Chainlink Price Prediction: Will LINK Escape Declining Streak?

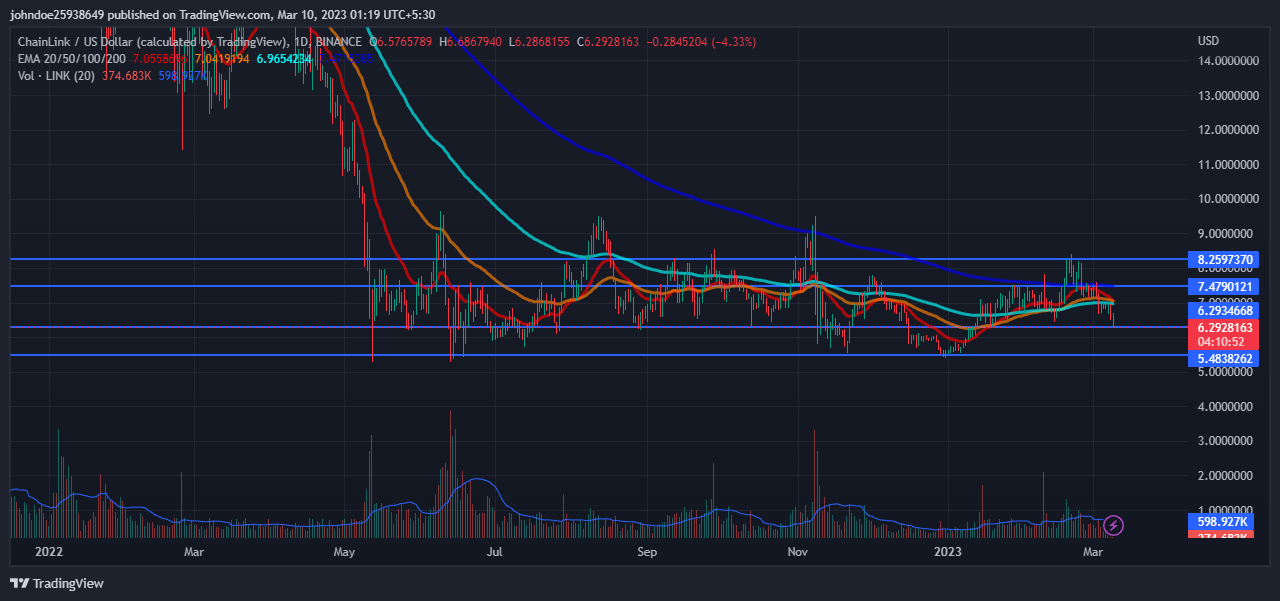

- Chainlink was currently at $6.31, which decreased by 4.33% during the intraday trading session.

- The 24-hour low of LINK was $6.31 and the 24-hour high of LINK was $6.69.

- The current Chainlink token price is below 20, 50, 100, and 200-Day EMA.

The pair of LINK/BTC was trading at 0.000303 BTC with a rise of 0.82% over the intraday trading session.

Chainlink price analysis suggests that it is currently in a downtrend. From the start of 2022, the token was in a steep decline till May of 2022 and also made its new 52-week low in that month. This shows that the sellers have been dominating the market since the start of 2022 which cause the token steep decline in value. After that buyers tried to keep the coin above its primary support of $6.293 but the token began consolidating between its primary support and secondary resistance. Near the end of the year, sellers took control of the market and pushed the token below its primary support and keep the there till the end of the year.

After the start of 2023, the token again started its upward movement with the support of buyers breaking its primary support and resistance on its way up. But as soon as the token touched its secondary resistance of $8.259 sellers became active in the market pushing the token below its primary resistance.

Source: LINK/USD by Tradingview

The volume of the coin has decreased by 5.15% in the last 24 hours. The decrease in volume indicates that the number of sellers has increased. This shows that sellers are trying their best and there is a relationship between volume and the price of LINK, which represents strength in the current bearish phase.

Chainlink Price Technical analysis:

Source: LINK/USD by Tradingview

RSI is decreasing in the oversold zone and is showing a negative crossover which indicates that the sellers are coming in the majority and pushing LINK downwards. This suggests the strength of the current bearish trend. The current value of RSI is 34.45 which is below the average RSI value of 46.22.

The MACD and the signal line are decreasing but not showing any definitive crossover over the daily chart which can support the RSI claims. Investors need to watch every move over the charts during the day’s trading session.

Conclusion

Chainlink price analysis suggests that it is currently in a downtrend. From the start of 2022, the token was in a steep decline till May of 2022 and also made its new 52-week low in that month. After the start of 2023, the token again started its upward movement with the support of buyers breaking its primary support and resistance on its way up. The decrease in volume shows a lack of confidence in traders. RSI is decreasing in the oversold zone and is showing a negative crossover which shows strength in the current bearish phase, as per the technical indicators.

Technical Levels-

Resistance level- $7.479 and $8.259

Support level- $6.293 and $5.483

Disclaimer-

The views and opinions stated by the author, or any people named in this article, are for informational purposes only, and they do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur