Crypto Adds Unsavory Footnote to Dreadful 2022: Year of the Rug Pull

The year 2022 is likely to go down as one of the worst ever in the blockchain industry’s volatile history.

But for scammers trolling digital-asset markets for suckers or even easy pickings from savvy crypto traders, it’s been a banner year.

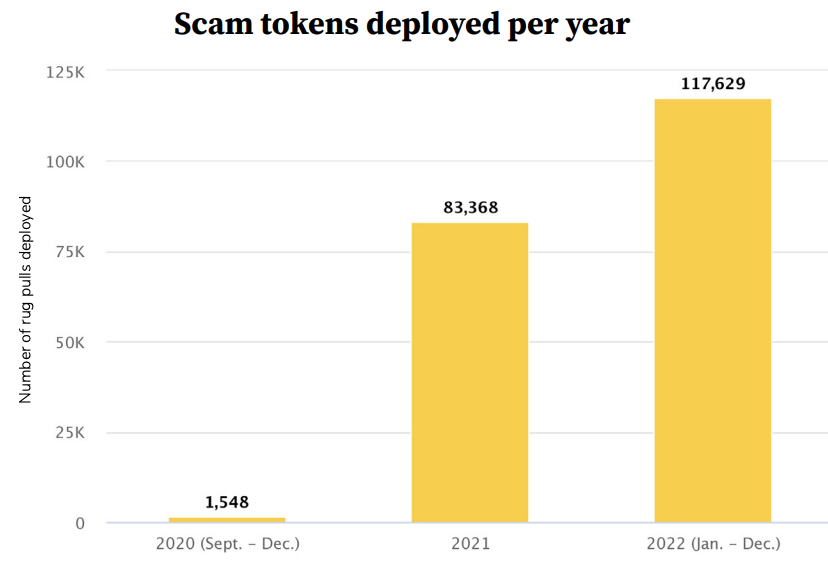

A new report from blockchain risk monitoring firm Solidus Labs shows that fraudsters deployed over 117,000 scam tokens from Jan. 1 to Dec. 1, 2022, a 41% increase over the full 2021.

Chart shows fraudsters deployed over 117,000 scam tokens from January through Dec. 1, a 41% increase over the full 2021. (Solidus Labs).

The study also revealed that 8% of all Ethereum tokens are programmed to execute rug pulls, while 12% of all BNB Chain tokens are alleged to be scams.

According to Solidus Labs, many of the scammers behind these tokens use crypto-to-fiat exchanges to both seed their scams and launder their proceeds.

“These fraudsters – benefiting from the fact that more than 99% of their malicious tokens have evaded detection under traditional approaches to scam identification – deposited and withdrew a combined $11 billion worth of ETH to/from 153 different centralized finance [CeFi] exchanges during the time period we studied,” the report read.

The scam tokens deployed in 2022 brings the total since September 2020 to more than 200,000, based on the tally by Solidus Labs, and almost 2 million investors have lost funds to rug pull tokens.

Hidden theft

One common scheme is known as the “rug pull” and involves “creating a token, funding the liquidity pool, and then removing all the liquidity after an initial rush of people buy the token,” as described by Riyad Carey, research analyst at crypto data firm Kaiko.

But why have the majority of rug pulls gone undetected in the past, and why aren’t these tokens counted on crypto pricing sites that mostly put the number of digital assets in existence at around 20,000?

Solidus Labs Chief Operating Officer Chen Arad pointed out that not all tokens deployed on blockchains are listed on pricing data sites because they’re not verified.

The number of cryptocurrencies tracked by data tracker CoinMarketCap reached over 22,000 as of today, but many existing tokens didn’t meet the site’s listing guidelines. They may still be featured on the site as untracked listings or unverified listings, including over 145,000 Ethereum ERC-20 tokens and 1.2 million BNB Chain BEP-20 tokens.

Arad told CoinDesk in an emailed comment that the report’s data is based on “continuously scanning smart contracts as they’re deployed on blockchains and flagging the token smart contracts that are hard-coded to scam users.”

According to the study, in many rug pull cases, the theft occurs exclusively on-chain: “The scam is encoded in the token’s smart contract, the token is traded on a decentralized exchange, and the scammer’s illicit profits are denominated in crypto, not fiat currency.”

The study identified a “hard rug pull” as a token scam where the scammer programs their token to steal from investors.

Another type is called “soft rug pull,” or an exit scam where the scammer promotes their token to steal from investors by publishing misleading marketing websites and roadmaps, announcing fake partnerships, or using bots to manufacture trading activity, according to the report.

Solidus Labs said 2021’s dizzying rise-and-fall of the Squid Game token was an example of the combination of two types of rug pulls: The project was a “honeypot” that prevents buyers from reselling their tokens, while having its own “marketing website, whitepaper, and promotional video.”

The hidden theft phenomenon reveals “significant gaps in consumer protection, anti-money laundering and crypto market integrity,” the report added.

The Solidus Labs report is directionally consistent with separate data from Comparitech suggesting that the number of rug pulls climbed to at least 262 this year, more than five times the number in 2021.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Decred

Decred  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond