Can Chainlink (LINK) Developers Initiate Another Bullish Price Rally?

Chainlink has experienced a 10% correction in the past week. An in-depth analysis of historical on-chain data shows that LINK price movements are closely correlated to development activity. Could the recent DeFi boom trigger a price rebound for LINK in the coming weeks?

LINK has gained some traction as investors turn to decentralized finance protocols amid turmoil in the US banking sector.

Chainlink has Intensified Development Activity

Chainlink (LINK) is a blockchain-based decentralized oracle network (DON) that feeds real-world data to DeFi protocols built on smart contracts. Among other factors, the recent LINK rally has been fueled by the spike in demand DeFi products after major collapses in the TradFi banking sector.

As more investors turn to decentralized finance products and services, the host DeFi protocols, in turn, require the auxiliary services provided by Chainlink. The recent rise in the Chainlink development activity to service the growing demand from various DeFi smart contract platforms has highlighted this.

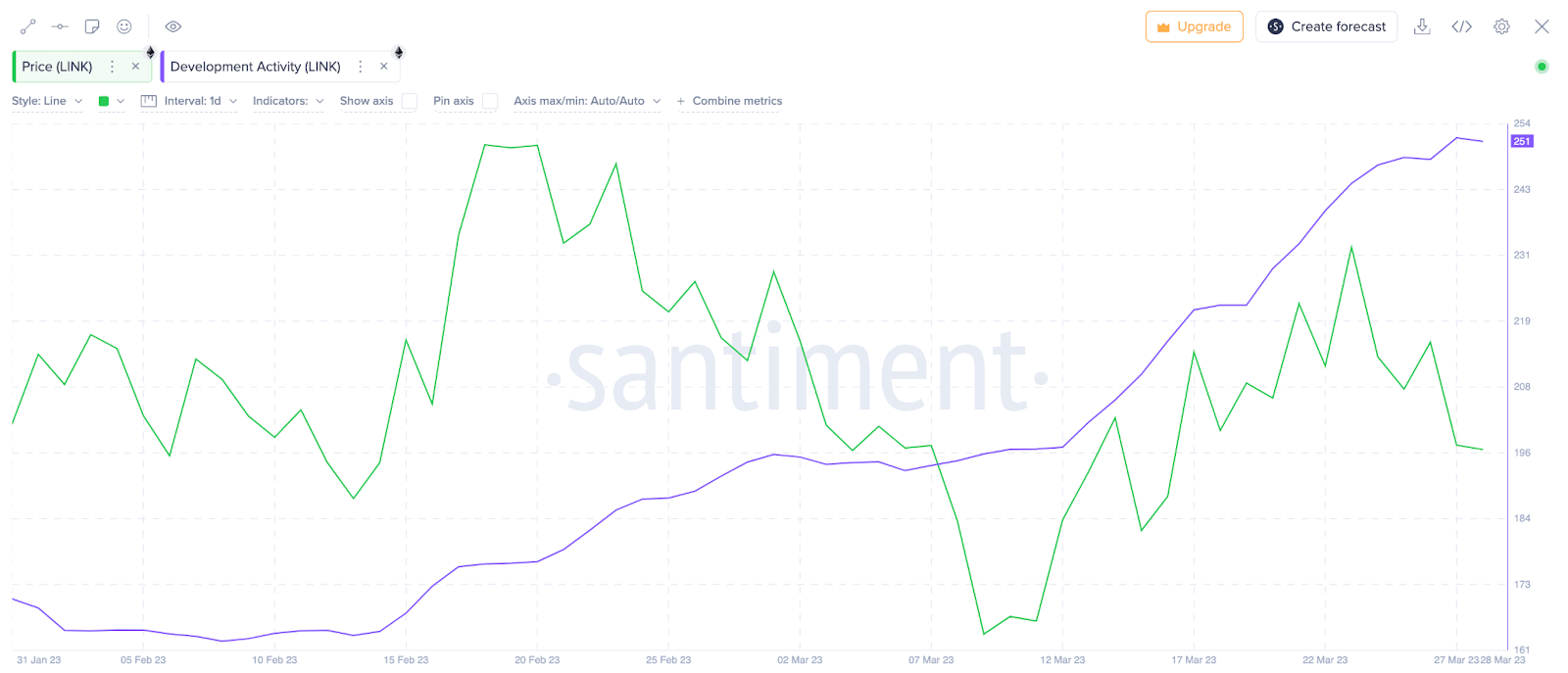

According to on-chain data from Santiment, developer activity on the Chainlink blockchain network has increased by more than 50% since early February. As depicted below, the Chainlink development activity score increased from 164.90 to 251.80 between Feb 2 and March 28.

Chainlink (LINK) Development Activity, March 2023. Source: Santiment

Development activity indicates how much resources are being devoted to improving the network. This could mean adding new features, expanding network capabilities, or deploying bug fixes.

A persistent increase, as observed above, poses a bullish signal. Investors may pile into LINK, expecting that the value added by the increased development activity will positively impact its long-term price performance.

Notably, previous LINK price rallies have often been preceded by a spike in development activity. If this condition holds, LINK holders can expect another price upswing in the coming weeks.

Chainlink Holders are Positioning for More Gains

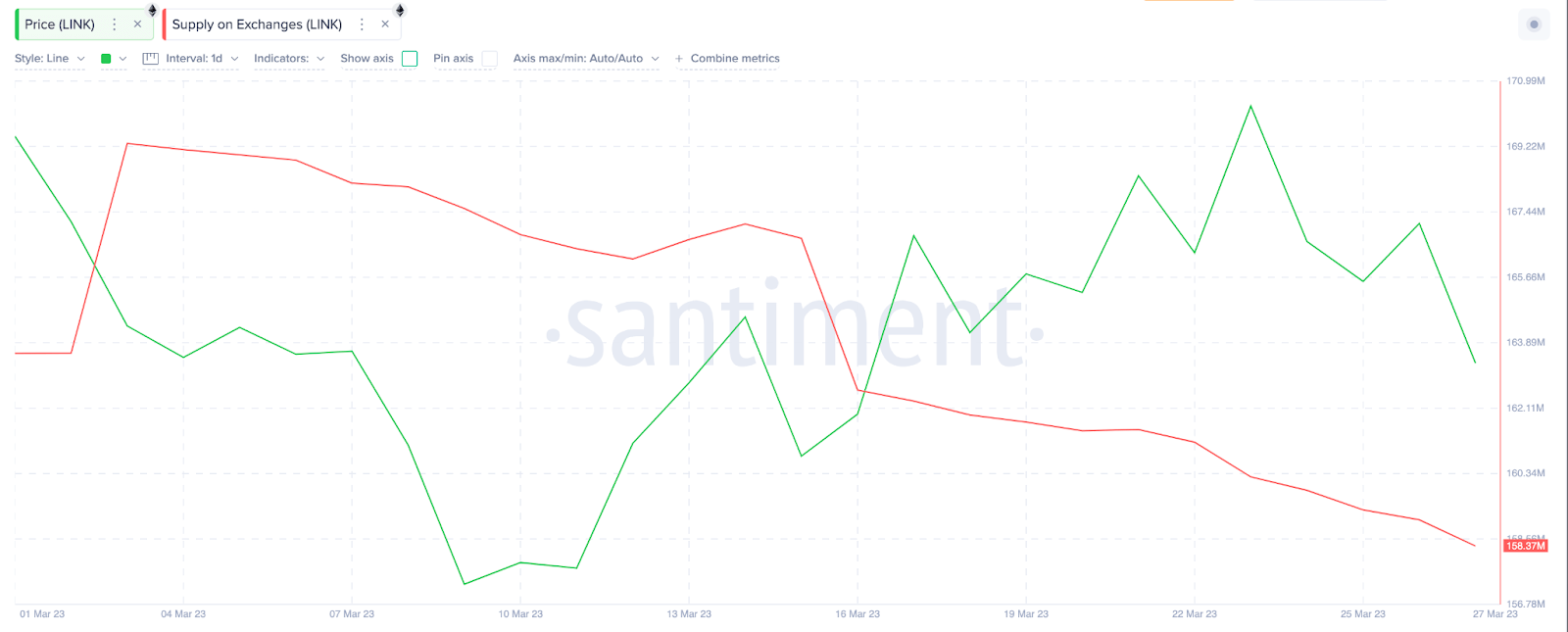

Another critical on-chain metric that supports this bullish stance is the decline in the supply of LINK tokens on exchanges.

Supply on Exchanges metric tracks the flow of tokens into exchanges when daily outflows are deducted. The number of tokens in recognized exchange wallets has declined persistently since early March, according to Santiment.

As the red line in the chart below depicts, LINK supply on exchanges has reduced from 169.3 million tokens to 158.7 million as of March 28.

Chainlink (LINK) Supply on Exchanges, March 2023. Source: Santiment

When supply on exchanges declines for an extended period, it reduces the number of tokens available to fulfill short-term trades. The relative scarcity caused by holders moving tokens off exchanges could drive up the price of LINK.

Ultimately, if Chainlink developers continue to buidl at the current rate and holders continue to move tokens off exchanges, crypto investors can expect a prolonged LINK price rally.

LINK Price Prediction: $9.0 is a Viable Target

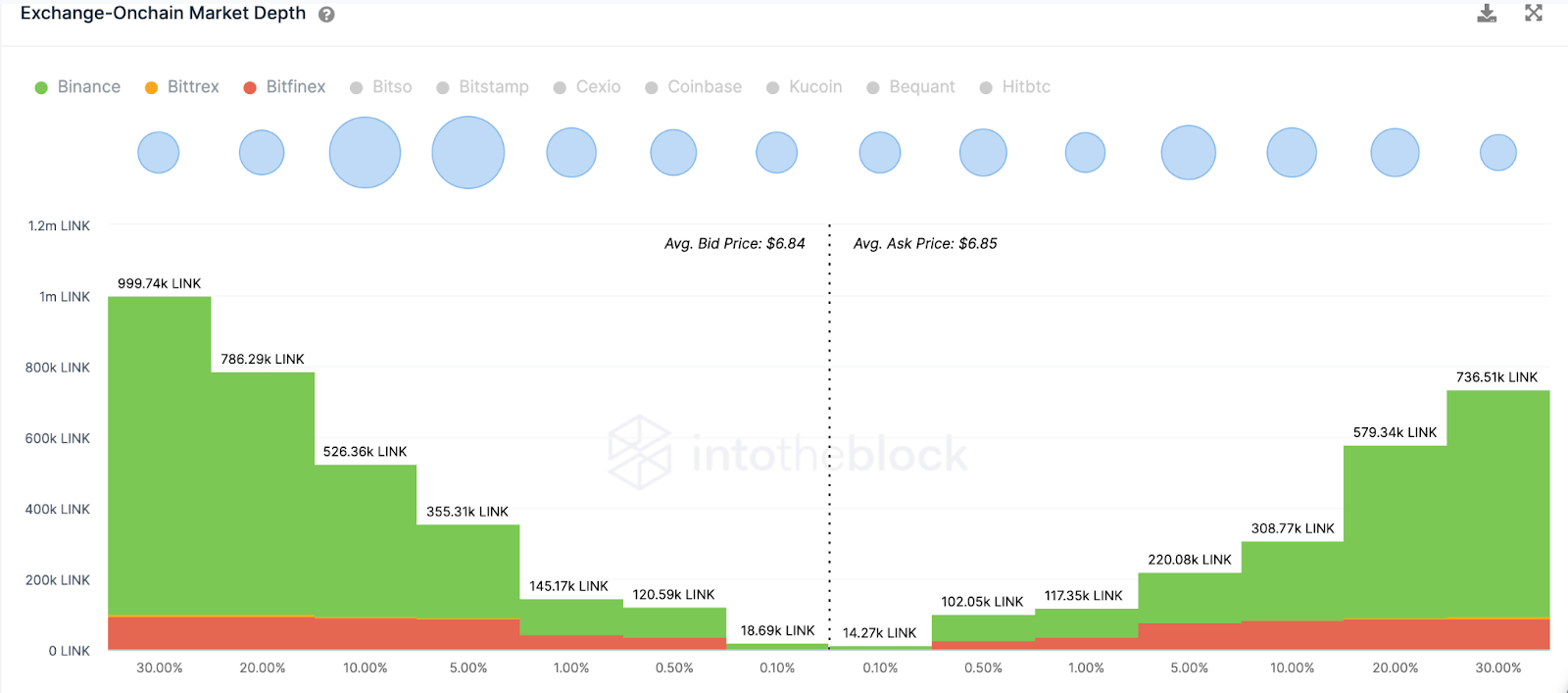

The Exchange Market Depth data compiled by IntoTheBlock depicts that Chainlink could experience some difficulty breaking above the $7 mark.

At the $7 zone, LINK traders have placed sell orders of about 66 million tokens. But if LINK can clear this zone, the next significant resistance will be around $8.2, where LINK traders have offered another 30 million tokens for sale.

Chainlink (LINK) Exchange Market Depth, March 2023. Source: IntoTheBlock

Still, the bears can invalidate the bullish outlook if Chainlink slips below the 277 million buy wall at $6.22. However, if that support does not stop the slump, LINK holders can expect a further downswing to $5.2, where another 17 million buy orders can offer support.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond