Cryptoeconomics: A Cornerstone of Decentralized Networks

Summary: Cryptoeconomics is an emerging field that helps us design or analyze the economy of a crypto project. For crypto investors, understanding the cryptoeconomics behind a blockchain reveals the fundamentals that can determine whether a project is healthy or stagnant. Here’s how to use this investing superpower.

Cryptoeconomics is a discipline that uses cryptography and economic incentives to create new forms of decentralized networks and applications. We can regard this new field as a mashup of mathematics, computer science, and economic theory.

The goal of cryptoeconomics is to find the ideal approach to coordinate the behavior of decentralized network participants. In plain English, cryptoeconomics tries to understand how to best design, fund, and facilitate the growth of blockchains.

(Note: Cryptoeconomics is slightly different from tokenomics, although the two overlap. Tokenomics refers to the economics of a token, where cryptoeconomics refers to the economics of the blockchain as a whole.)

The Three Elements of Cryptoeconomics

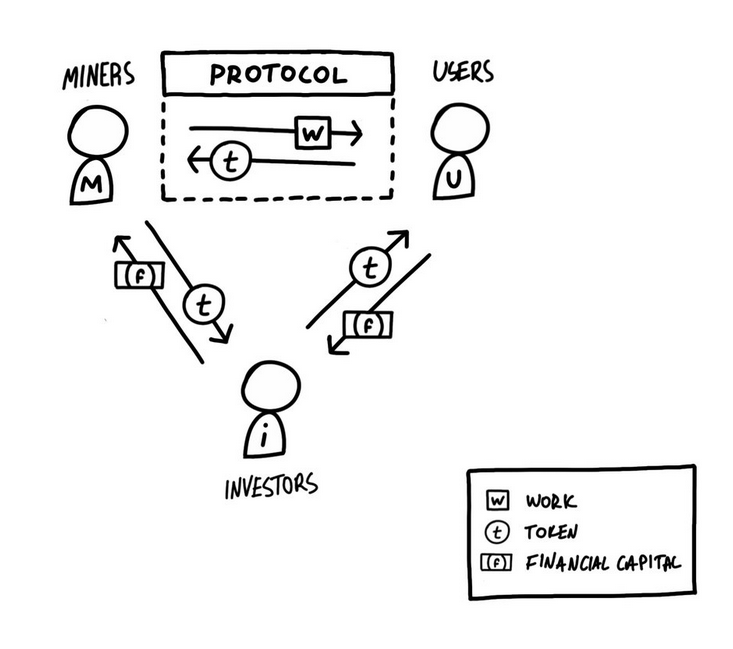

Joel Monegro pioneered the so-called Cryptoeconomic Circle to describe the relationship between the three leading players of a decentralized network:

- Miners, who are responsible for contributing to the consensus protocol and coordinating their resources (e.g., computing power) to maintain the network and add blocks. If the decentralized network relies on a PoS algorithm, block creators are called validators, and they stake the native token to become eligible to participate in the block creation process.

- Users, who consume the service, whether it’s a form of digital money or a utility token.

- Investors, who capitalize on the network and contribute liquidity.

Thus, the Cryptoeconomic Circle has three forms of interactions: the miner-user, investor-miner, and investor-user relationships.

This model implies a dual role for investors like us:

- We provide liquidity, so that miners can capitalize on the tokens that are rewarded for their mining effort.

- We ensure the network is well-capitalized, so the token rewards exceed the mining costs and keep mining profitable.

In this model, crypto investors are divided into two main groups:

- Traders, who aim for short-term gains.

- Hodlers, who buy and hold the token with the goal of long-term gain.

Traders are responsible for creating liquidity so that miners can sell their mined coins and cover operational costs. This is a direct form of value transfer in which miners sell their earned tokens in the open market to cover costs and potentially reinvest profits.

The second group of investors includes hodlers, who capitalize the network to foster its growth by supporting the cryptocurrency price. This miner-hodler relationship implies an indirect flow of value that can be deduced from miners’ balance sheet instead of their income statements.

Therefore, investors play an important role in maintaining the health of a crypto network. Different capitalization levels have a direct impact on how the supply side evolves.

We may consider that a cryptocurrency network is fully capitalized when the token price is at a level where mining is breakeven. If the token price drops below this level, the network becomes under-capitalized, so mining becomes unprofitable, and supply contracts.

When prices increase above that line, the network is well-capitalized, and this contributes to an expansion in supply and boosts the profitability of miners. In this way, by achieving certain price levels, hodlers have an indirect impact on the supply.

This relationship is especially important at the start of a cryptocurrency network, as investor capital helps bootstrap the supply side (i.e. kickstarts user demand). It may happen that the network is over-capitalized, which is a problem when user demand falls short of investors’ expectations. In this case, capital withdrawal can lead to sudden price drops that take miners out of business.

Besides this interaction between investors and miners, there is also an investor-user relationship. Investors usually expect the price of a token to appreciate as demand increases over time (i.e., as more users join the network).

As you can see, the cryptoeconomic circle calls for strong collaboration between all three groups, as all participants depend on each other to achieve their goals. The strong interdependence, with investors playing a key role, is what makes a healthy blockchain ecosystem.

Cryptoeconomics in Decentralized Finance

Decentralized Finance (DeFi) is probably the most important trend within the crypto industry, with ING and Bank of America separately concluding that DeFi is more disruptive than bitcoin itself.

The goal of DeFi is to move financial services onto blockchain infrastructure, in order to cut middlemen and streamline peer-to-peer (P2P) interactions. Think about trading, lending, insurance, payments, and investing: these and other financial services can be decentralized.

In DeFi, cryptoeconomics determines the rules for how the application works. For example, most DeFi protocols are built on existing blockchains, such as Ethereum. This underlying Layer 1 blockchain provides a unit of value (in this case, ETH) that can be used to make the cryptoeconomic system work, in the same way that dollars make the US economy work.

This is an enormous innovation, and why we expect that only one or two L1 networks will win over the long term: developers will build on the networks with the most commonly-accepted units of value (for example, ETH on Ethereum).

Cryptoeconomics Use Cases

One of the best examples of cryptoeconomics applications in DeFi is the Automated Market Maker (AMM) model employed by DEXes. It enables liquidity providers (investors) to generate income by facilitating trades and collecting a fee. The AMM model helps DEXes such as Uniswap and dYdX operate without a centralized order book: a key element for any spot exchange.

Another example is prediction markets, such as Augur and Gnosis. The former has a system of incentives that use its native token REP. The protocol rewards users for reporting accurate information to the app, which is eventually used to settle bets. Elsewhere, Gnosis employs a similar cryptoeconomics mechanism. However, it also enables users to determine true outcomes with the help of so-called oracles, which provide blockchains with verified off-chain data. Investors can benefit by providing or verifying data on these prediction markets, and generate income based on their contribution to the network.

Another use case of cryptoeconomics in DeFi relates to governance, which enables DeFi protocols to be managed by communities rather than corporate teams. For example, the lending protocol Compound is managed by a decentralized community of COMP holders and their delegates, who have the right to propose and vote on upgrades. Contributing to governance, like being an active shareholder of a public company, is both an investment opportunity as well as a tool to directly influence the direction of the crypto project.

Investor Takeaway

Both institutional and retail investors can benefit from understanding the three basic elements of cryptoeconomics — miners, users, and investors — as this helps them make better crypto investing decisions.

Cryptoeconomics can give you insights into the fundamentals of a project. Also, understanding a project’s incentive mechanisms helps investors find great income opportunities — lending, staking, or yield farming — that may be overlooked.

At Bitcoin Market Journal, we believe that cryptoeconomics will become a recognized field with its own principles and applications. It will attract many traditional investors looking for alternative strategies and exposure to assets that show a low correlation to traditional markets.

Understand cryptoeconomics, and you understand the ecosystem.

Understand the ecosystem, and you can uncover new opportunities.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur