Cryptos Flat as Recession Fears Outweigh Improved US Labor Productivity

Bitcoin remained reasonably steady at around the $16,850 mark as U.S. nonfarm productivity rose 0.6% for Q4 2022.

The slight quarter-on-quarter increase in productivity means that employers can raise wages without worrying about their contribution to inflation. This should be mildly bullish for investors in risky asset classes as it reduces the chance of a U.S. recession.

Nonfarm Productivity up as Pandemic Pressures Fade

The Q4 increase in productivity follows an adjusted Q3 growth of 0.8% that broke step with declines in the previous two quarters. Companies found themselves forking out extra money to attract and retain employees after the pandemic.

Nonfarm productivity measures labor efficiency for nonfarm employees producing goods and services. It is calculated by dividing an index of real output by an index of hours worked by every worker. Workers include employees and unpaid family workers.

Employers can invest in new equipment and systems to improve worker productivity without contributing to inflation.

Nonfarm Productivity Unable to Quell Recession Fears

The second-quarter increase in productivity should have been a welcome surprise after last week’s Nov. jobs numbers revealed that wage increases were outpacing efforts by the Federal Reserve to control inflation.

Instead, stock market futures declined in early trading. The declines came as fears of a 2023 recession extinguished the glimmer of hope offered by higher labor productivity.

Stock market futures fell in early trading. Dow Jones futures slumped 0.5%, S&P 500 futures declined by 0.7%, and Nasdaq futures slipped 1.1%.

Major cryptos, including Bitcoin and Ethereum, improved marginally after the announcement but mainly were flat at around $16,850 and $1,230.00, respectively, breaking step with the stock market.

BTC/USD | Source: TradingView

ETH/USD | Source: TradingView

While investors have experienced significant losses in their crypto investments over the past six months, the relatively stable price of Bitcoin in recently has indicated that the pain could be waning.

Still, one technical analyst at Fairlead Strategies believes that the chances of a positive breakout are limited.

“We would respect lower highs and lower lows, which define the prevailing downtrend,” said Fairlead partner Katie Stockton. “While short-term momentum has improved for Bitcoin, the recent breakdown and declining trend-following gauges suggest it is best to stay on the sidelines.”

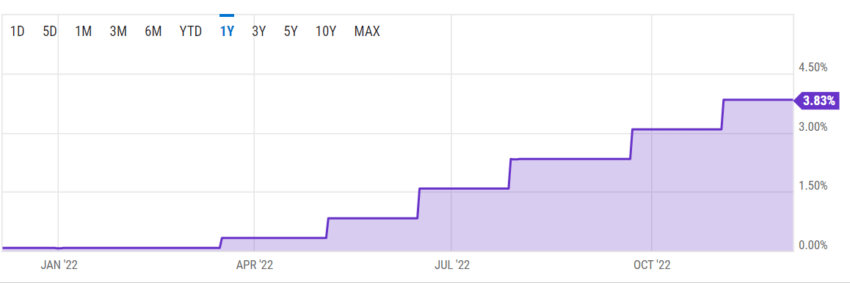

Inverted Treasury Curve Points to Imminent Recession

Despite recent labor and consumer data suggesting that the Fed’s aggressive tightening policies are bearing fruit, strong nonfarm wage growth in Nov. has led some investors to believe that the Fed will continue increasing interest rates for longer than initially expected, increasing the odds of an economic recession. The current federal funds rate is around 3.8%, following six consecutive hikes in 2022.

Source: YCharts

“All told, financial indicators point to a recession on the horizon,” said Azhar Iqbal of Wells Fargo to the bank’s clients on Dec. 7. He added that the so-called inverted treasury-yield curve, a predictor of inflation since 1960, is one indicator.

Yield curve inversions happen when investors flock to low-risk government investments like Treasury instruments, which pay yield at different fixed intervals.

In a market fraught with recession fears, investors clamor for longer-term treasury investments, like 10-year bonds. This increased demand drives yields of longer-term instruments downward.

As yields plummet, the difference or spread between the yield of short-term treasuries and long-term treasuries grows more negative, foreshadowing a recession.

The yield spread between two and 10-year treasuries at press time is -0.8%.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  DigiByte

DigiByte  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur