Bulls Hegemony in CELO, Paves Stage for Further Price Surge

Bears previously dominated the Celo (CELO) market, but bulls defied this pattern after finding support at $0.5898. This upward trend succeeded in driving prices higher, reaching a high of $0.6234, a 3.77 % increase as of press time.

Investors are excited about CELO, which could lead to more buying and prices going up even more. This assumption is corroborated by a 3.98% increase in market capitalization and a 217.22% gain in trading volume to $297,509,878 and $36,060,792, respectively.

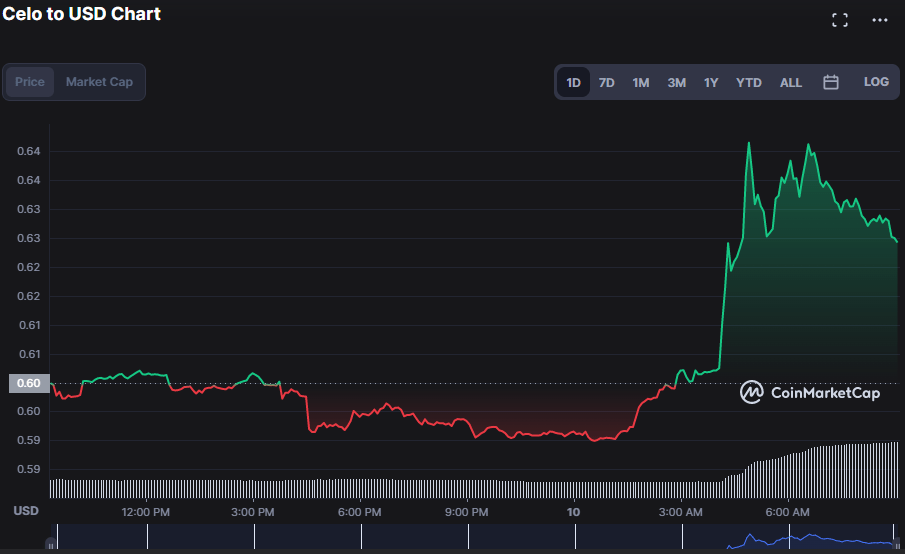

CELO/USD 24-hour price chart (source: CoinMarketCap)

The commodity channel index (CCI), which is now at 206.46 on the 4-hour CELO price chart, is increasing. The purpose of CCI trading is to purchase when the indicator rises over 100 and sell when it falls below 100. As a result, considering that the CELO CCI has a rating of 206.46, the currency’s positive trend is predicted to continue.

As it crosses above the signal line, the Moving Average Convergence Divergence (MACD) value of -0.003 suggests a bullish crossing. This action lends credibility to the notion that a bull run will continue until the bulls wear out.

When bullish momentum is likely to advance, the Bull Bear Power (BBP) line is forecast to rise above “0.” The BBP line on the CELO 4-hour price chart is heading northward, with a value of 0.039 reflecting this trend.

CELO/USD 4-hour price chart (source: TradingView)

A purchase signal known as a “Golden Cross” is triggered when the short-term MA swings over the longer-term MA. This is mirrored in the CELO price chart, where the 5-day moving average is 0.610 and the 20-day moving average is 0.599. As the price oscillates above both MAs, the uptrend is strengthened, suggesting bulls will prevail.

CELO/USD 4-hour price chart (source: TradingView)

If the CELO market’s positive trend is to continue, bulls must fight to maintain the resistance level and prices afloat.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Siacoin

Siacoin  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Lisk

Lisk  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD