Chainlink price analysis: Bullish trend escalates LINK prices above $8.56 level

Chainlink price analysis shows that the digital asset is currently trading at $8.56 after a surge of 1.10 percent in the last 24 hours. The market capitalization for LINK is now at $4 billion and its trading volume has reached $1.2 million in the same time period. The cryptocurrency’s price action over the past few days has been very bullish as it surged past the $8.0 level and even managed to hit the $8.83 mark. LINK is currently ranked in position 20 on CoinMarketCap’s list.

Resistance for LINK/USD is present at $8.83 and if the digital asset breaks above this level, it could target the $9.0 region. On the downside, support for LINK/USD is present at $8.44 and if the cryptocurrency starts to head lower, it could find support at the $8.0 level.

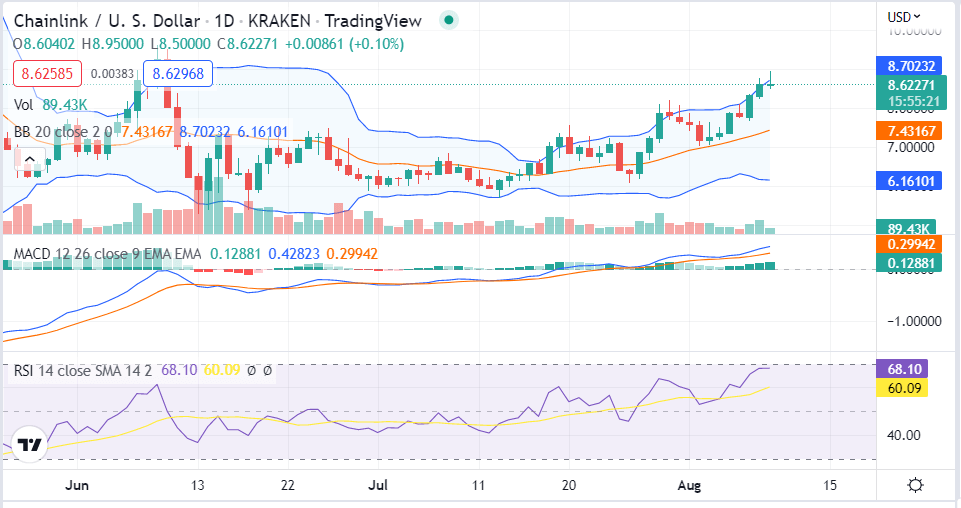

LINK/USD 1-day chart price analysis: Bulls face a major challenge at $8.83

The one-day Chainlink price analysis shows that the digital asset has made higher highs and higher lows for the last 24 hours. The MACD indicator is in the positive territory, but the RSI indicator is close to the overbought levels which could mean that a correction is on the cards.

LINK/USD 1-day price chart, source: Tradingview

The Bollinger bands are starting to widen, an indication that the market is starting to gain some momentum. The upper band is currently at $8.80 which is very close to the major resistance level. The digital asset will have to close above this level on a daily basis in order to continue the uptrend. The buyers have been able to push the prices above these moving averages as buying pressure has increased in the market.

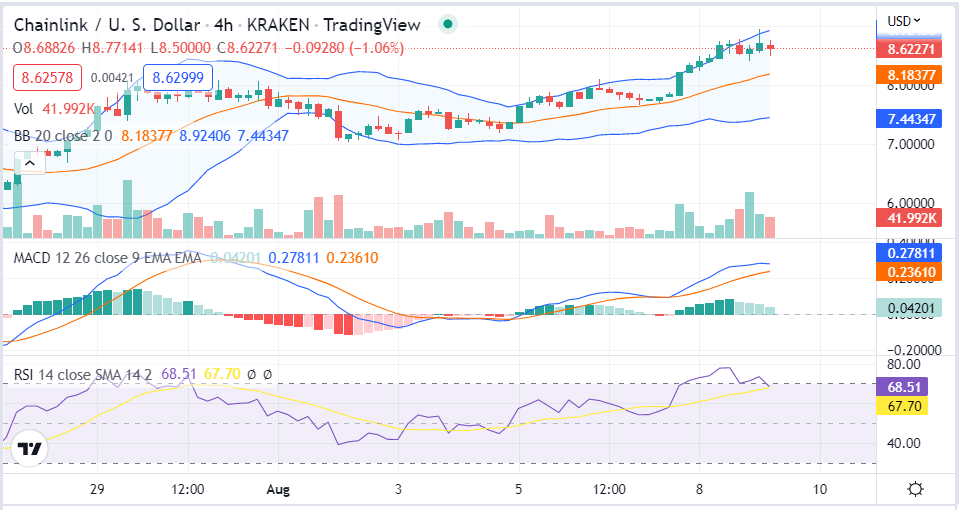

LINK/USD 4-hour price analysis: Recent development

The hourly LINK price analysis shows that the digital asset was trading in a tight range between $8.44 and $8.83 for some time before it started to head lower and found support at the $8.44 level. The digital asset has now started to move higher once again as bulls try to push prices back above the $9.0 level.

LINK/USD 4-hour price chart, source: Tradingview

The RSI indicator is currently trading at 58 which is in neutral territory and does not give a clear indication of which direction the market is likely to move in. The MACD indicator is close to making a crossover and this could mean that we could see some more upside in the market.

The upper Bollinger band is currently at $10.8 and the digital asset will have to close above this level on a daily basis in order to continue the uptrend. The lower Bollinger band is currently at $8.6 which is close to the major support level.

Chainlink price analysis conclusion

Overall, Chainlink price analysis shows that cryptocurrencies are currently in an uptrend and are facing some resistance at the $8.83 level. The Bearish momentum could take over if the prices start to head lower and find support at the $8.44 level as the bulls and bearish battle for control of the market. The technical indicator on both the 4-hour and 1-day timeframe is currently giving mixed signals and it is hard to predict which direction the market is likely to move in.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond