Bitcoin, Ethereum Hit Monthly Highs Ahead of Inflation Report

Ahead of the Fed’s upcoming CPI report, Bitcoin and Ethereum are bullish.

The Consumer Price Index (CPI) measures the rate of change in the price of various goods and services in the United States. It’s used as a key indicator for measuring inflation.

Bitcoin (BTC) broke its near-term sidewise momentum, with the leading cryptocurrency hitting a new monthly high of $18,287.30, according to data from Coingecko.

At press time, BTC is changing hands at around $18,165, up 4.1% over the past 24 hours.

Alongside the bullish price action, Bitcoin’s daily trading volumes have also risen 48.73% to $33.398 billion over the same period.

On a weekly note, Bitcoin is up 7.8%, reversing all its monthly losses.

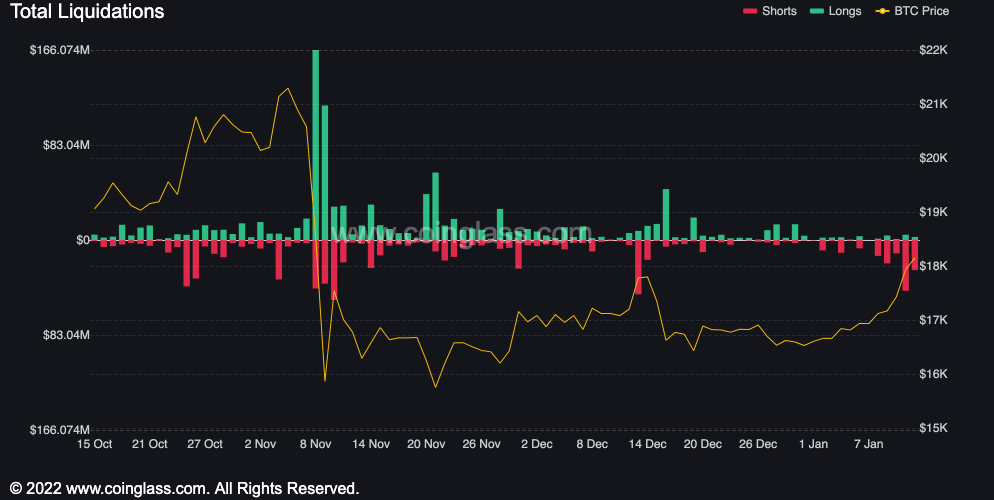

Amid Bitcoin’s bullish run today, over $77 million worth of Bitcoin futures trades were liquidated over the past 24 hours, per data from Coinglass. Most liquidations (~93.32%) came from blown-out short positions.

Bitcoin liquidations over time; red bars indicate blown-out short trades. Source: Coinglass.

Despite short-term price heroics, Bitcoin is still far from its historical all-time high of $69,044 in November 2021.

Ethereum joins Bitcoin bounce

Ethereum (ETH), the second-largest cryptocurrency, with a market capitalization of roughly $168.9 billion, has also gained 4.8% over the past 24 hours, per data from Coingecko.

Since November 8, 2022, Ethereum has struggled to rally past the $1,400 resistance level. Earlier today, ETH breached that level and rallied as high as $1414.11, the coin’s new monthly high.

According to data from Coinglass, Ethereum is leading liquidation activity.

Over the past 24 hours, Ethereum futures positions totaling $112.21 million were liquidated. Of the total trades liquidated, 94.48% were short positions.

Bitcoin, Ethereum and Dogecoin Jump as CPI Report Shows Cooling Inflation

Apart from the bullish price action, Ethereum-based NFT trading volume has also spiked 38.45% to $28.679 million over the past 24 hours, according to data from Cryptoslam.

Total Value Locked (TVL), a measure of DeFi activity on Ethereum, is up 2.25% to $25.33 billion, supporting the ongoing price rally.

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Algorand

Algorand  Gate

Gate  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Holo

Holo  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Enjin Coin

Enjin Coin  Ontology

Ontology  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur