XRP May Make Everyone Cry, This Trader Says

The XRP cryptocurrency might be in the process of “loading a moonshot,” according to the pseudonymous trader and investor Crypto Rand.

The token’s potential rally would make “everyone cry,” according to the popular chartist.

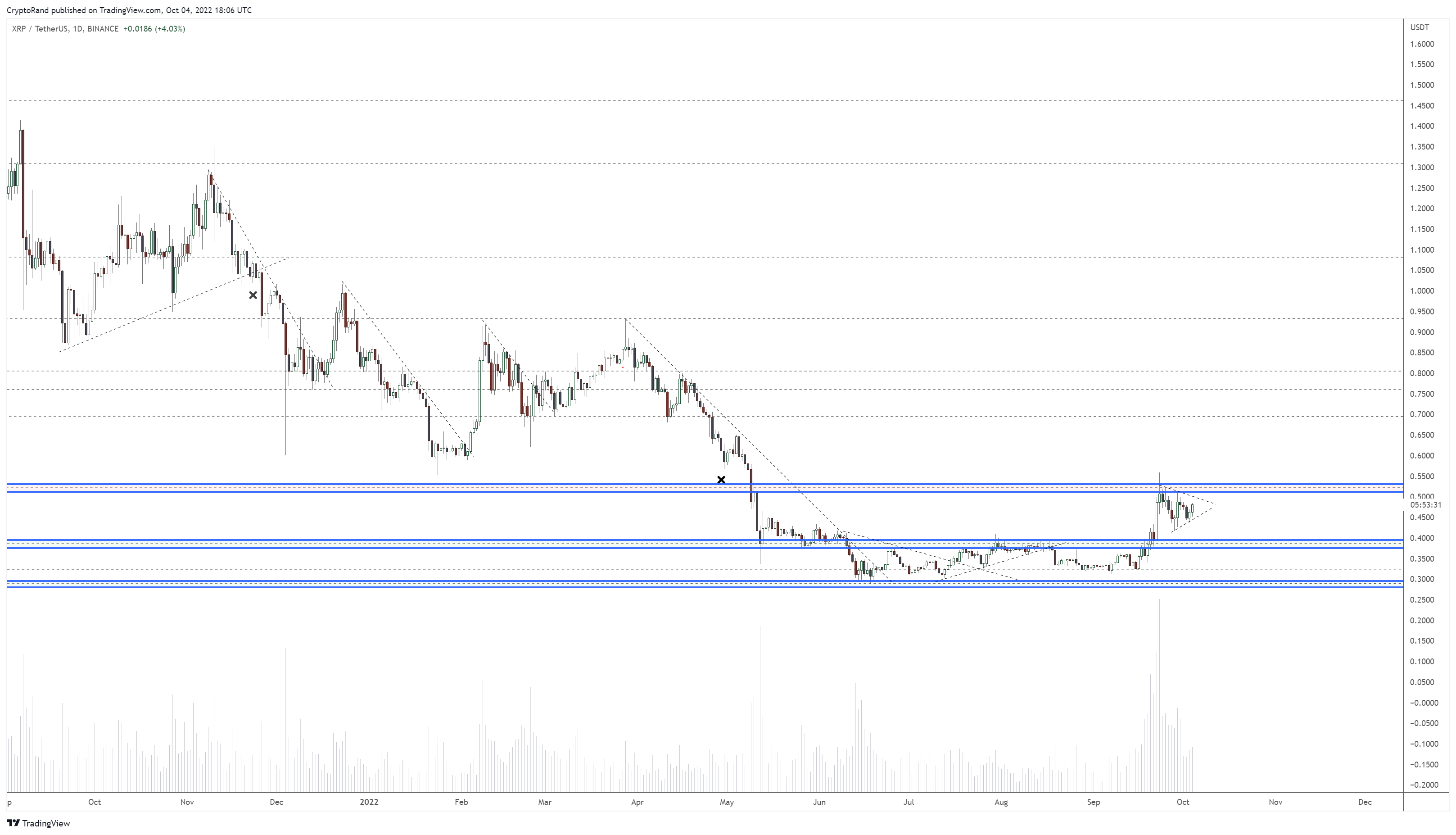

A price chart shared by Crypto Rand shows that the XRP token appears to have formed a symmetrical triangle. Such patterns typically form during periods of consolidation. The direction of the ongoing trend is to the upside, which is good news for the bulls.

The XRP price is up 5.66% over the past 24 hours, according to data provided by crypto data site CoinMarketCap. The cryptocurrency is changing hands at $0.48 on major spot exchanges.

As reported by U.Today, the XRP token experienced a significant rally last month amid fresh speculation surrounding Ripple’s ongoing battle with the U.S. Securities Commission. In September, both parties filed motions for summary judgment.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Hedera

Hedera  Litecoin

Litecoin  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Gate

Gate  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Tether Gold

Tether Gold  Zcash

Zcash  Theta Network

Theta Network  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Ravencoin

Ravencoin  Dash

Dash  Decred

Decred  Zilliqa

Zilliqa  Synthetix Network

Synthetix Network  Qtum

Qtum  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Siacoin

Siacoin  Holo

Holo  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Nano

Nano  Ontology

Ontology  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Numeraire

Numeraire  NEM

NEM  BUSD

BUSD  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Energi

Energi  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  HUSD

HUSD