DOGE Price Fluctuates, Investors Remain Cautiously Optimistic

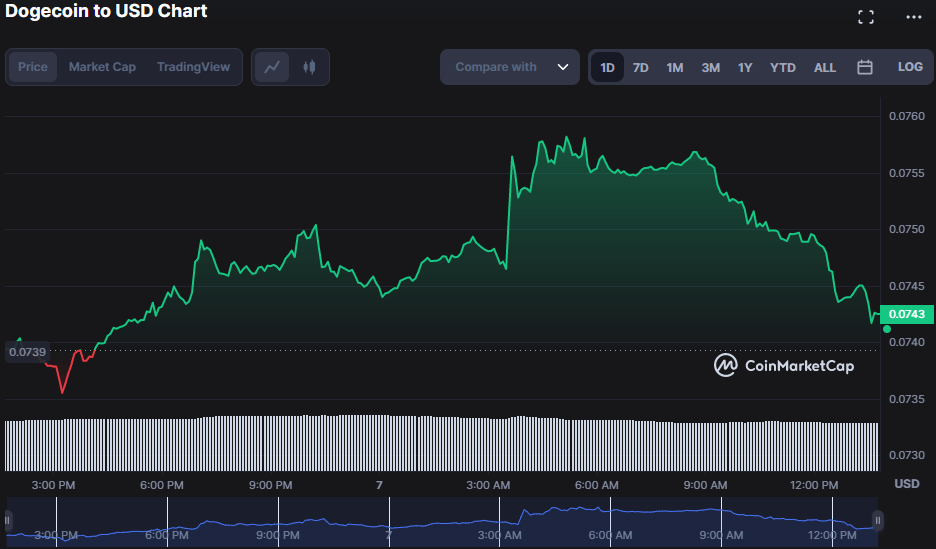

After starting the day on a negative note, bulls rallied and reclaimed control, with the price of Dogecoin (DOGE) falling to $0.07355.

DOGE price surged to an intra-day high of $0.07583 and maintained the trend to press time, valuing it at $0.07416, a 0.34% gain.

Despite the recent market turbulence, the market capitalization of DOGE increased by 0.30% to $9,840,183,387, demonstrating that investors remain positive and are prepared to invest more in it. The 24-hour trading volume, however, declined by 5.62% to $249,090,758, indicating that investors are hanging onto their DOGE holdings rather than selling in a panic.

DOGE/USD 24-hour price chart (source: CoinMarketCap)

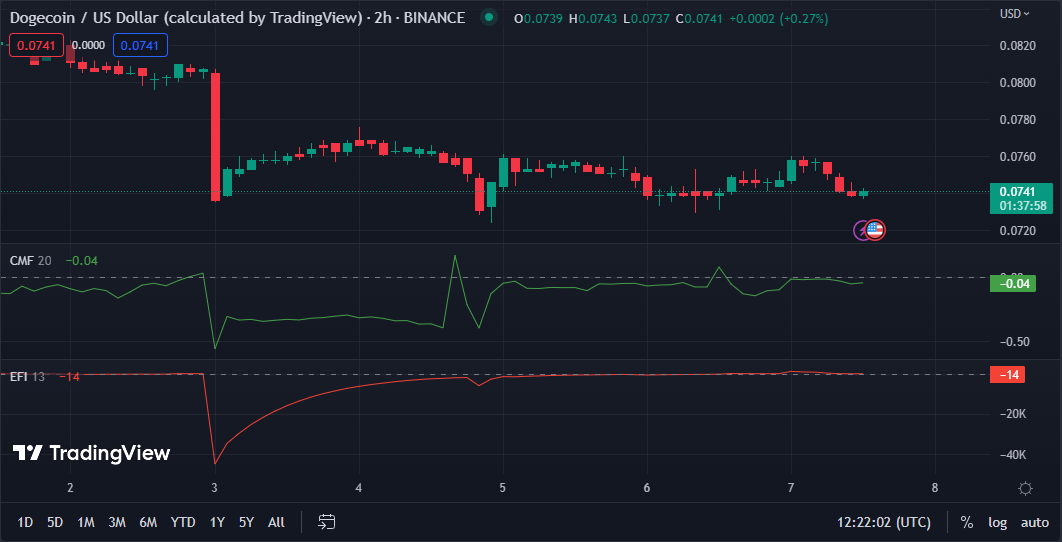

While the market is buoyant, negative sentiment may rise, as seen by the Chaikin Money Flow (CMF) reading of -0.04 on the 2-hour price chart for DOGE. The CMF’s downward trajectory reflects the growing selling pressure, so investors should be wary of opening new long positions and may consider cashing in on those already open.

With a rating of -39, the Elder Force Index (EFI) also reflects the pessimistic attitude in the market and suggests that the selling pressure will likely endure soon. This motion might cause a downward trend in the market; therefore, investors must carefully monitor price activity for a reversal before placing any new investments.

DOGE/USD chart by TradingView

The 100-day MA climbs above the 20-day MA, forming a bearish crossing, with the latter hitting 0.0745 and the former at 0.0779. This move indicates that the bullish trend is ending, and a probable reversal is on the horizon. Investors should closely monitor the price activity and consider using risk management measures to safeguard their holdings.

When the price movement falls below both bands, it may signal an oversold state and a possible buying opportunity. This move calls the bullish trend into doubt; thus, traders should exercise care and wait for confirmation before starting a long position.

Moreover, the Money Flow Index (MFI) is trending south with a score of 55.70, indicating some selling pressure in the market, which might lead to additional price declines. This action indicates that investors may be taking gains or decreasing their exposure to the asset, suggesting a likely change in attitude toward a pessimistic view.

DOGE/USD chart by TradingView

DOGE’s recent gains may be short-lived as negative sentiment grows. Investors should exercise caution and closely monitor price activity for potential reversals.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond