Chainlink Approaches Significant Supply Wall

Chainlink has seen a significant increase in bullish momentum, currently leading the cryptocurrency market. Still, multiple indicators suggest that LINK could experience a brief correction if it enters the $10 zone.

Chainlink Approaches Double-Digit Territory

Chainlink has outperformed the top 10 cryptocurrencies by market capitalization, surging more than 6% since the start of Friday’s trading session.

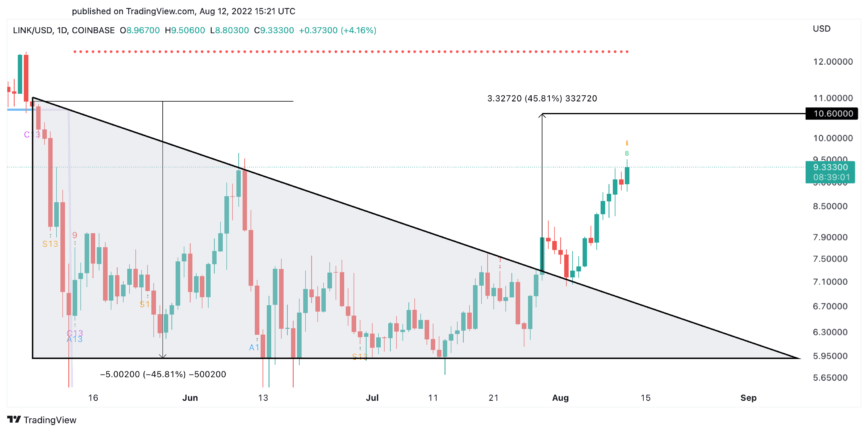

LINK rallied from a low of $8.97 to an intraday high of $9.50, before cooling to $9.21 at press time. As upward pressure continues to mount, the token appears to have more room to ascend. The development of a descending triangle on the daily chart suggests that Chainlink could rise another 11% before its uptrend reaches exhaustion.

The Y-axis of this technical formation projects a $10.60 target for LINK since it overcame the $7.30 resistance level on July 29. Although the rest of the cryptocurrency market has shown signs of weakness, it appears that Chainlink could achieve its upside potential from a technical perspective.

LINK/USD daily chart (Source: TradingView)

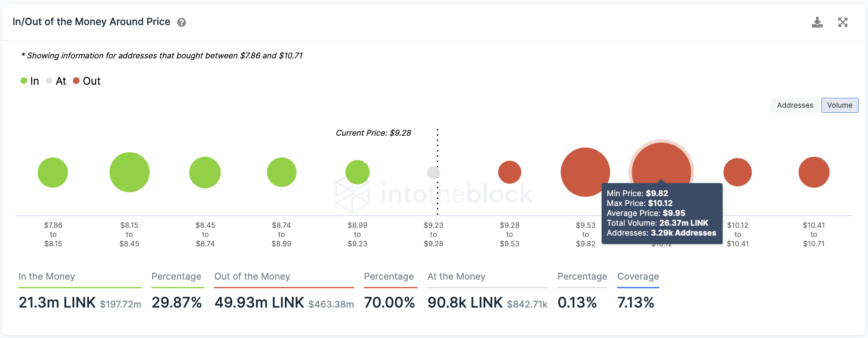

Still, IntoTheBlock’s In/Out of the Money Around Price model shows a stiff supply barrier ahead. Roughly 3,300 addresses have previously purchased nearly 26.4 million LINK between $9.82 and $10.12. This significant area of interest could reject the upward price action as underwater investors could attempt to break even on some of their holdings.

Chainlink’s IOMAP (Source: IntoTheBlock)

Although LINK may have the strength to hit double-digit territory, Chainlink is approaching a significant area of resistance. The Tom DeMark (TD) Sequential indicator also has a high probability of presenting a sell signal on LINK’s daily chart. The potential bearish formation could lead to a one to four daily candlesticks correction before the uptrend resumes.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur