Bitcoin, crypto prices buoyant, while Coinbase hits all-time low as Silvergate sinks 12%

Bitcoin and other crypto prices are holding onto gains after better-than-expected inflation data ahead of the Fed’s last rate decision of the year.

Crypto stocks didn’t fare so well, however, with Coinbase hitting an all-time low. Silvergate sank almost 12%.

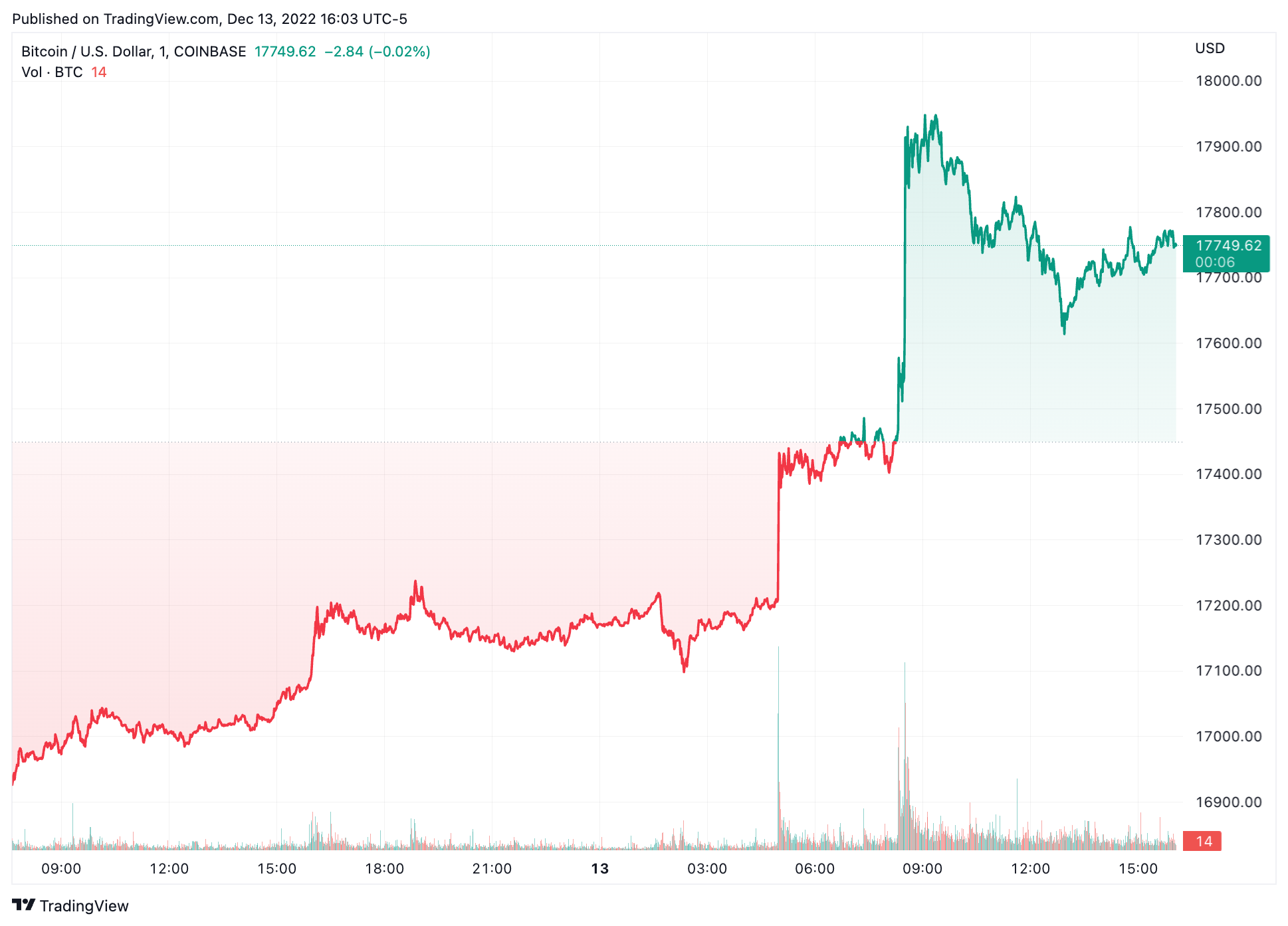

Bitcoin was trading at around $17,750 at 4 p.m. EST, up over 3% in the past day, according to TradingView data. Most of bitcoin’s gains followed the U.S. CPI data at 8:30 a.m. EST.

BTCUSD chart by TradingView

Ether continues to trade above $1,300, having tacked on over 3.5% throughout the day. Binance’s BNB token pared some of its losses, although it is still down over the past day, dipping 2.1%. Binance resumed USDC withdrawal requests around midday EST. The exchange had temporarily stopped processing withdrawals due to inadequate reserves on the platform, according to Binance CEO Changpeng Zhao.

After today’s inflation data, markets are now trained on the U.S. Federal Reserve tomorrow. The central bank’s policy-setting committee — the FOMC — is set to announce its last interest rate decision of the year. A 50 basis point increase is widely expected after several 75 basis-point bumps.

Today’s CPI data materially increases the chances the Fed will raise rates by just 50 basis points tomorrow, Marc Arjoon, an analyst at CoinShares, told The Block. «A confirmation of this 50 basis points hike tomorrow will see a further marginal upside,» he said.

Ivan Kachkovski, executive director of crypto and FX research at UBS, echoed this. «Bitcoin and ether have recently been trading as risk assets such as U.S. micro-cap stocks, thus sensitivity to any slowdown in rate hikes beyond market expectations would likely be significant,» he said.

Arjoon expects Fed Chair Jerome Powell to be less hawkish tomorrow compared with his speech in November, which roiled markets at the time.

Crypto stocks

The S&P 500 and the Nasdaq 100 closed higher, up 0.7% and 1.1%, respectively.

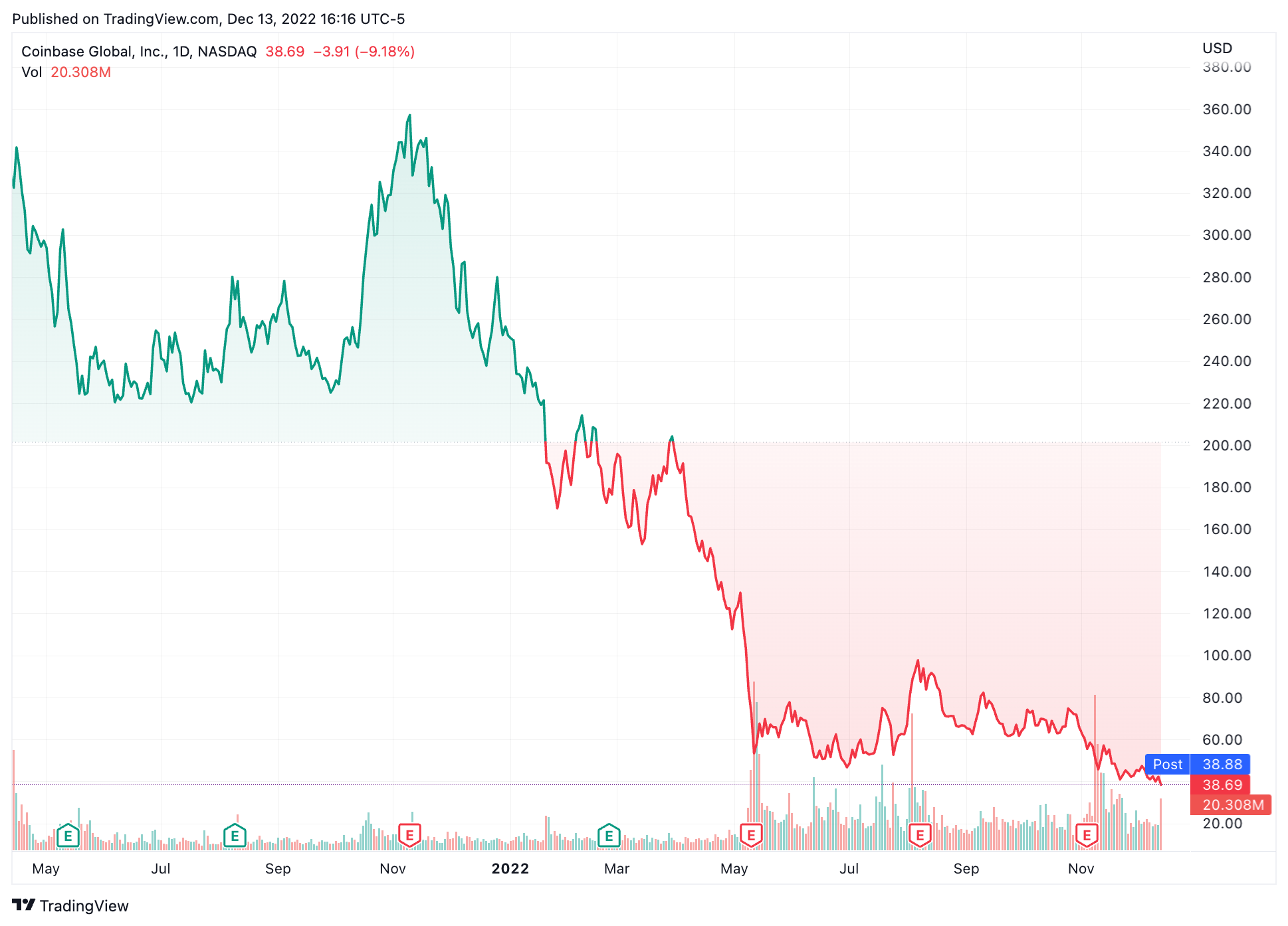

Coinbase slumped 9.2%, according to Nasdaq data. Shares of the exchange closed below $40 for the first time since debuting in April 2021 and hit an all-time low of $38.50 toward the end of today’s session.

COIN chart by TradingView

Last week, CEO Brian Armstrong said revenue for 2022 will likely be down 50% year-on-year amid the ongoing market tumult, in line with analyst estimates.

Silvergate shares also sank, plunging 12% to $18.73, a more than two-year low. Block and MicroStrategy bucked the downtrend in crypto-related stocks, adding 7.3% and 2.9%, respectively.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond