AVAX Price Analysis: Can The Technical Enhancements Revive The Network?

- AVAX is currently working on technical aspects of the ecosystem.

- The ecosystem has lost more than 90% TVL this year.

- Avalanche (AVAX) was trading at a market price of $13.47.

Technical improvements May Help The Network

Avalanche (AVAX) took to Twitter that they are involved in some technical advancements on their ecosystem for the validators. It will launch the Banff 4 technology for bandwidth enhancement for the persisting validators. This year has shown some of the worst calamitic scenarios that the crypto industry has ever witnessed.

Banff 4 adds bandwidth optimizations for existing validators and enables custom VMs to store data on disk, as well as setting the stage for exciting new features slated for Banff 5. https://t.co/00wnUB7wT7

— Avalanche ? (@avalancheavax) December 7, 2022

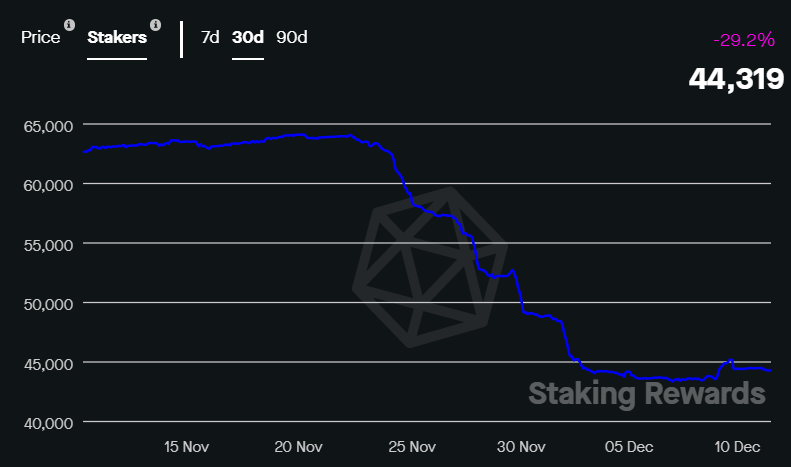

Source: Staking Rewards

But the technological advancements are not helpful in keeping the stakers onboard as they have declined by over 29% in a month. There were 44,329 stakers on the ecosystem at the publication time. This is not it, Avalanche experienced a hard blow in the DeFi sector too.

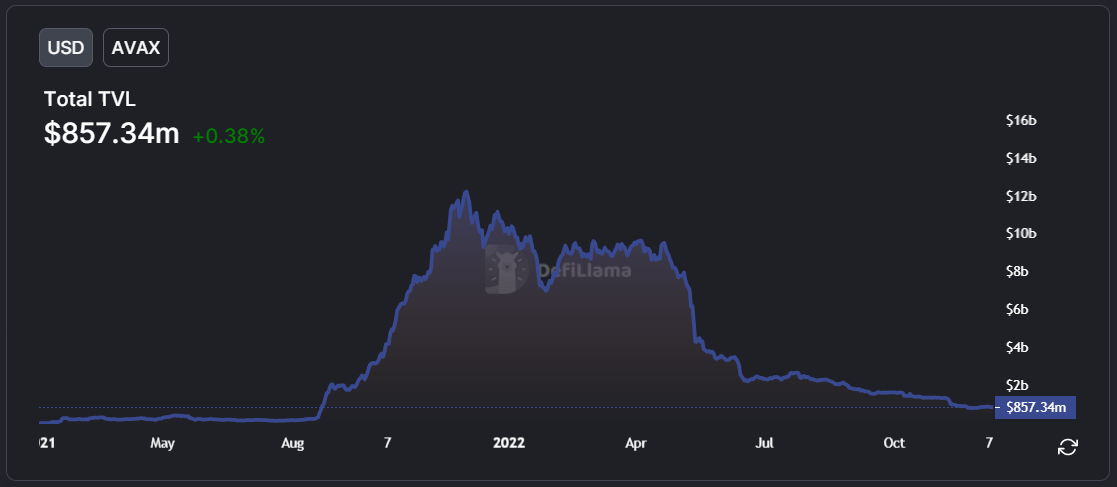

Source: DeFi Llama

According to DeFi Llama, AVAX had a Total Value Locked (TVL) at $857 Million at the time of writing. We can see how the ecosystem operated flawlessly during the first quarter this year. But it plunged sharply from around $9 Billion to what we are witnessing now. This translates into over 90% decline since Q1 2022.

Recently, Avalanche announced their collaboration with the Alibaba Cloud to provide a validator facility, Node-as-a-Service, on the ecosystem. With this, the organization is planning to introduce the MNC giant as a part of their co-operative efforts. This will put Avalanche in charge of blockchain node’s technical aspects while guaranteeing the security.

Avalanche (AVAX) Price Analysis

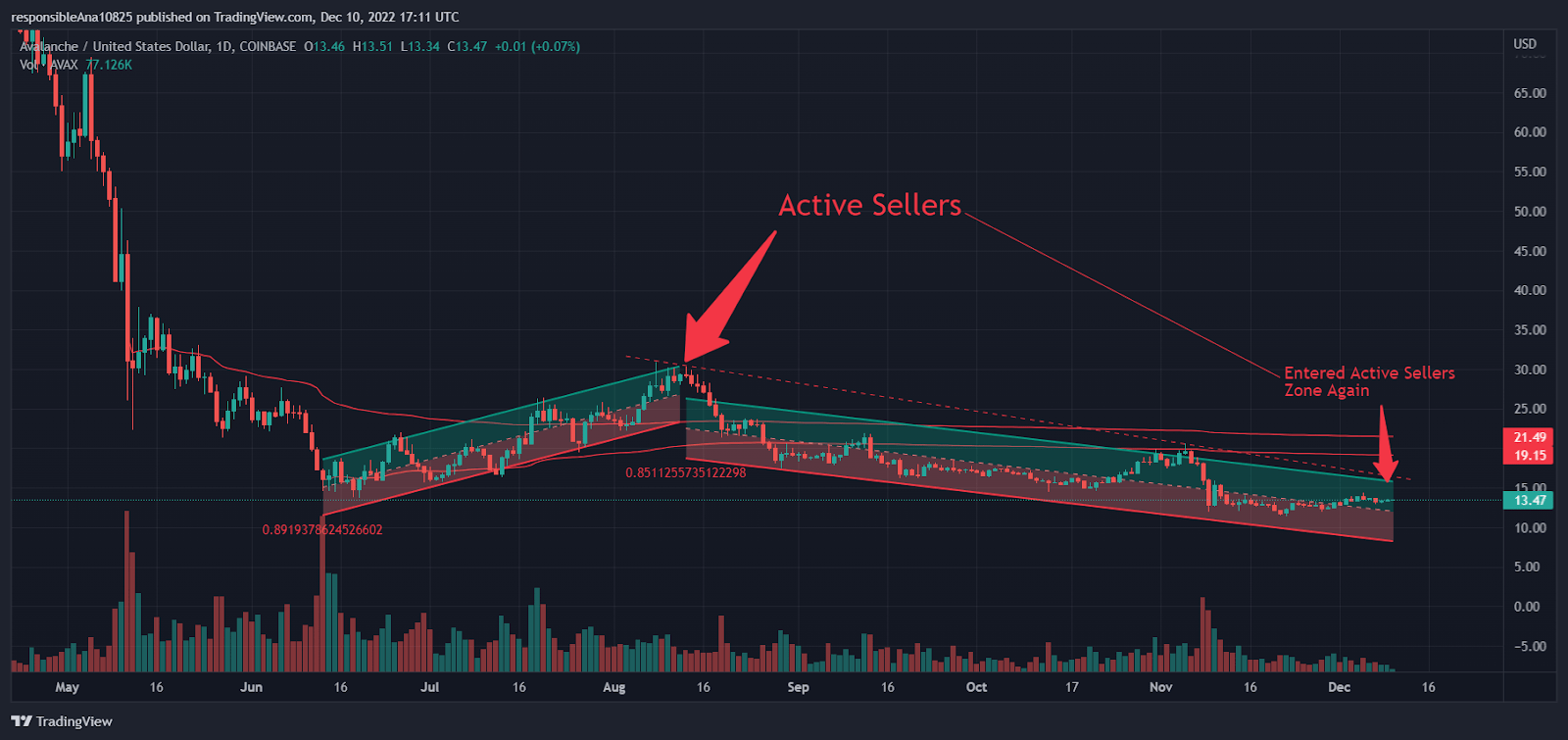

Source: AVAX/USD Price at TradingView

Crypto winter has created a lot of bloodbath in the market which is crystal through the chart. AVAX has lost around 90% in its value since April 2022. The asset traded at the yearly high of $104 during April 2022. It then followed a steep decline where it hit the bottom to around $14 in June 2022. Reason for the plunge remains fleeing investors during May 2022.

The first regression trend shows a huge amount of sellers causing a plunge during May 2022. As AVAX started showing potential it was met with smaller daily sell offs in the mid-August to end the uptrend. The latter shows a similar trend as the price has entered the active sellers zone again. Currently, the asset was trading at $13.47, less than 1% decline in the past 24 hours.

AVAX is a third generation cryptocurrency and is considered one of the Ethereum killers alongside Cardano, Solana, Tezos and more. But the year has proven to be a hard struggle for almost all the virtual currencies in the sector. Finally, when the fog appeared settling in the market, FTX happened. And the cold winds seem to gain a positive momentum instead.

Cryptosphere had a market cap at $857 Billion at the publication time with Bitcoin and Ethereum collectively shedding 56.8% dominance over the market.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur