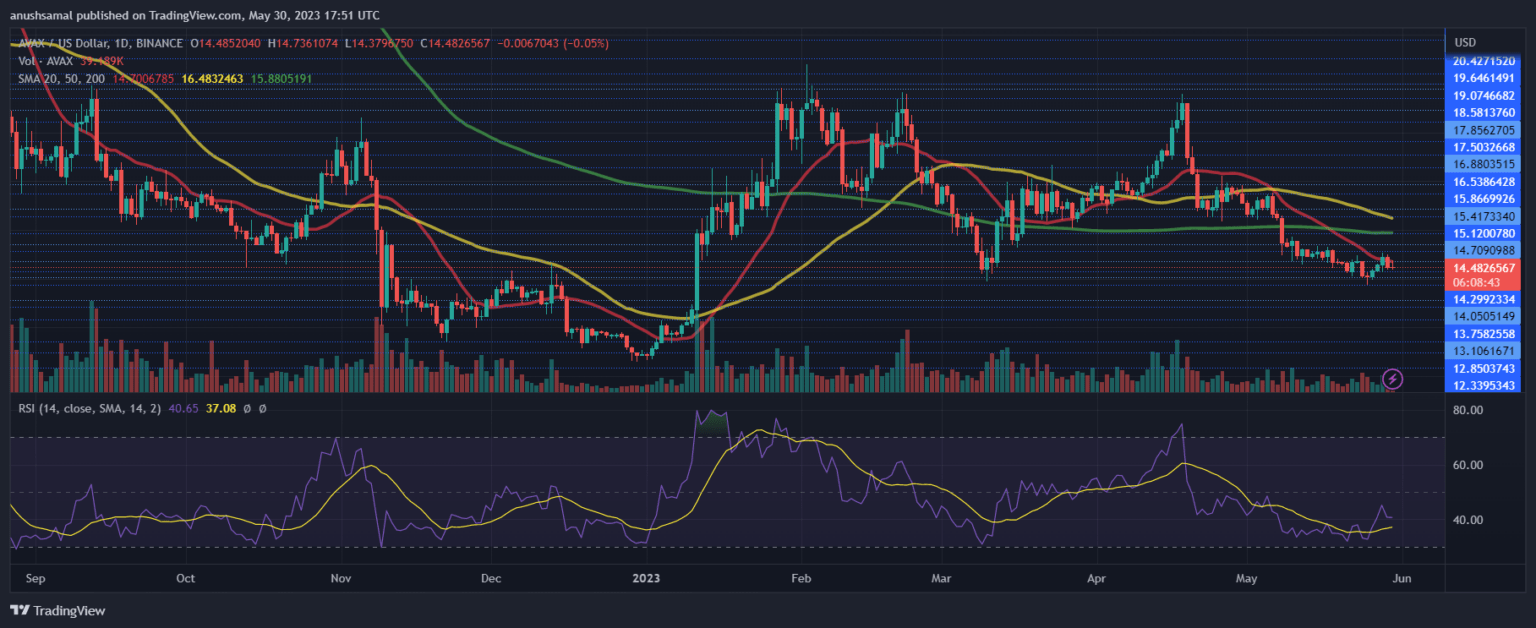

Technical Analysis

Throughout May, AVAX has experienced a lack of positive demand. The Relative Strength Index (RSI) has remained below the 50-mark, indicating that sellers have outnumbered buyers. The consistent rejection at the current price level could further diminish demand.

Furthermore, AVAX has fallen below the 20-Simple Moving Average (SMA) line, suggesting that sellers have been dictating the price momentum at the time of writing. This indicates a bearish sentiment in the market.

In line with other technical indicators, the buy signal for AVAX has been diminishing. The Moving Average Convergence Divergence (MACD) indicator, which measures price momentum and reversals, has shown declining green histograms, indicating a decrease in buy signals.

Additionally, the Bollinger Bands, which depict price volatility and the potential for price fluctuations, have significantly narrowed. This suggests that AVAX may experience a period of consolidation, with the potential for explosive price action in the upcoming trading sessions.

Related Reading: Rare Crypto Signal Emerges That Could Spark Another 2017-Style Boom

If AVAX can maintain its position above the current price level, there is a possibility that it might attempt a rally. However, the success of this rally will depend largely on the overall strength of the broader market and the support from buyers.

Featured Image From UnSplash, Charts From TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond