Surge to $18K or a Crash to $15K: What’s More Likely For BTC? (Bitcoin Price Analysis)

Bitcoin’s price continues to consolidate in a tight range, as it failed to break a significant resistance level to the upside a few days ago. However, from a technical analysis standpoint, the time for a decisive breakout is near.

Technical Analysis

By: Edris

The Daily Chart

On the daily chart, the price is still consolidating in a large falling wedge pattern. These are commonly known as potential bullish reversal patterns in a bear market, provided they get broken to the upside.

However, last week’s rejection from the $18K resistance level and the 50-day moving average has halted the rally toward the higher boundary of the pattern. As a result, it likely initiated a drop down to the $15K support level and the lower trendline of the wedge.

Considering today’s bullish daily candle, a retest of the 50-day moving average currently located around the $17K mark seems likely. The short-term future of BTC’s price would be determined by the outcome of this attempt.

The 4-Hour Chart

Viewing the 4-hour timeframe, it is evident that the price is recovering but is experiencing major issues returning above the $16,800 level following last week’s plunge.

In the event of a break above the $16,800 level, a retest of the broken bullish trendline would be expected. On the other hand, the price’s failure to break above $16,800 would likely initiate a bearish continuation toward the key $15K area.

A recent short-term bullish move was signaled by the RSI indicator, as a clear divergence was formed between the last two price lows.

However, the oscillator is currently showing values around 50%, hinting at a neutral state in momentum and offering little clue on the probable direction of the trend in the short term as the market continues to witness a fragile equilibrium between buyers and sellers.

Onchain Analysis

By Shayan

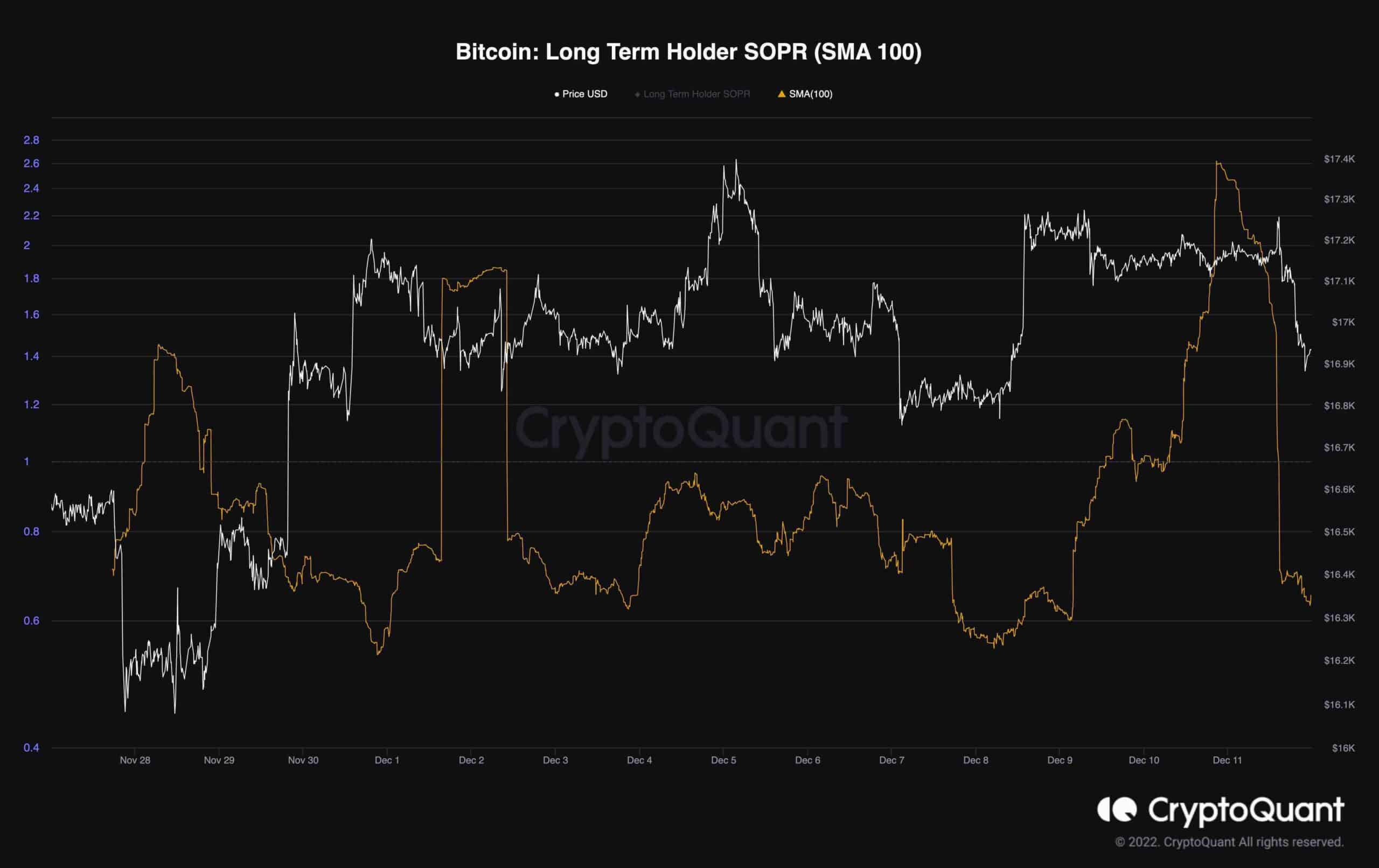

The following chart includes the Long Term Holder SOPR(Block resolution) and Bitcoin’s price.

Long-Term Spent Output Profit Ratio is a ratio of spent outputs (more than 155 days) in profit at the time of the window. Values over ‘1’ indicate more long-term investors are selling at a profit, while values below ‘1’ mean more long-term investors are selling at a loss.

The metric spiked three times during the price recovery from $16K to roughly $18.4K. Also, it has printed a significant jump after Bitcoin surged and reached the crucial resistance level of $18K.

This proves that long-term holders consider each price surge an opportunity to offload their assets and realize profits.

This is typical behavior during the late bear market stages; however, the next bull run won’t be initiated unless this cohort stops distributing their assets and start accumulating BTC with higher rates.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stacks

Stacks  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Decred

Decred  Zcash

Zcash  NEM

NEM  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Nano

Nano  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD  Augur

Augur