Can These Tokens Rise After A Major Drop? NEO, ETC, BCH

Leading smart contract platform Neo has a $930 million market cap. Recently, it was included in Binance Neo’s staking solution. Also the price of Ethereum Classic bottomed out in mid-June, bulls have taken back the initiative. Along with the price of Bitcoin, the Bitcoin Cash cryptocurrency is rising.

The remains of so-called “dead coins,” which were introduced with much fanfare but eventually provided little to no value to anyone, are all over the cryptocurrency sector. As their team cashed out users’ investments and left bagholders to wonder where the value of their portfolio went, these coins typically met an unjust and frequently intentional demise. Many of the earlier crypto currencies falls under such category. Some older coins are still making a comeback, though. Let’s examine some vintage tokens.

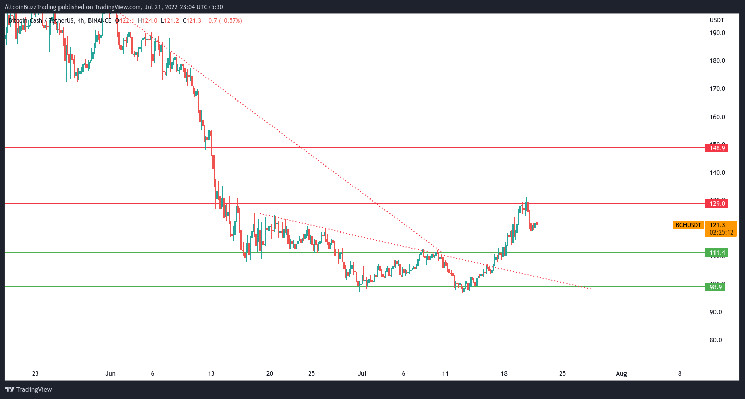

Bitcoin Cash (BCH)

Those who are critical of the coin’s ethos and future also refer to Bitcoin Cash as “Bcash” Despite being arguably the most outspoken BCH proponent, Roger Ver has not stopped claiming that BCH is superior than Bitcoin. Ver sparked controversy when it was revealed that he owes cryptocurrency investment platform CoinFLEX $47 million in stablecoin USD Coin (USDC).

Ver disputes the allegations, sparking this week’s ongoing social media uproar. Regardless of the result, it has had a noticeable effect on BCH. BCH/BTC dropped 98.83 percent below its 2017 peak on June 29, reaching a new record low of only 0.005. Let’s take a look at the BCH prices

BCH can reverse course and head back to the crucial support level of $111.40 if it is unable to overcome the $129.0 resistance level. In the medium term, BCH has to break over the $129.0 resistance level in order to turn bullish once more. The price of BCH must remain above the $129.0 resistance level in order to reach the significant resistance level at $148.9.

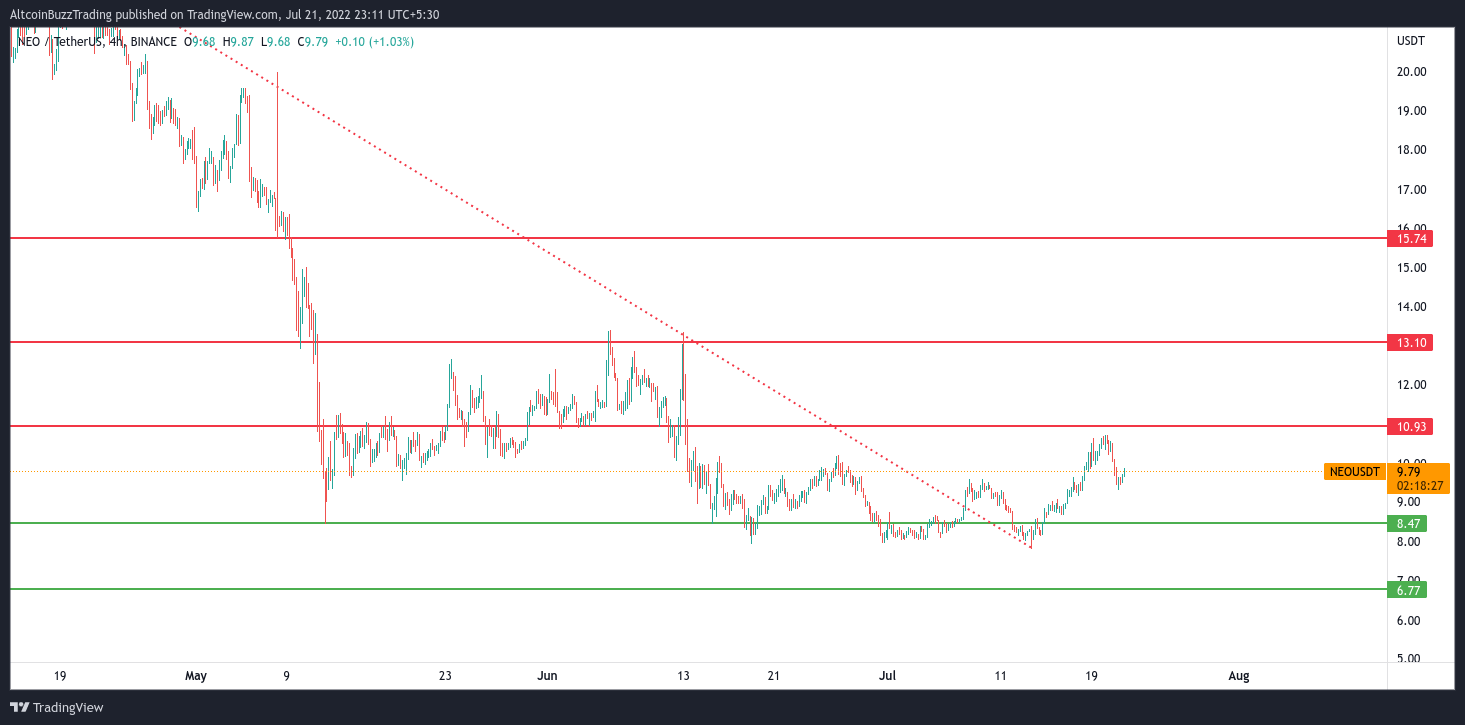

NEO (NEO)

NEO’s great stance in the Asian markets is its feature challenging to think anything but a success for this trading platform. Its developers continuously update the platform with NEO3. The Onchain technology of NEO was designed from the beginning to be regulation-friendly and have a centralized process that is very distinct from many other cryptocurrencies. Let’s examine the NEO price levels.

NEO just tested the $8.47 support level after breaching the $10.93 resistance level. However, it was unable to go past the significant $13.10 resistance level. The support level of $8.47 can be attained once more. NEO can aim for the significant resistance levels at $13.10 and $15.74 if the bulls get beyond the $10.93 resistance level and close above it.

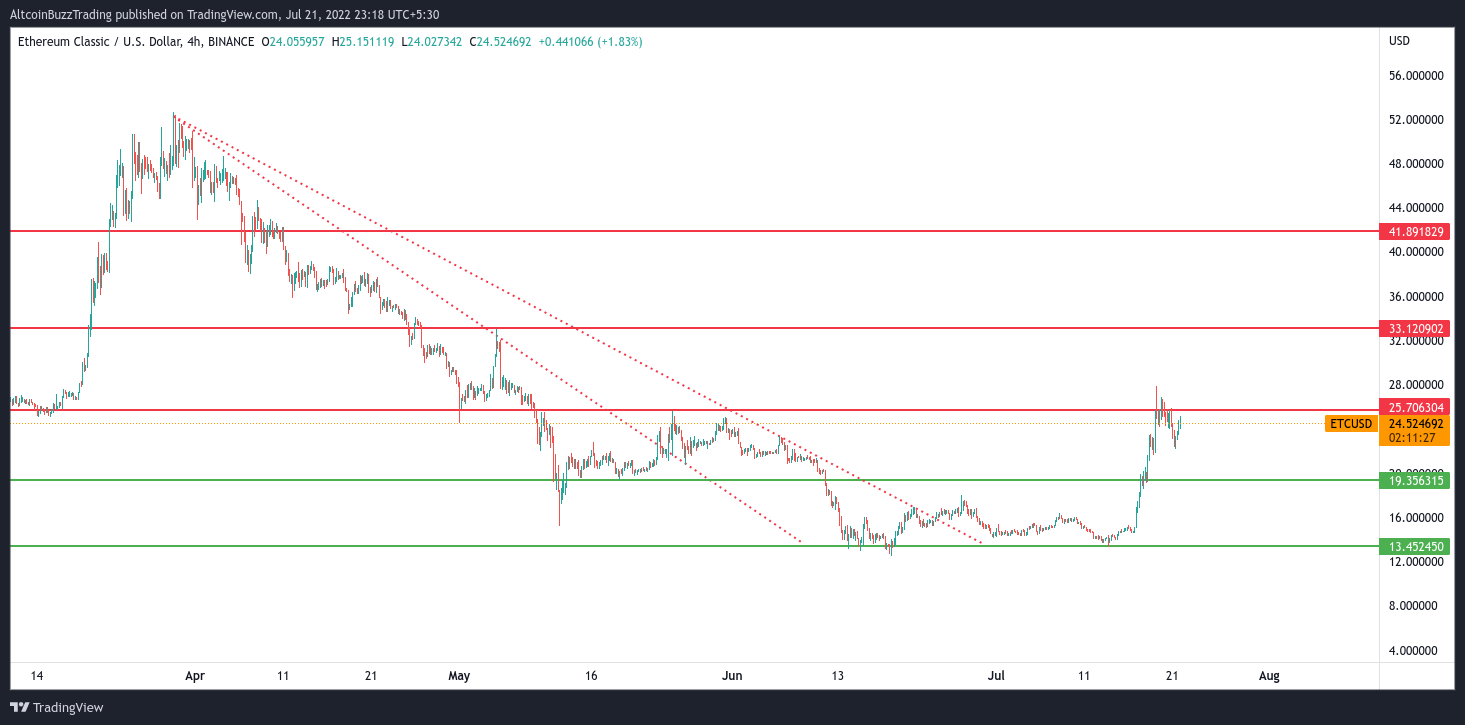

Ethereum Classic (ETC)

The previous week has seen a significant increase in the price of Ethereum Classic as well. This week, the ETC token has started to climb quickly upward. The announcement of the Merge has recently spurred the bulls in addition to the lift from the bitcoin relief.

When Ethereum switches from Proof-of-Work (PoW) to Proof-of-Stake (PoS) in September, assets like ETC might benefit from it. Notably, as they will only require minimal changes to start mining on Ethereum Classic, ETC has the potential to support transferring Ethereum workers. Let us look at the ETC price levels

Since May 2021, the price of ETC has been falling, and as of right now, it is worth $24.50. It is around 90% less than its all-time high of $167.09. Between the $25.70 weekly resistance level and the $19.35 weekly support level, it is swinging.

Due to the overall bearish picture on higher time frames, the bulls must raise the price over $25.70. It will prevent the bears from lowering it below $19.35. The downtrend will not play out if ETC breaks down below the $25.70 mark. If this level breaks, a rally to $33.12 might be possible. For us to be bullish for the midterm, ETC’s daily or weekly price candle must close above $33.12.

And for our best, freshest research on NFT buys, Layer 1 chains, DeFi, or games, come check out Altcoin Buzz Access. Plans start at only $99 per month

Images courtesy of TradingView.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided.

Do your own due diligence and rating before making any investments and consult your financial advisor. The researched information presented we believe to be correct and accurate however there is no guarantee or warranty as to the accuracy, timeliness, completeness. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd. All rights reserved.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond