Chiliz (CHZ) Holders Might See Some Gains, But There Is A Catch

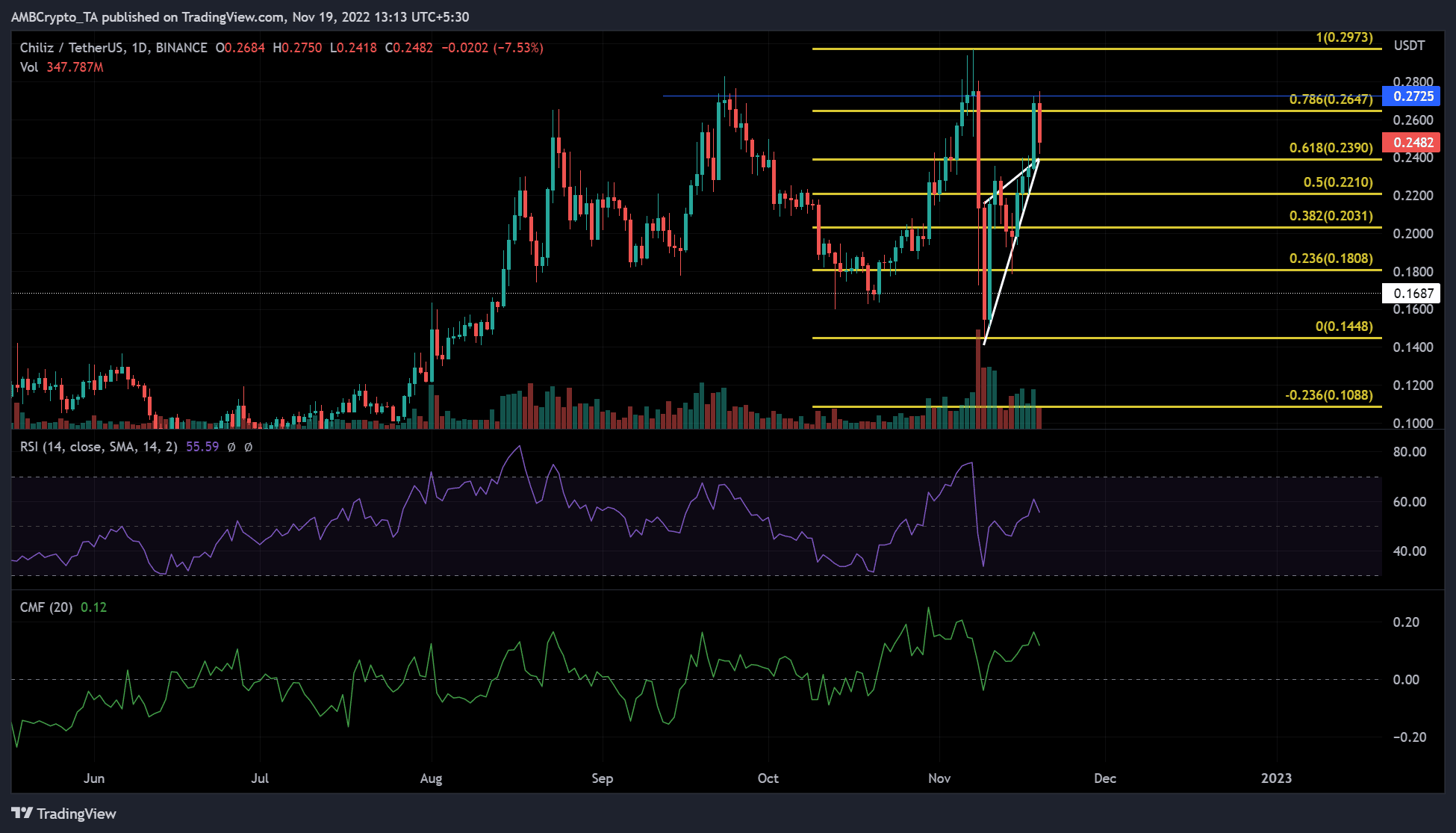

Chiliz (CHZ) posted gains as most of the altcoins slumped after the recent market crash. The daily chart of CHZ was bullish after a patterned breakout. At the time of publication, the token was trading at $0.2482. Nonetheless, the considerable ceiling is located at $0.2725 and it might undermine its recovery.

Moreover, in case the bulls break the ceiling, they might target the 100% Fib retracement level located at $0.2973. For now, there is a pattern breakout; can the Chiliz bulls continue the rally?

After a recent correction, CHZ pumped and targeted its recent all-time high of $0.29. Nonetheless, $0.2725 was a key ceiling for October and November. At the time of publication, the Relative Strength Index (RSI) stood above the neutral 50 level at 55.61. This indicated that the daily chart was generally bullish.

Moreover, the Chaikin Money Flow (CMF) stood above zero, indicating that the bulls were in control at the time of publication.

Thus, there stood the possibility of the bulls surging past the $0.2725 level and targeting $0.2973 in the coming weeks, making huge gains in the process. Nonetheless, a daily close below $0.2390 would invalidate this bullish theory.

Hence, a reversal might possibly find support between 50% and 38.2% Fib retracements. It means that the sellers can benefit from these levels to lock in profits if Chiliz records a drop below $0.2973.

Long-Term Chiliz Holders To Enjoy Profits

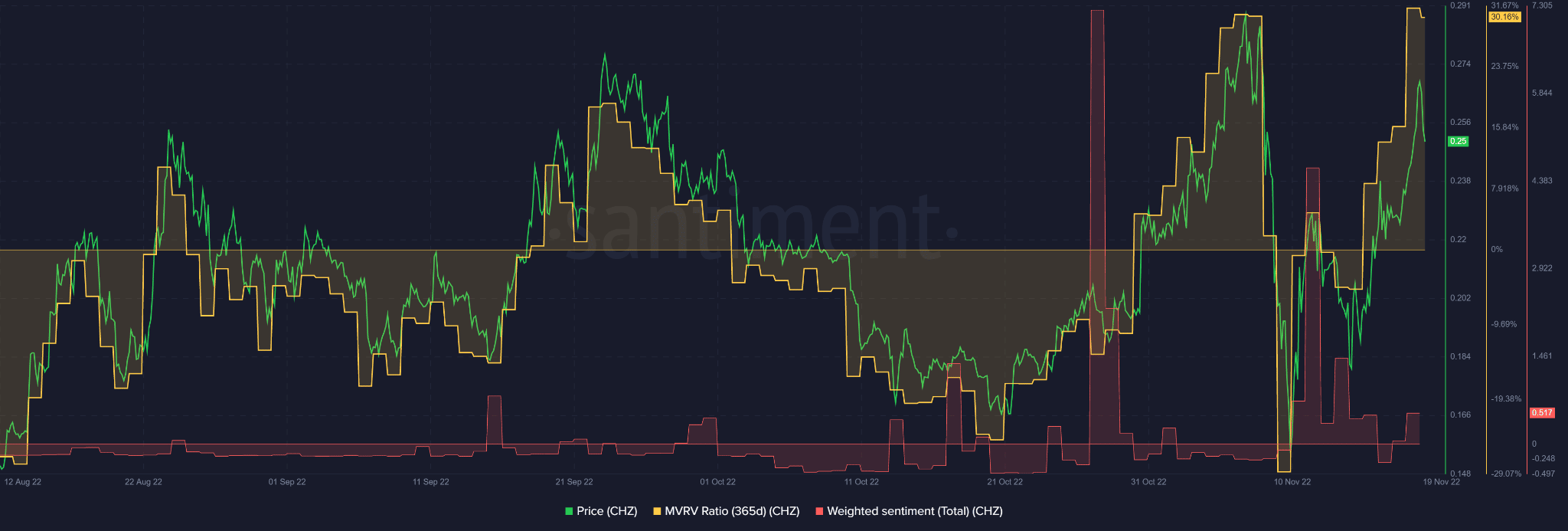

Based on data acquired from Santiment, the 30-day and 365-day Market Value to Realized Value (MVRV) surged slowly to the positive territory. This indicated that both the short-term and long-term Chiliz holders enjoyed gains, despite the current FUD that crippled the entire crypto market.

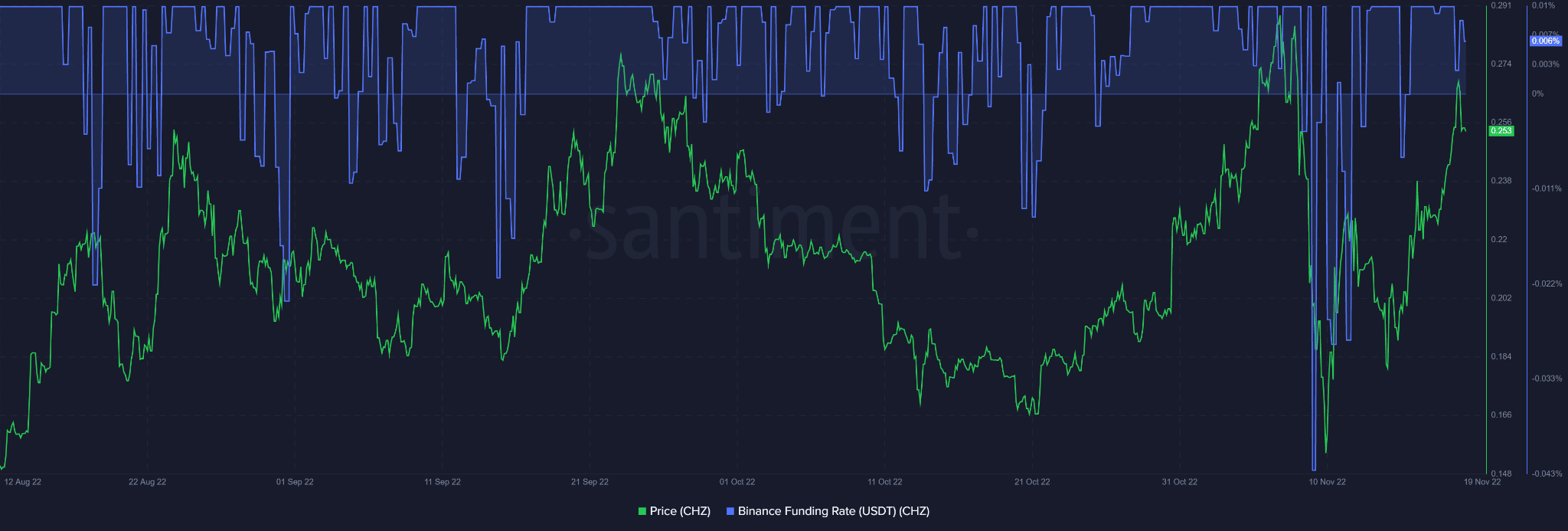

Additionally, at the time of publication, there was a small shift in the weighted sentiment, and CHZ moved to positive territory. The positive sentiment was also seen in the derivatives market, as CHZ saw a positive funding rate on the Binance Crypto exchange.

It meant that the outlook on the derivatives markets was positive for CHZ. In most of these cases, the sentiment on the spot and derivatives markets appeared similar.

Therefore, investors are advised to closely monitor CHZ sentiment and metrics in the coming days.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Decred

Decred  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Siacoin

Siacoin  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond