Bullish Indicators Arise on TRX, ENJ, SXP, ONT, ATOM Daily Charts

At the moment, there are five altcoins showing some promise as they are trading above the 200-day SMA. This is generally considered to be an important indicator to determine if an asset is on an uptrend or a downtrend. The five altcoins with this potential to move upwards is TRON (TRX), Enjin (ENJ), Solar (SXP), Ontology (ONT), and Cosmos (ATOM).

TRON/Tether US 1D (Source: TradingView)

TRON is considered to have the biggest chance of a big price increase soon as the crypto has been trading above its 200-day SMA since January 26. TRON is now facing a hurdle around $0.0645, but if the crypto is able to flip this, the price of TRON could rally by 12%.

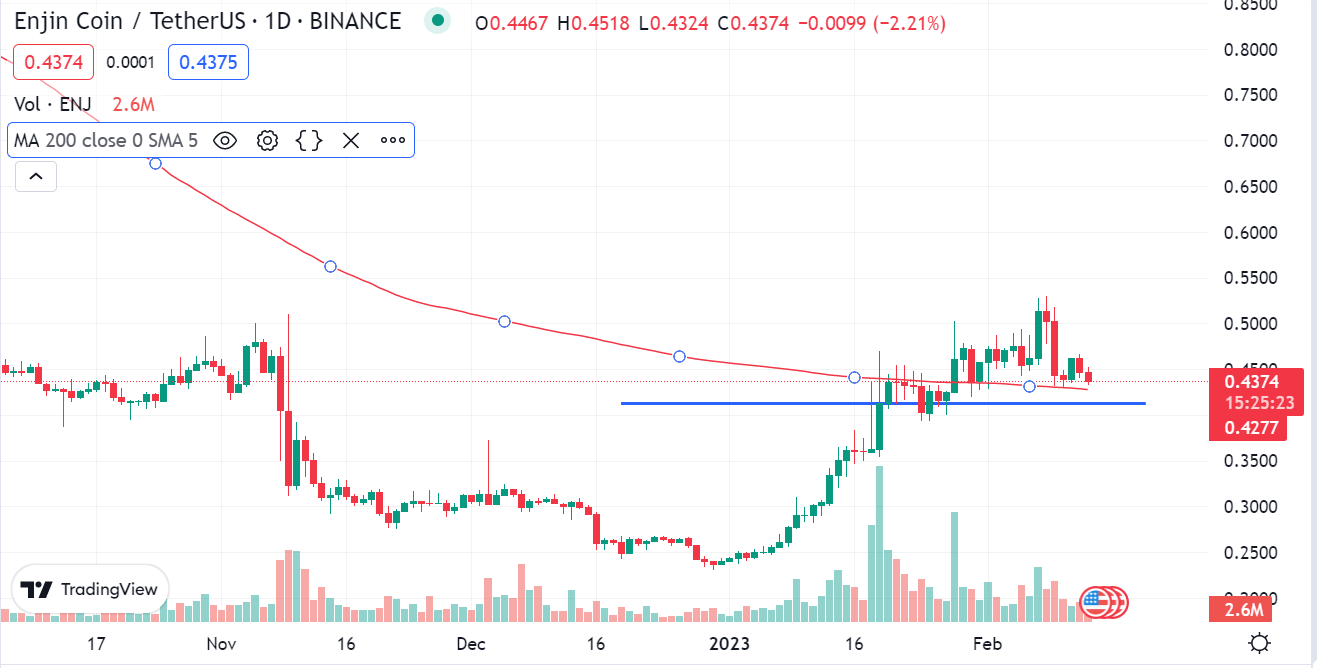

Enjin Coin/Tether US 1D (Source: TradingView)

ENJ has also crossed its 200-day SMA, and has rallied by 130% over the last 40 days. In addition to this, it has also flipped an important resistance level at $0.4121 into a support. The price of the altcoin is now expected to target $0.5753, which is 35% away from its current price.

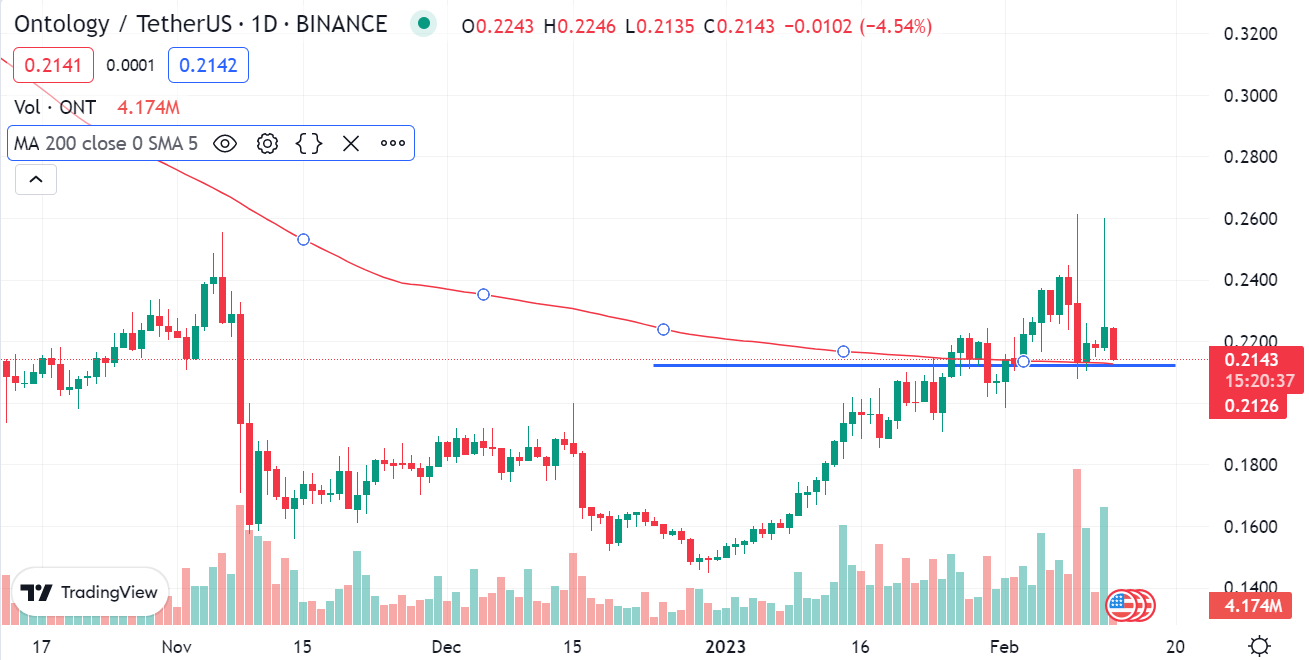

Ontology/Tether US 1D (Source: TradingView)

ONT is in a very similar position as it is also trading above its 200-day SMA, and is now expected to make a 79% upswing after recently flipping the $0.2124 resistance. Bouncing off of this support will be key in triggering the crypto’s upswing.

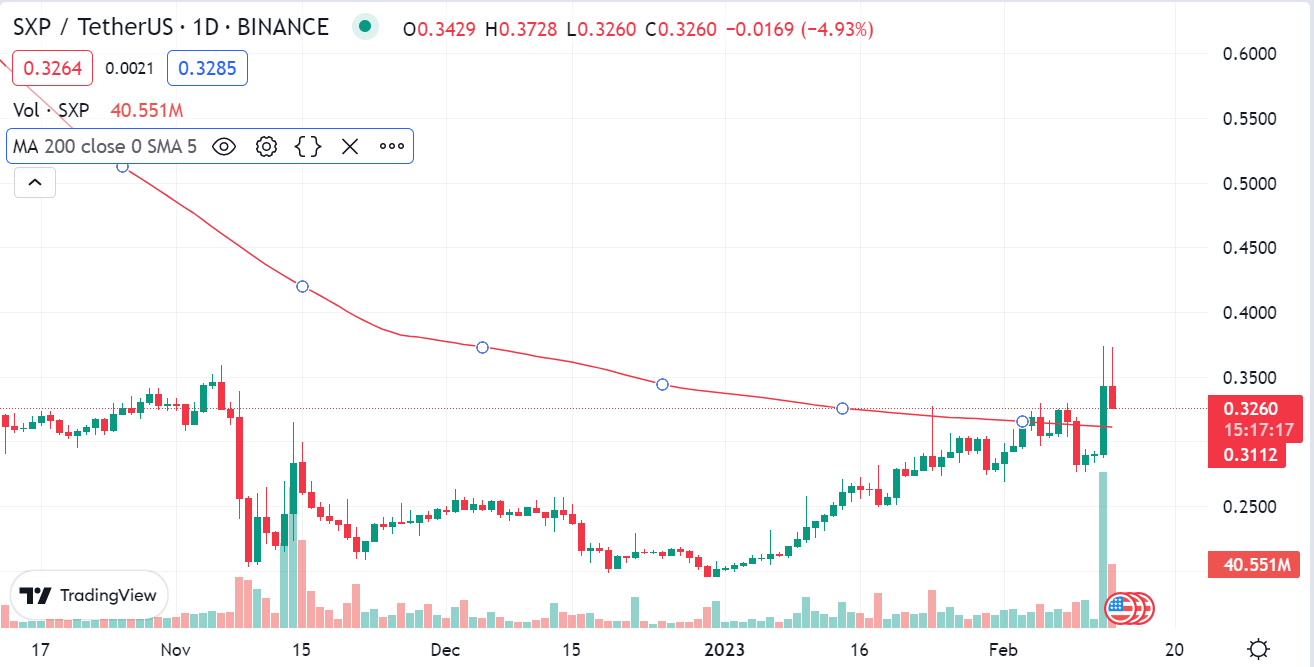

SXP/Tether US 1D (Source: TradingView)

As with the rest of the altcoins mentioned above, SXP is also trading above the 200-day SMA, and is now primed for an upward move. SXP is currently trading hands at $0.3248 after a 11.59% increase in price.

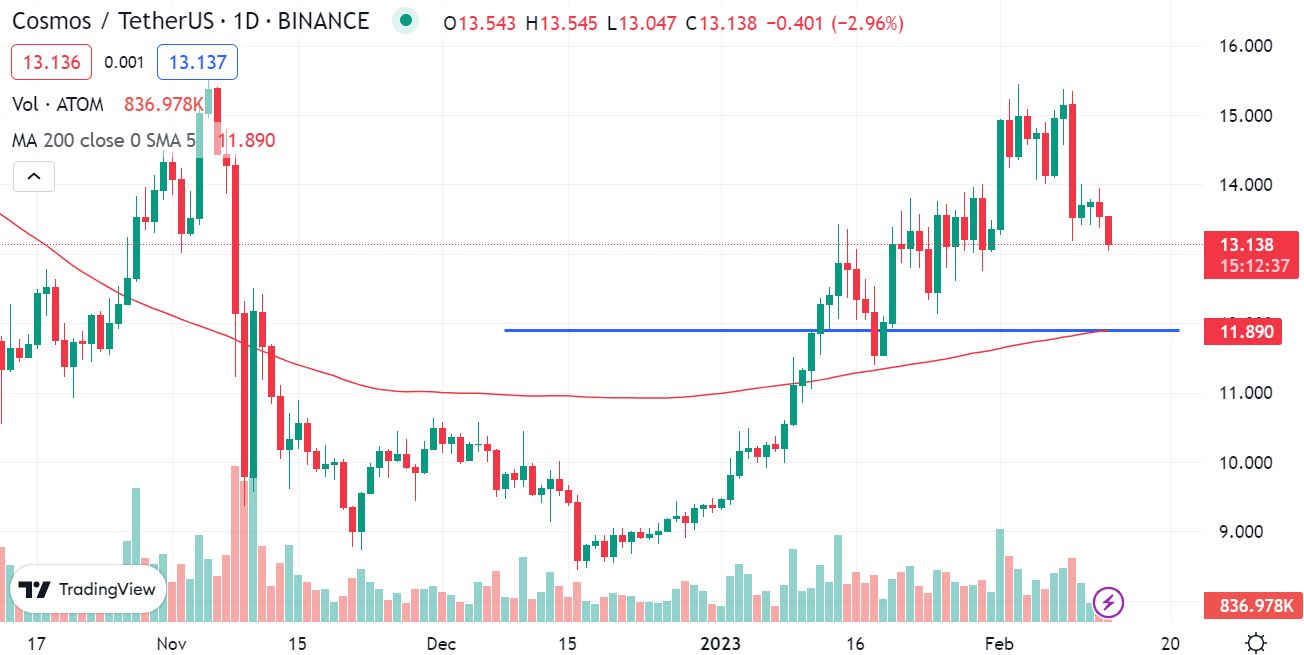

Cosmos/Tether US 1D (Source: TradingView)

The ATOM price action is weaker than the rest of the altcoins due to its lack of distinctive higher lows. The price of ATOM will likely lower to touch the 200-day SMA at $11.88. If bulls can defend this level, the price of ATOM can bounce by about 48% to retest $17.54.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur