Chainlink Price Prediction: LINK Crypto is Facing Retracement Phase, What’s Next?

- Chainlink token is again moving lower due to aggressive sell-off on September 28.

- Today, LINK token is retesting the 20 day moving average during the retracement phase.

- The Chainlink crypto belonging to the Bitcoin pair is down 2.6% at 0.0003923 satoshis.

Chainlink crypto trapped bulls in recent bullish breakout, now price is moving lower but trading volume is also decreasing. Recently the SWIFT— the interbank messaging system—allows for cross-border payments, which is working with Chainlink. Everyone awaits for the price impact of SWIFT partnership with Chainlink cross-chain crypto transfer in upcoming trading sessions.

At the time of writing, Chainlink crypto against the USDT is trading at $7.6 mark at the time of writing .altcoin is again moving lower due to aggressive sell-off on September 28. This day was extremely volatile in the last 60 days, showing a bear’s presence in the market. Thus Chainlink crypto belonging to the Bitcoin pair is down 2.6% at 0.0003923 satoshis.

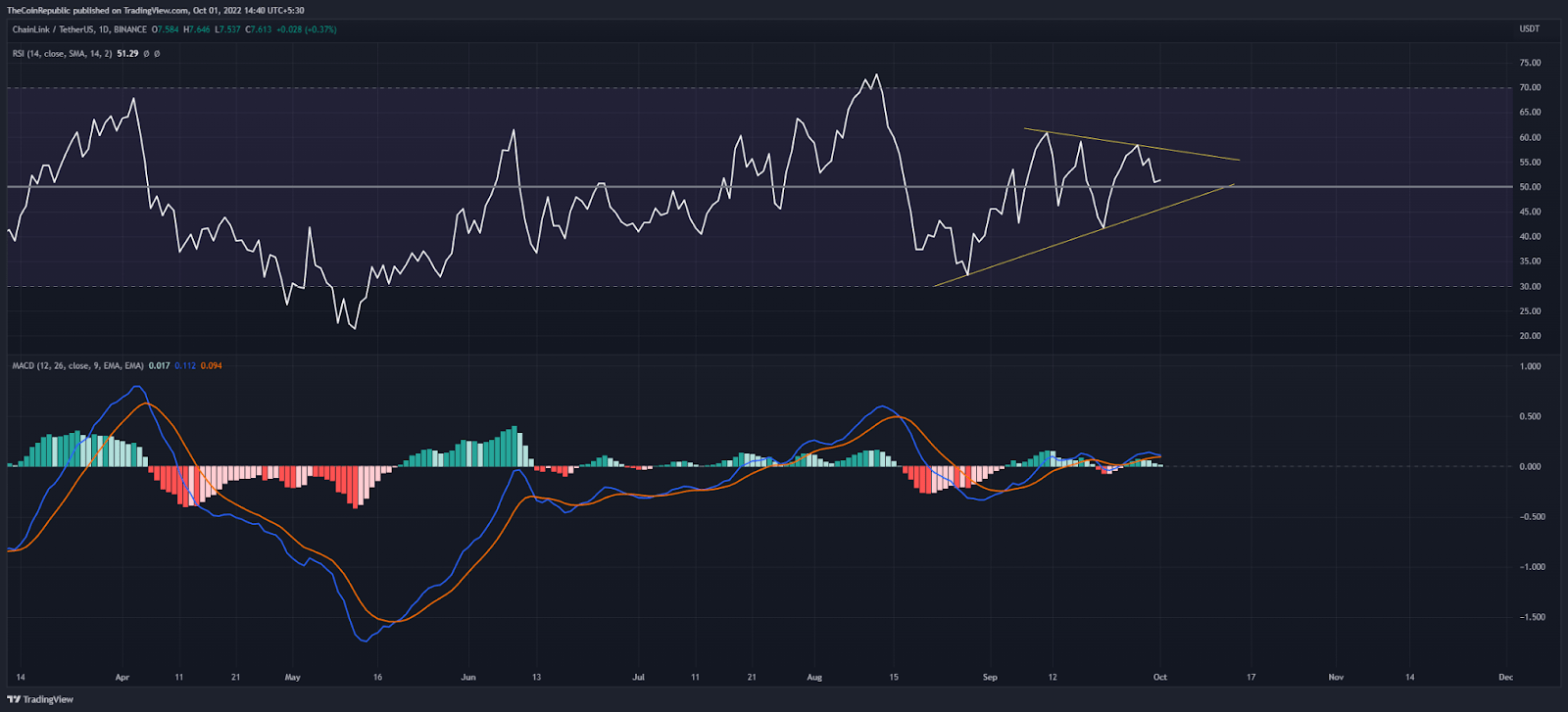

Source: LINK/USDT by Tradingview

Chainlink cryptocurrency has begun to rise after an annual low, and buyers barely manage to take control of the directional trend. For the past many days, the LINK price has been aggressively pursuing a high-low structure, positive indication. But despite bulls’ presence in the market, prices face pullback this week.

Because of the recent pull back, the Chainlink crypto is retesting the 20 day moving average (blue) today in the context of daily price scale. Bulls again started to manage prices above this support level. In case, if price moves below this zone, price may revisit the annual low again.

Conceptual Round Level of $10 Stands as a Key Selling Point

Source: LINK/USDT by Tradingview

RSI indicator is revesting halfway as a support. Although RSI peak is observing a bullish and bearish trendline in terms of the daily price scale. In addition, MACD moves gradually higher above the neutral zone.

Conclusion

The Chainlink crypto is observing just above the 20 day moving average, which acts as an immediate support level. Buyers need to maintain asset prices above this level to prevent themselves from steep decline.

Resistance level- $8.1and $9.5

Support level- $7.0 and $5.5

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only, and they do not establish the financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  DigiByte

DigiByte  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur