Bitcoin, Ethereum Technical Analysis: BTC, ETH Consolidate to Start the Week

Volatility in crypto markets remained high on Monday, as bitcoin was mostly in the red to start the week. The token has once again moved below $20,000, as prices appear to be consolidating. Ethereum was also trading sideways, with prices falling marginally below a key support level earlier in the day.

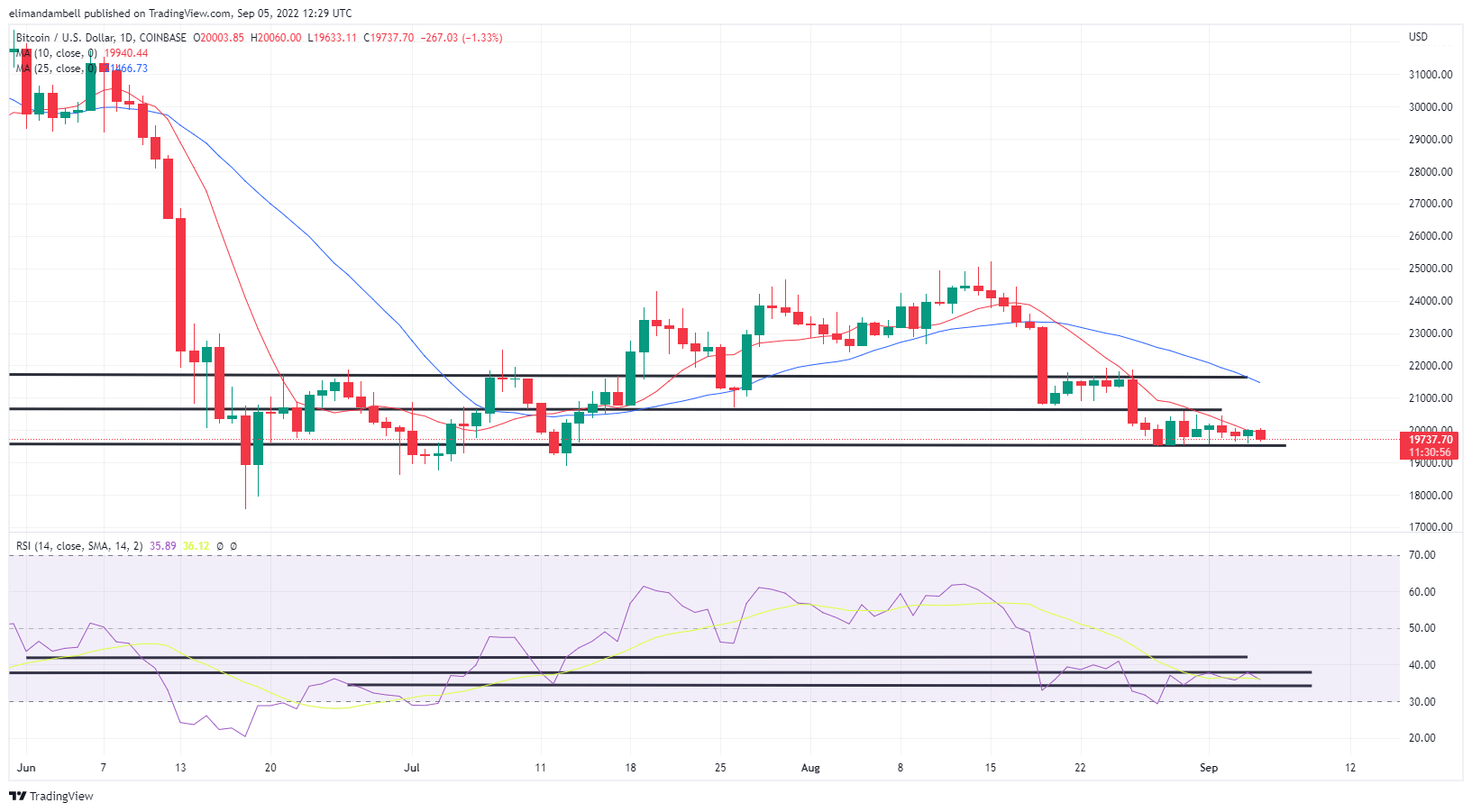

Bitcoin

Bitcoin (BTC) started this week how it ended the previous, trading not only in the red, but also below $20,000.

The world’s largest cryptocurrency fell to an intraday low of $19,673.05 on Monday, as the post-nonfarm-payrolls-report bearish sentiment continued.

Today’s low saw BTC/USD briefly move close to its support point of $19,600, however bulls have so far resisted a move below this point.

BTC/USD – Daily Chart

Looking at the chart, it appears as though the decline came as the 24-day relative strength index (RSI) failed to break through its own ceiling.

As of writing, the RSI is tracking at 35.84, which is below the aforementioned resistance point of 37.90.

In order for bitcoin to climb back above $20,000, this is likely a hurdle it must first overcome.

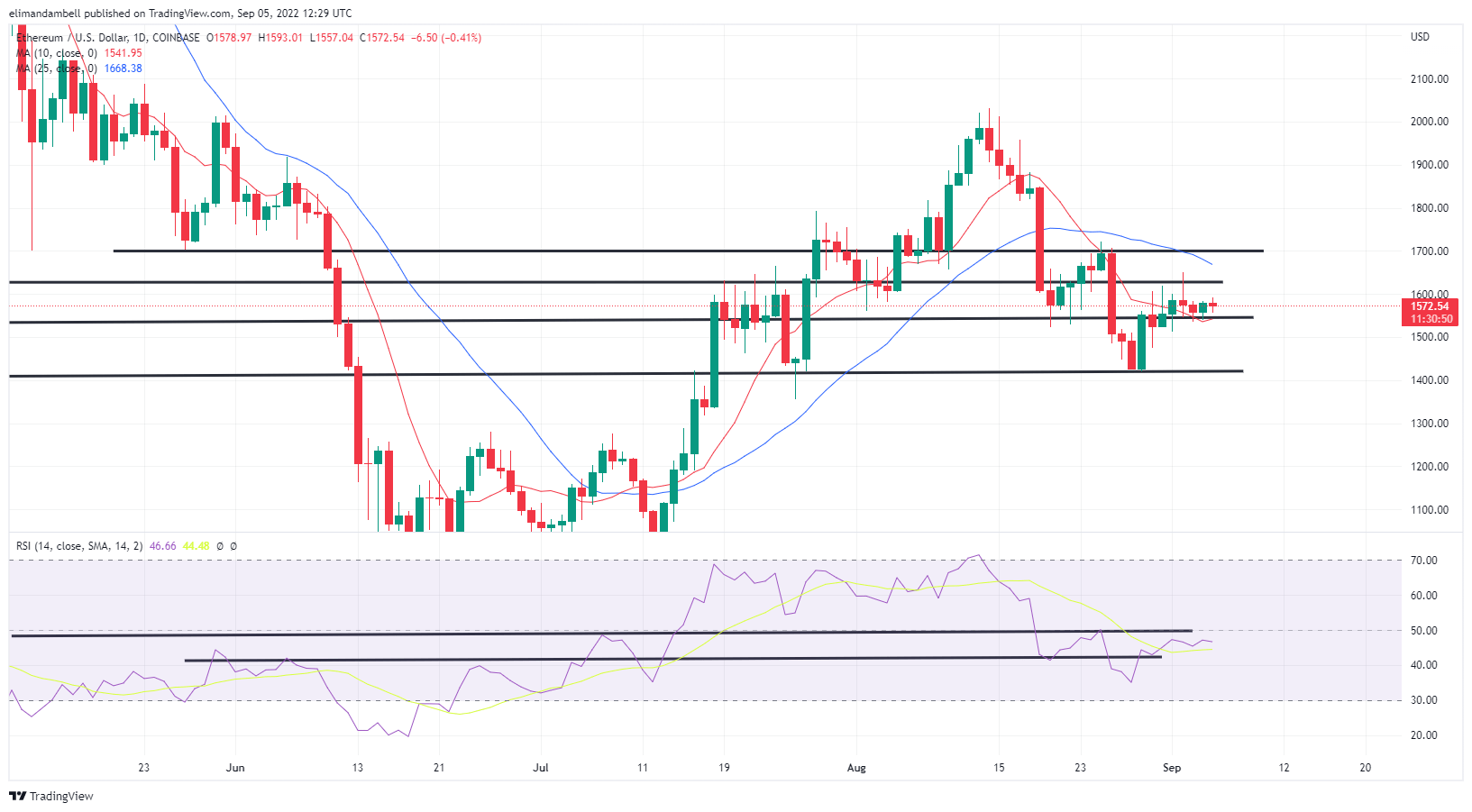

Ethereum

Although ethereum (ETH) was once again trading below $1,600, prices were mostly higher than Sunday’s low.

ETH/USD hit a low of $1,540 during yesterday’s session, however it has rallied to a peak of $1,584.26 so far today.

The move takes ethereum closer to its recent resistance level of $1,615, which appears to be an area of sizable uncertainty.

ETH/USD – Daily Chart

This level of volatility has been heightened by the fact that the RSI is also near a similar point of resistance, as the index currently tracks at 48.00.

As seen from the chart, bears typically opt to reenter at this point, hoping to capitalize on bulls hoping for a breakout.

Like with bitcoin, should ETH bulls intend to send prices surging, they will first need to move past these current points of contention.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur