Bitcoin, Ethereum Technical Analysis: BTC, ETH Hit Multi-Month Lows to Start the Week

On Monday, bitcoin fell to its lowest level since June, as sentiment in cryptocurrency markets remains bearish. The token has fallen lower in consecutive sessions following last week’s U.S. inflation report, and the fall comes ahead of the upcoming U.S. Federal Open Market Committee meeting. Ethereum was also down, hitting a multi-month low of its own.

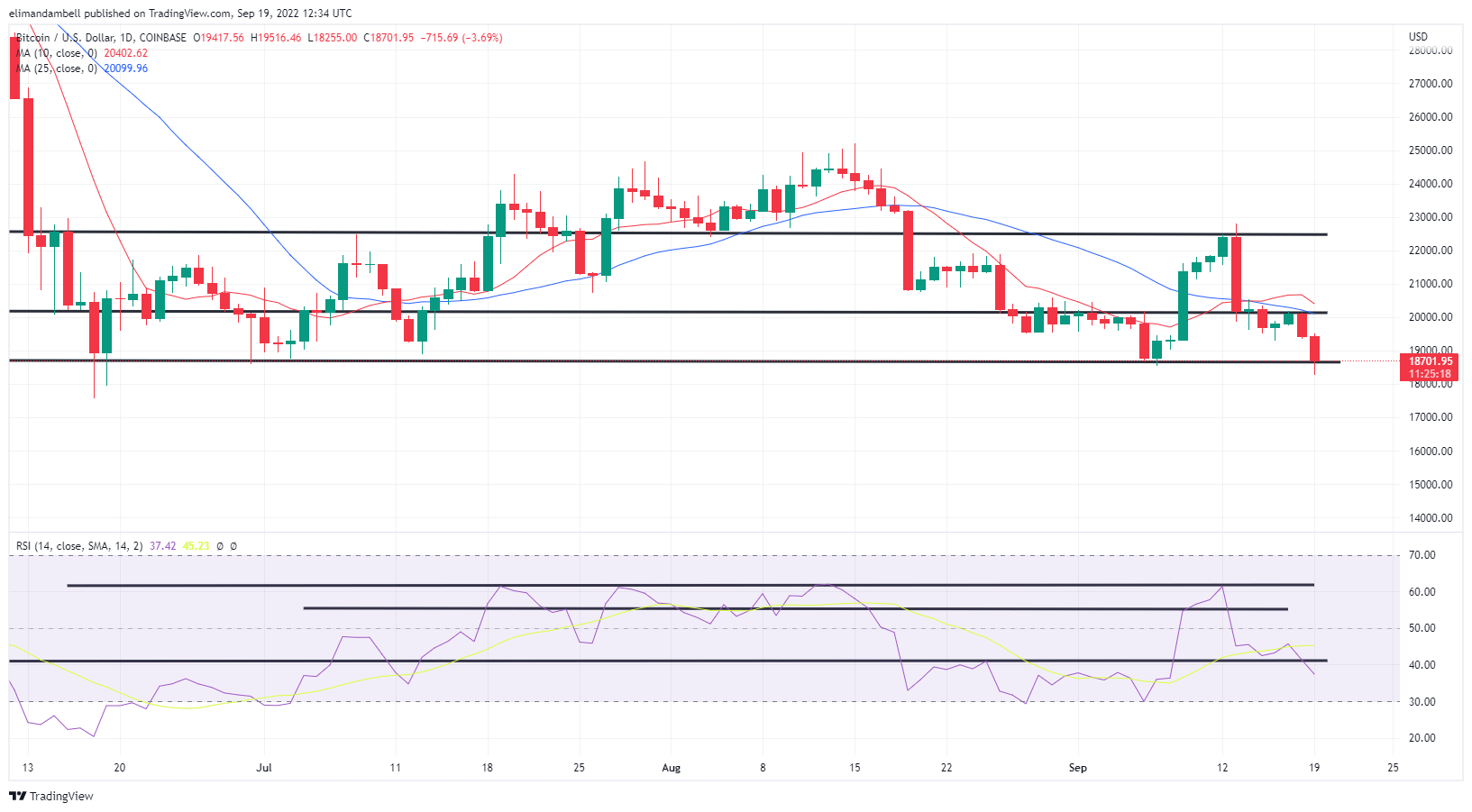

Bitcoin

Bitcoin (BTC) fell to a four-month low to start the week, as bearish sentiment remains high in crypto markets.

BTC/USD slipped to an intraday low of $18,390.32 earlier in the day, which comes following a breakout of a floor at $18,645.

The drop saw bitcoin hit its weakest point since June 18, which was the last time this support level was also broken.

BTC/USD – Daily Chart

Many believe the decline comes ahead of this week’s U.S. Federal Open Market Committee meeting, where it is expected that interest rates will be hiked.

Looking at the chart, Monday’s sell-off comes as the 14-day relative strength index (RSI) fell below a floor of its own at 41.30.

As of writing, the token is trading below 38.00, and is currently in oversold territory, which could be a positive for those anticipating an eventual turnaround.

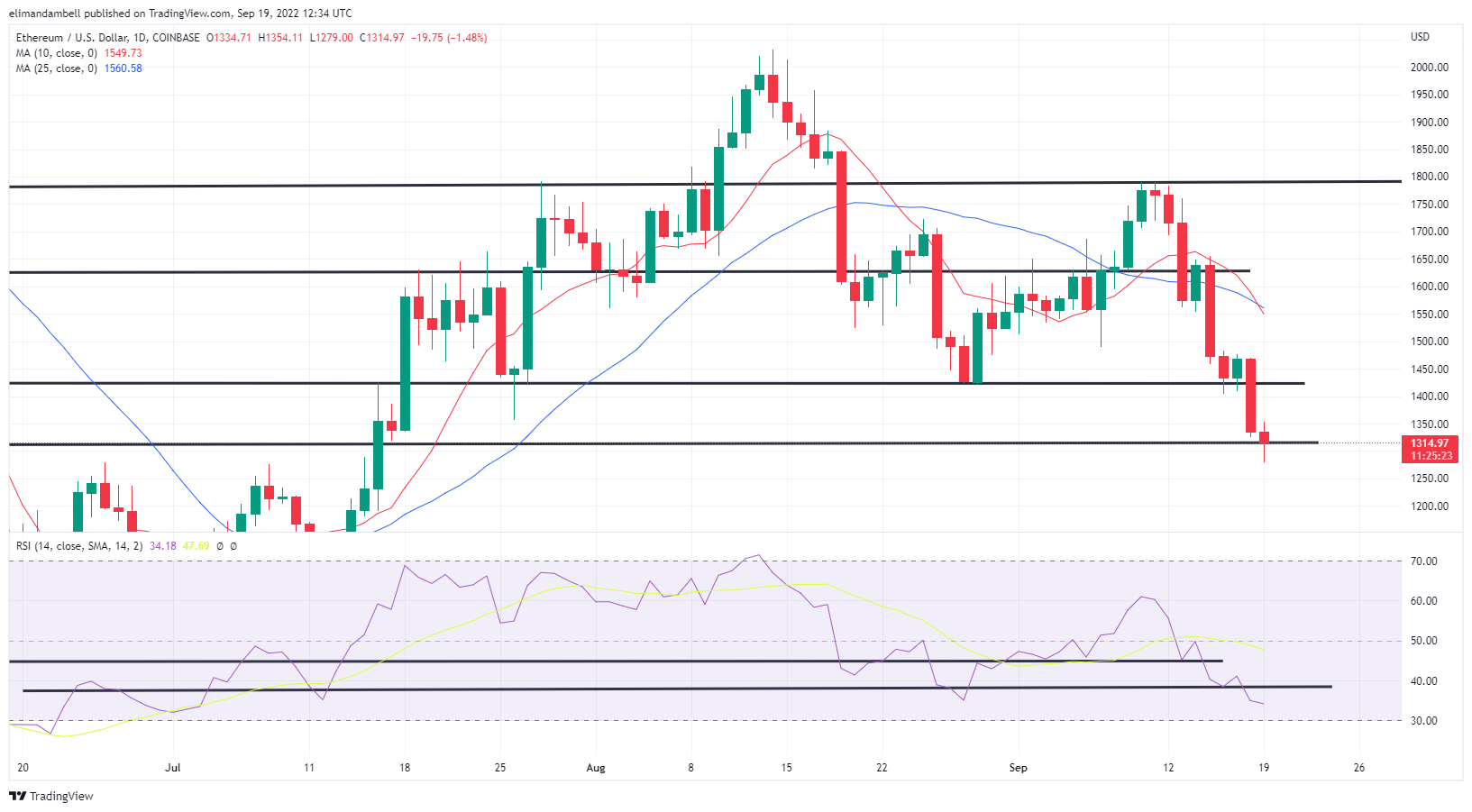

Ethereum

Last week was a historic week for ethereum (ETH), as the highly anticipated Merge took place, seeing the token become “green”.

However, since then, prices have dropped considerably, with today’s decline taking the token to a low of $1,287.42.

This comes less than a week after the world’s second largest cryptocurrency was trading above $1,700.

ETH/USD – Daily Chart

As seen from the chart, the drop saw ETH/USD fall to its lowest point since July 16, when prices were rising from a spell below the $1,000 level.

The momentum of moving averages (MA) has also shifted, with the 10-day (red) trend line crossing against its 25-day (blue) counterpart in a downward direction.

Some believe that we may still see further slippages, with bears attempting to take ethereum below $1,000.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Stellar

Stellar  LEO Token

LEO Token  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  Dash

Dash  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond