BTC, ETH, XRP, ADA and BNB Price Analysis for June 5

The new week has started with the bears dominating as the rates of most of the coins are falling.

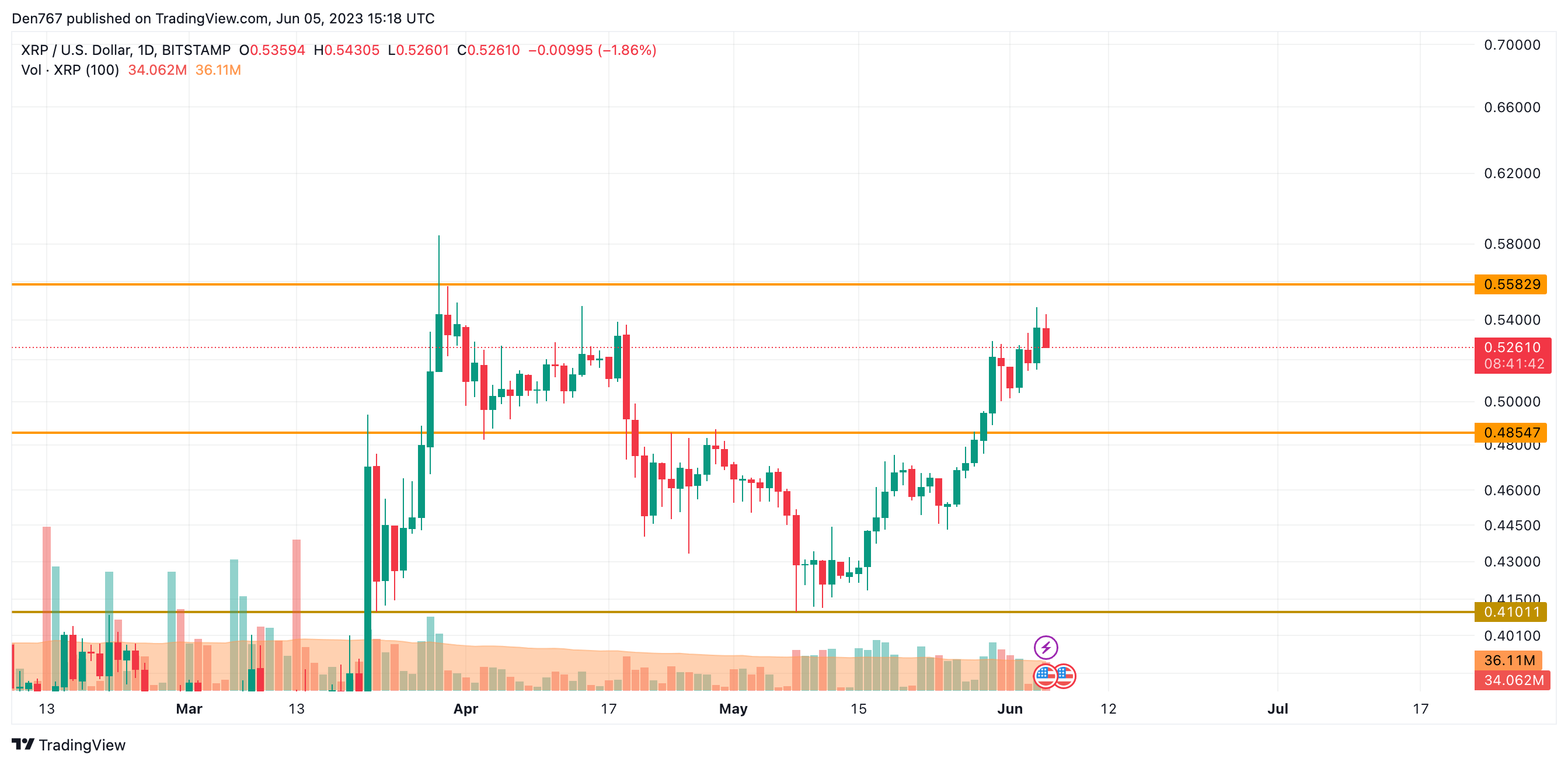

Top coins by CoinMarketCap

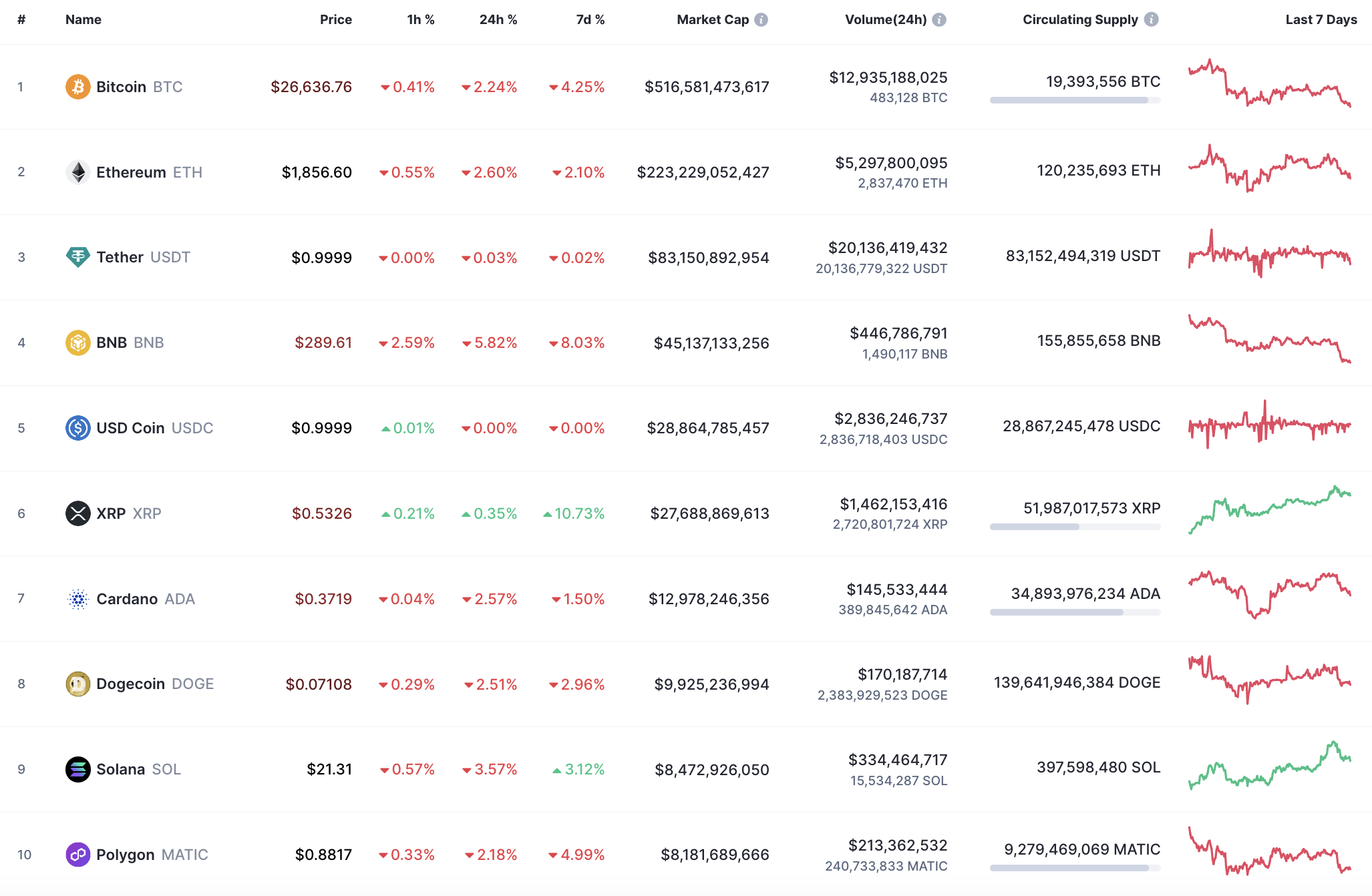

BTC/USD

The rate of Bitcoin (BTC) has dropped by 2.24% over the last 24 hours.

Image by TradingView

On the daily chart, the price of Bitcoin (BTC) has lost the vital mark of $27,000, which is a bearish signal. Now, traders should focus on the nearest interim level at $26,500. If the closure happens near it, one can expect an ongoing drop to the support at $25,800.

Bitcoin is trading at $26,673 at press time.

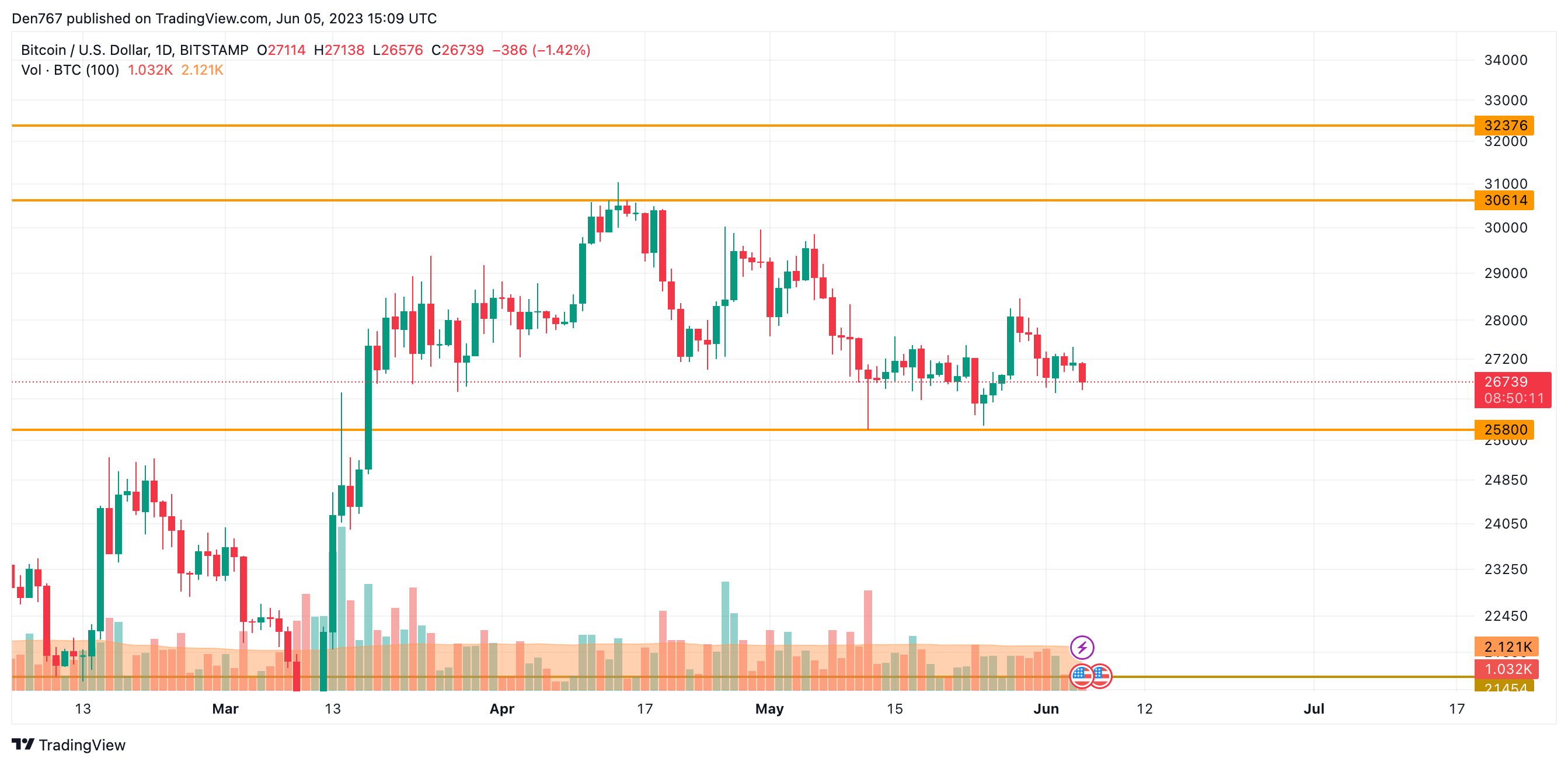

ETH/USD

Ethereum (ETH) has followed the decline of Bitcoin (BTC), going down by 2.60%.

Image by TradingView

Despite today’s fall, Ethereum (ETH) is not looking as bearish as BTC, as the rate is far from the key levels. However, if buyers cannot seize the initiative shortly, a decrease below $1,800 may be a prerequisite for a more profound drop to the support at $1,737.

Ethereum is trading at $1,857 at press time.

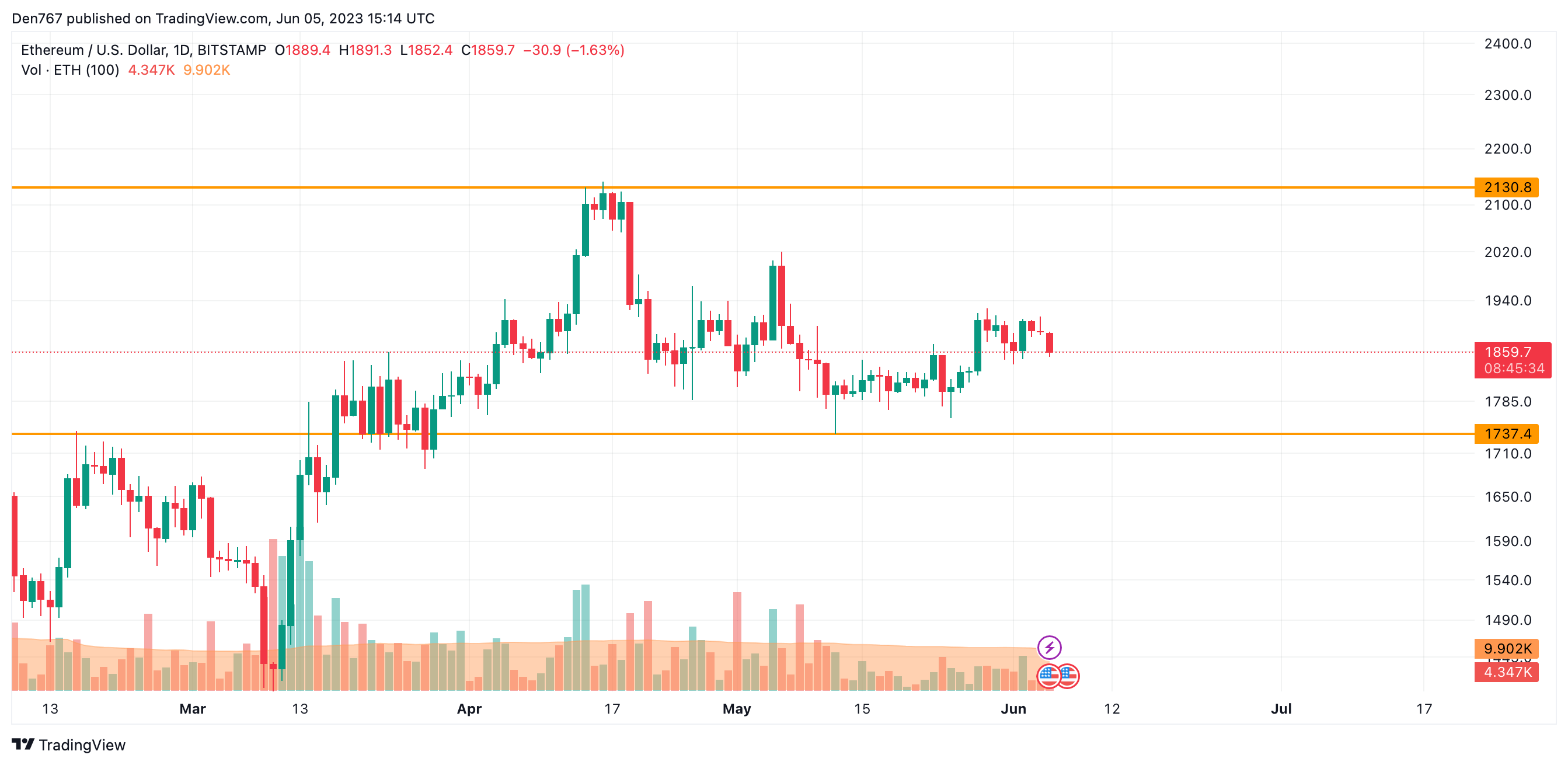

XRP/USD

XRP is the only growing coin from the top 10 list today, rising by 0.35%.

Image by TradingView

Despite today’s slight rise, XRP could not continue yesterday’s bullish candle. If the bar closes below the low at $0.51, bears can get back in the game and get back to the support at $0.4854 shortly.

XRP is trading at $0.5250 at press time.

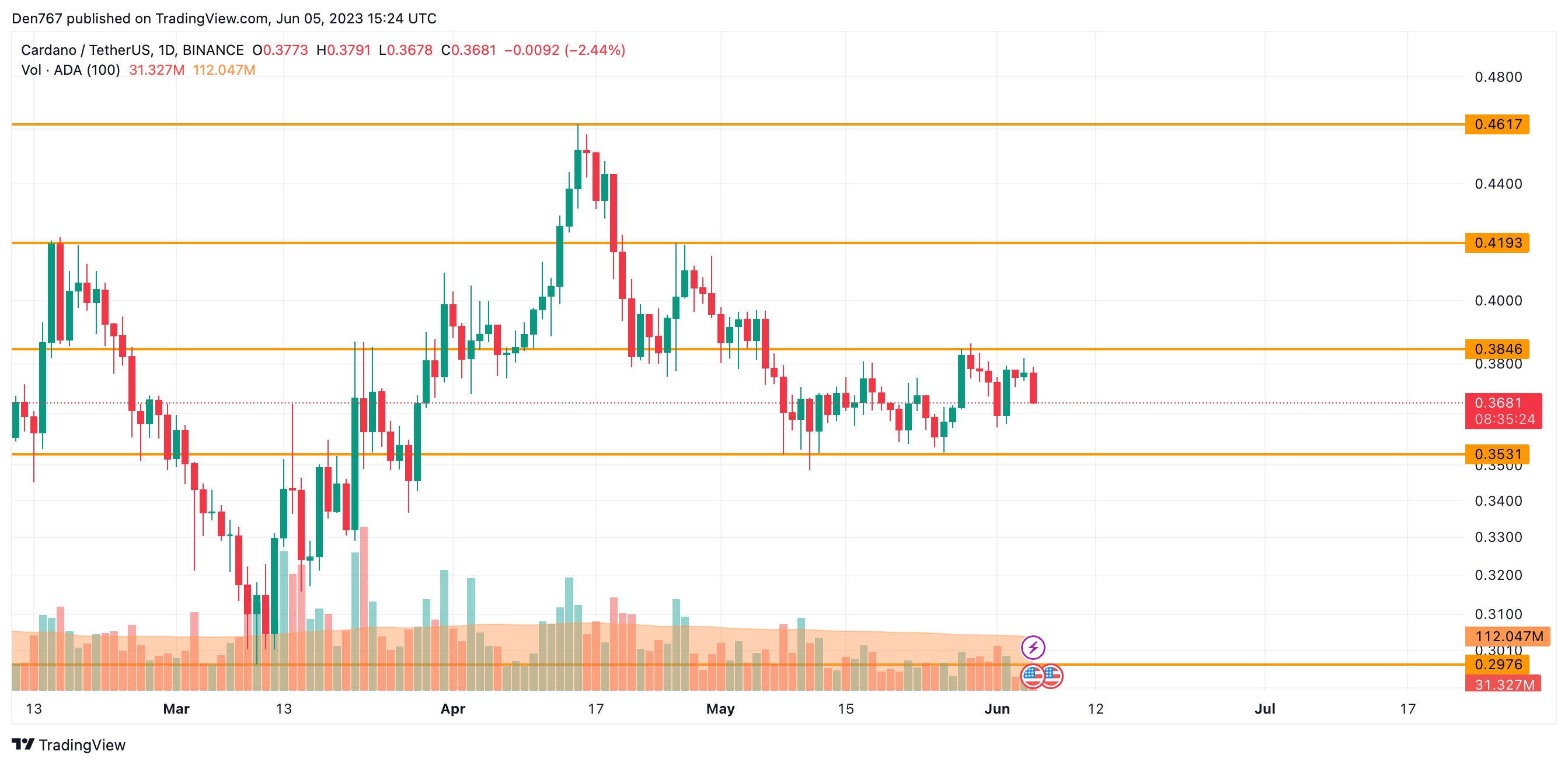

ADA/USD

The price of Cardano (ADA) has fallen by 2.57% since yesterday.

Image by TradingView

The price of ADA has continued the fall after a failed attempt to fix above the $0.38 zone. If today’s candle closes with no long wick, the fall is likely to continue to $0.36.

ADA is trading at $0.3673 at press time.

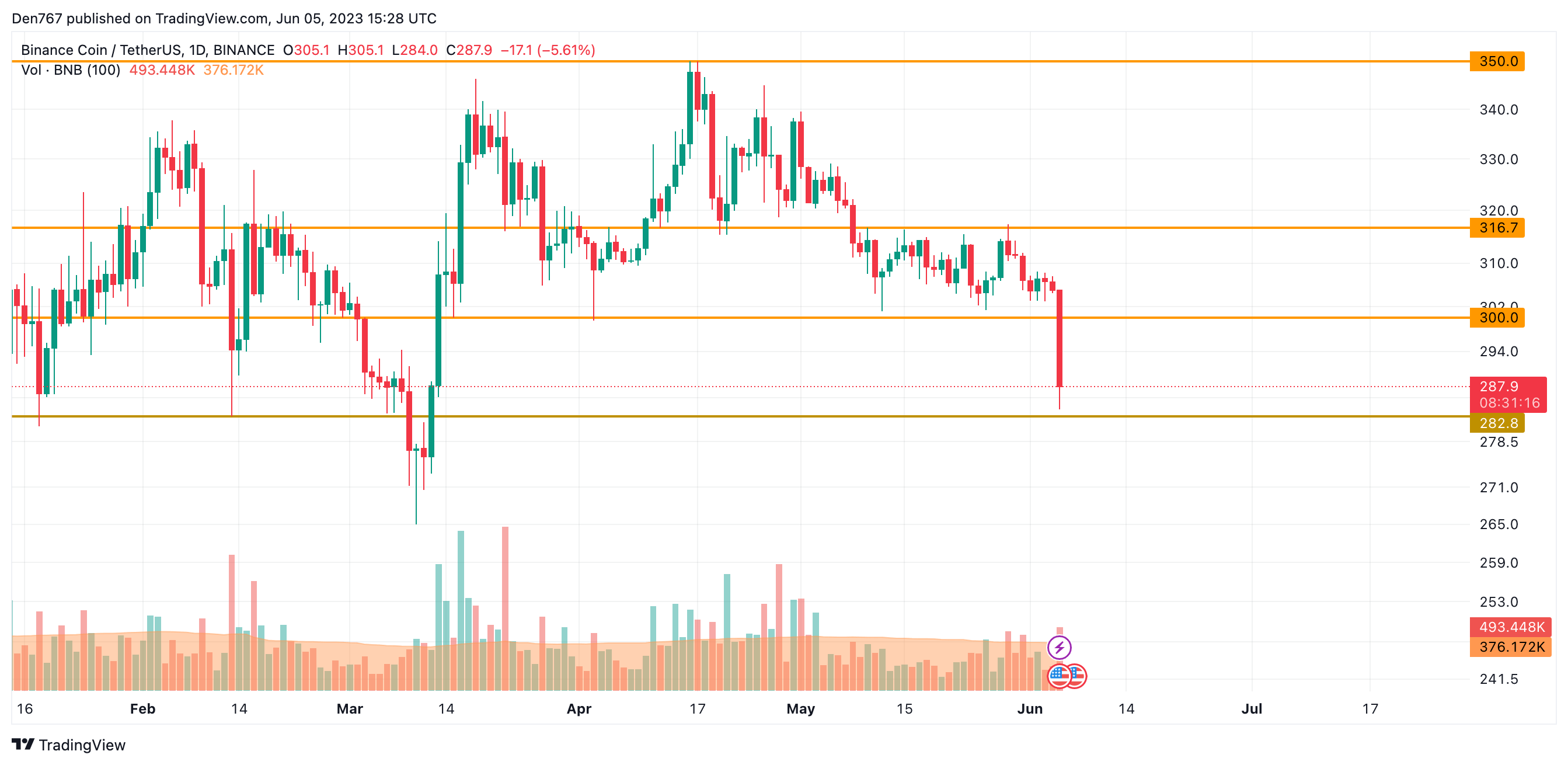

BNB/USD

Binance Coin (BNB) is the biggest loser today, going down by more than 5%.

Image by TradingView

On the daily time frame, the price of Binance Coin (BNB) has almost tested the support level at $282.8. At the moment, traders should focus on the bar closure. It it happens around that mark, the decline may continue to the $270 area this week.

BNB is trading at $285.5 at press time.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond