Bitcoin (BTC) Spot Trading Dominance Skyrockets, Suggesting a Growing Accumulation

Bitcoin (BTC) whales accumulate more of the asset as spot trading dominance sees a recent massive surge.

While some investors see Bitcoin’s current underperformance as a reason to be wary, others believe the asset’s current price actions are an opportunity to amass more tokens, as they reckon it is currently undervalued. Whales, whose movements are major determinants of an asset’s price actions, appear to have shown more interest in Bitcoin

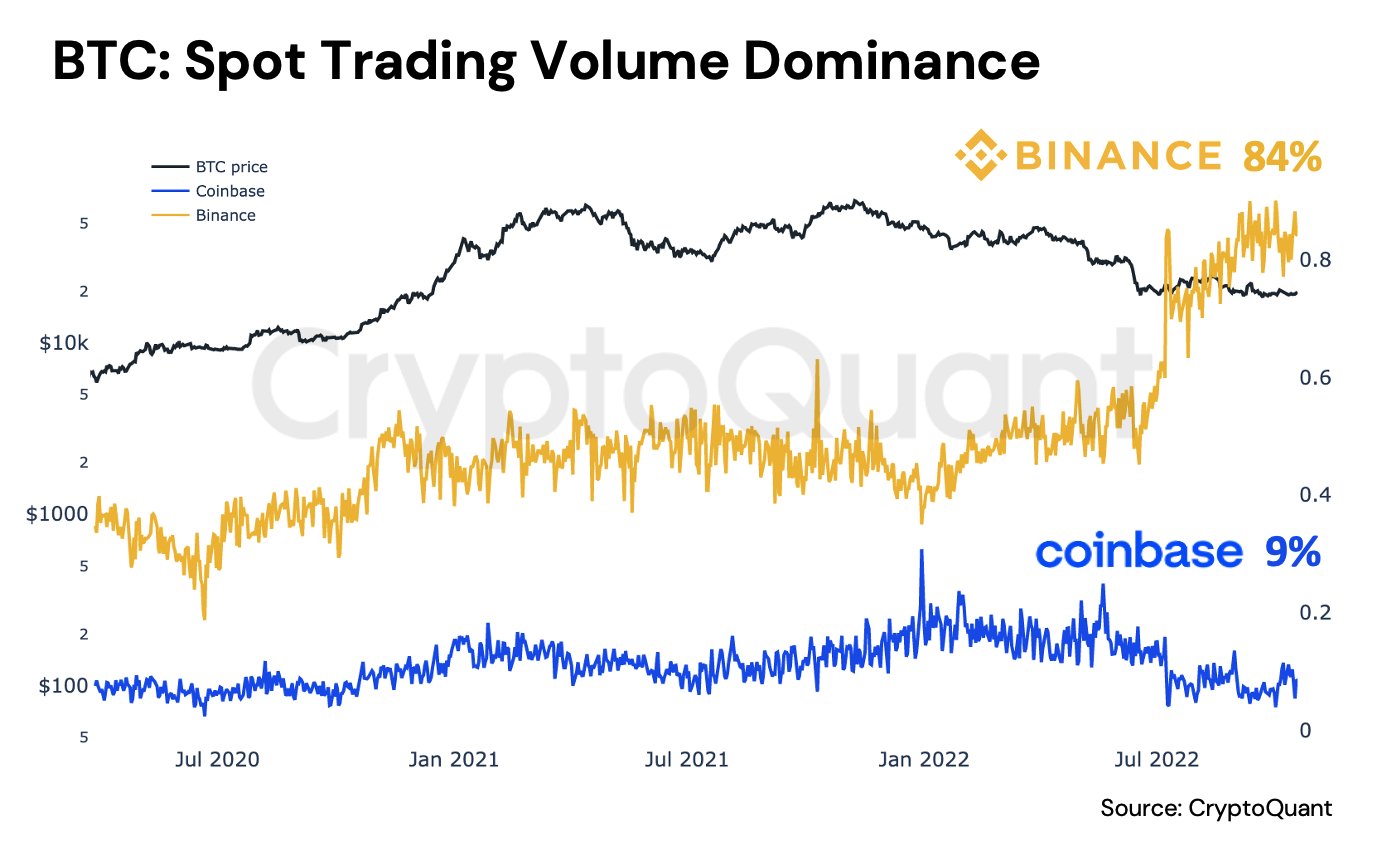

Following Bitcoin’s journey to the $20k zone, Bitcoin’s spot trading volume on the world’s largest exchange, Binance, saw a massive dominance, as revealed by CryptoQuant’s CEO Ki Young Ju in a recent analysis.

As the asset plummeted to the $20k level in July, spot trading suddenly saw a surge in response, hitting a dominance rate of 84% on Binance – levels that hadn’t been witnessed for over two years. Additionally, BTC spot trading on America’s largest exchange, Coinbase, skyrocketed, hitting a dominance rate of 9% as of press time.

“Since Bitcoin price hit the $20k level, Binance spot trading volume dominance skyrocketed, and it’s now 84%. The second biggest is Coinbase, 9%,” Ki highlighted in a tweet, as he shared a chart to corroborate his analysis.

Ki admitted that he’s uncertain of the investors behind this massive surge. Still, he limited his options to institutions utilizing prime brokers and large crypto investors looking to leverage Bitcoin’s undervalued price condition.

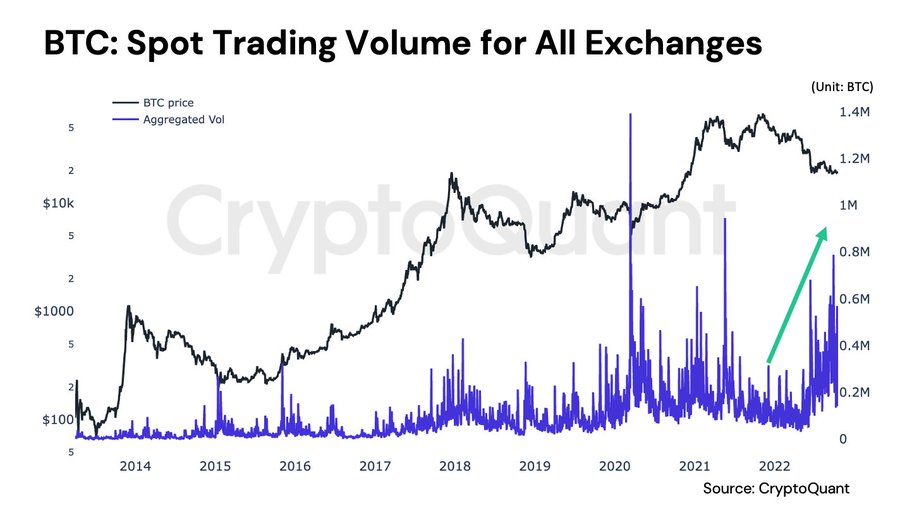

Furthermore, Ki pointed out that BTC exchange volumes on spot trading have increased by over 2,000% in the past six months, as they see a 20x rise.

“BTC spot trading volume for all exchanges increased 20x over the past six months. The volume renewed a year-high last month, but not much change in the daily closed price, indicating someone(s) is buying all the sell-side liquidity,” Ki noted in a separate tweet.

This increase in spot trading volume could either have been contributed by a growing trend of whale accumulation, or it could be the result of wash trading due to Binance’s recently-introduced zero-fee trading policy. Ki admitted that either or both of the mentioned could be the case, but he highlights that Binance, the world’s top exchange, does not need any form of wash trading to boost its trading volume stats.

A trend that points to whale accumulation is the recent movement of large bulks of BTC tokens that have been witnessed of late. The Crypto Basic recently reported the movement of about 48,000 BTC tokens from Coinbase Pro.

Additionally, Ki Young Ju pointed out that Bitcoin has reached the zone at which it tends to attract much interest from institutional investors.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  Synthetix Network

Synthetix Network  KuCoin

KuCoin  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Ontology

Ontology  Zcash

Zcash  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur