Calm Before the Storm as BTC Looks Ready for a Huge Move (Bitcoin Price Analysis)

Bitcoin currently gives a ‘calm before the storm’ feeling, as the price has had minimal changes in the last few days. However, there are some interesting levels to watch in the short term.

Technical Analysis

By: Edris

The Daily Chart

As seen on the daily chart, the price has observed very small changes in the last few days. Presently, Bitcoin is consolidating in a very tight range at the $20K support zone. The 50-day and 100-day moving average lines are located at the $22K and $23K levels, respectively.

If the price fails to break above these levels in the short-term, a bearish breakout below $20K could be expected. In this case, another massive bearish move towards the $15K area and beyond would be likely.

On the other hand, if the price breaks above these moving average lines and the $24K static resistance level, a rally towards the $30K supply zone would be highly probable. However, the market structure in the daily chart is still bearish. Ultimately, the bearish scenario appears to be the most likely outcome right now.

The 4-Hour Chart

On the 4-hour timeframe, the price is trapped in a symmetrical triangle pattern between the $20K and $21K levels. These could be either continuation or reversal patterns – it depends on whether the price breaks them to the upside or the downside.

Currently, it seems as though the cryptocurrency will break below the lower boundary of the pattern after 4 rejections in the last few days. This breakout could initiate a new bearish impulsive move to break below the $20K support level.

The RSI indicator is also showing values below 50% at the moment. This indicates that the bears are in control once again, and the price’s momentum is bearish, further boosting the probability of a bearish continuation.

On-chain Analysis

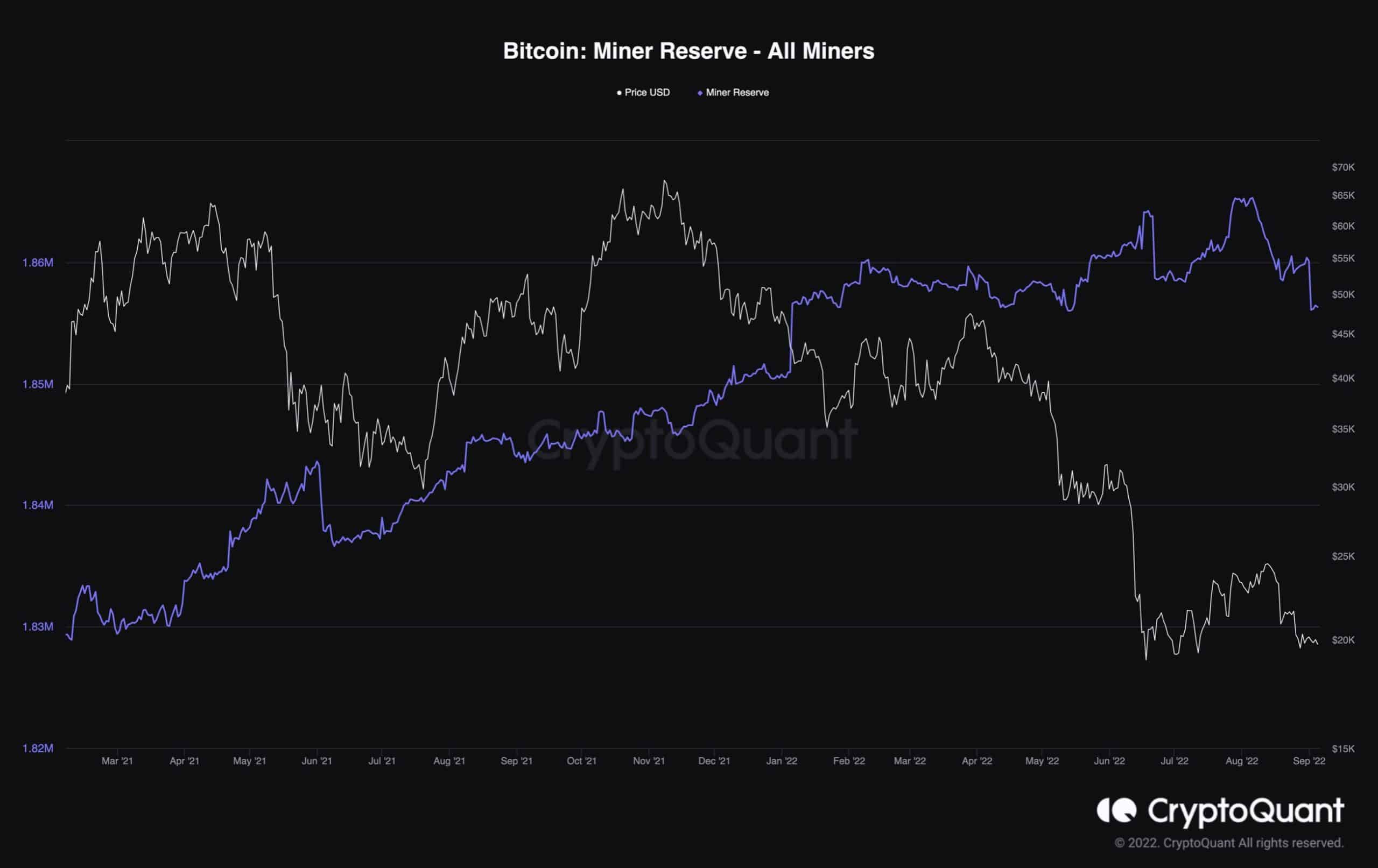

Bitcoin Miner Reserve

Bitcoin miners are key participants in the market, and their behavior can heavily influence the price. Aside from having large amounts of BTC, they also help secure the network, which is considered more valuable.

Looking at the Bitcoin Miner Reserve chart, it is evident that the miners have been under heavy pressure. The price has dropped as low as $18K, and there’s potential to experience even lower levels in the short term. This massive downtrend has caused the miners to sell more and more of their mined Bitcoin to cover their costs of operation in the last few months. The Miner Reserve metric is demonstrating these outcomes with a downtrend since early August.

The uncertainty surrounding whether the miners can continue their operations or not would take its toll on the market sentiment. Also, their selling pressure could overflow the market with supply and push the price even lower in the short term.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Zcash

Zcash  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Decred

Decred  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond  Ren

Ren