BNB Technical Analysis: Will Binance Coin Sustain the Bull Cycle?

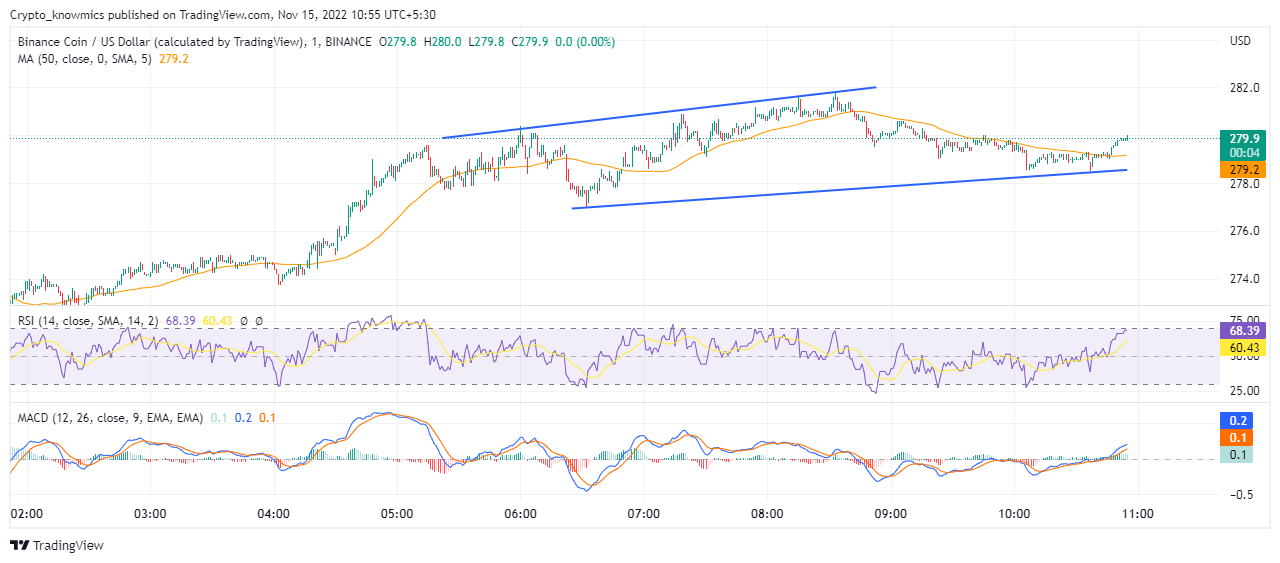

The BNB technical analysis displays a continuation of the bullish trend with high buying pressure in the market as RSI hit the overbought boundary. Despite falling around 13.56% in the last 7 days due to the bearish trend in the market caused by FTX financial crises, Binance Coin (BNB) grew 3.88% in the last 24 hours touching the daily high of $290.72 rebounding from the daily low of $268.23. Although BNB plunged to its 3-month low of $263.08 this week, BNB has managed to deliver relatively better returns as compared to other crypto markets with 3.63% growth in the last month regaining $10.16 points. The 3.92% rise in 24-hour market cap to 44.73 billion and 29.56% increase in trading volume to $1.5 billion support a strong bullish cycle in the BNB market.

Key Points

- The BNB price action shows an uptrend with higher price rejection candles

- BNB price actions maintain bullish momentum

- The intraday trading volume in BNB is $487.98 million

Source Tradingview

BNB Technical Analysis

In our previous analysis, BNB price actions displayed a downtrend with increased selling pressure. However, today BNB price actions have been able to maintain a bullish trend with increased buying pressure. The 50-day SMA confirms the bullish rally in the market, as it supports the support level in the uptrend and the resistance level in the downtrend. Currently, trading at $279.79 BNB forecast an uptrend with an intraday rise of over 3%. If buying pressure persists the BNB prices may break above the physiologically important mark of $300. However, if BNB fails to maintain the bull momentum, the prices may fall below $260 putting the $250 mark to test.

Technical Indicators

RSI makes a bullish divergence before touching the overbought boundary of 70% moving above the 14-day SMA, showing high buying pressure as bullish sentiments prevail in the market. As the histogram continues to be bullish, MACD makes a bullish crossover while moving above the halfway line. The technical indicators display a bullish rally in the market with increasing buying pressure and with the possibility of another bullish breakout for intraday buyers.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Cosmos Hub

Cosmos Hub  Dash

Dash  Algorand

Algorand  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  DigiByte

DigiByte  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur