Cardano price analysis: ADA rallies above $0.4400 as buying pressure mounts

The latest Cardano price analysis has a positive outlook as the bulls have managed to take control of the market. The bulls have surged the price past the $0.4400 barrier and are looking to break above that level. ADA is currently exchanging hands at $0.4292, which is a 3.70% increase from yesterday’s close.

As the buying pressure mounts, ADA is facing resistance at $0.4441, which is the high of today’s trading session. If the bulls manage to break above this level then we could see ADA/USD find a new resistance level above the 0.4500 mark. On the other hand, if the bears gain control of the market and push the price below the $0.4126 support level, then it will be an indication of a change in trend and ADA/USD could dip further.

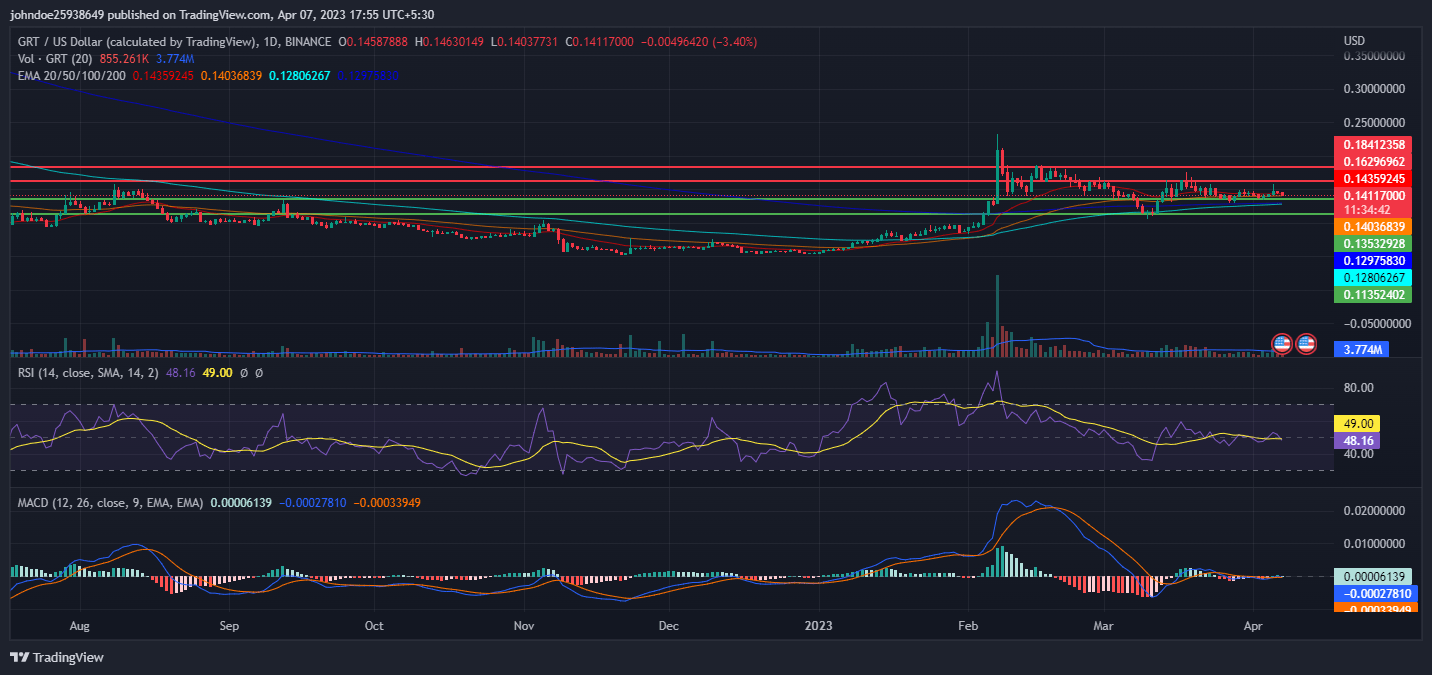

Cardano price analysis 1-day chart: ADA face resistance at $0.4441 amid Bullish momentum

The daily chart for Cardano price analysis shows that as long as the bulls remain in control, ADA/USD could continue its upward trend and break through resistance levels. The buyers were able to push the price from a low intraday of $0.4126 to a high of $0.4441 before the sellers forced the price to drop.

Technical indicators in this time frame suggest a bullish trend. The Moving Average Convergence Divergence (MACD) indicator on the daily chart shows an upward trend and bullish momentum building. The MACD line is well above the signal line and the histogram bar is increasing on the positive side.

ADA/USD 24-hour chart. Source: Trading View

The Relative Strength Index (RSI) indicator shows an increase in buying pressure as it has entered into an overbought zone. The RSI value stands at 71.02, which implies that ADA/USD could continue its upward trend. Moreover, the moving average (MA) indicator is trending below the green candlesticks, which is another sign of bullish momentum.

Cardano price analysis 4-hour chart: Recent developments and further indications

The hourly chart for Cardano price analysis shows a decline in ADA price as bears were able to penetrate the $0.4300 level. The selling pressure pushed the price to a low of $0.4292 as it is still holding above the $0.4200 level. The moving average (MA) is currently at 0.425 and the histogram is decreasing, with red bars developing in the chart.

ADA/USD 4-hour chart. Source: Trading View

The MACD indicator is still trending in line with bullish momentum as it has continued to remain above the signal line and its histogram bar is still in a positive outlook. The Relative Strength Index (RSI) stands at 64.23, indicating that selling pressure is still present in the market and ADA could drop further if the bears gain control of the market.

Cardano price analysis conclusion

Overall, Cardano’s price analysis shows that the bulls are in control of the market and ADA/USD could continue its upward trend as long as buyers remain in control. The pair could find further resistance at the $0.4441 mark and should it break above this level then the price could surge to a new high. On the other hand, if the sellers gain control of the market and push ADA/USD below the $0.4126 support level, then we could see a bearish trend develop in ADA.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM