EOS Price Analysis: Will EOS Break out of the Horizontal Range?

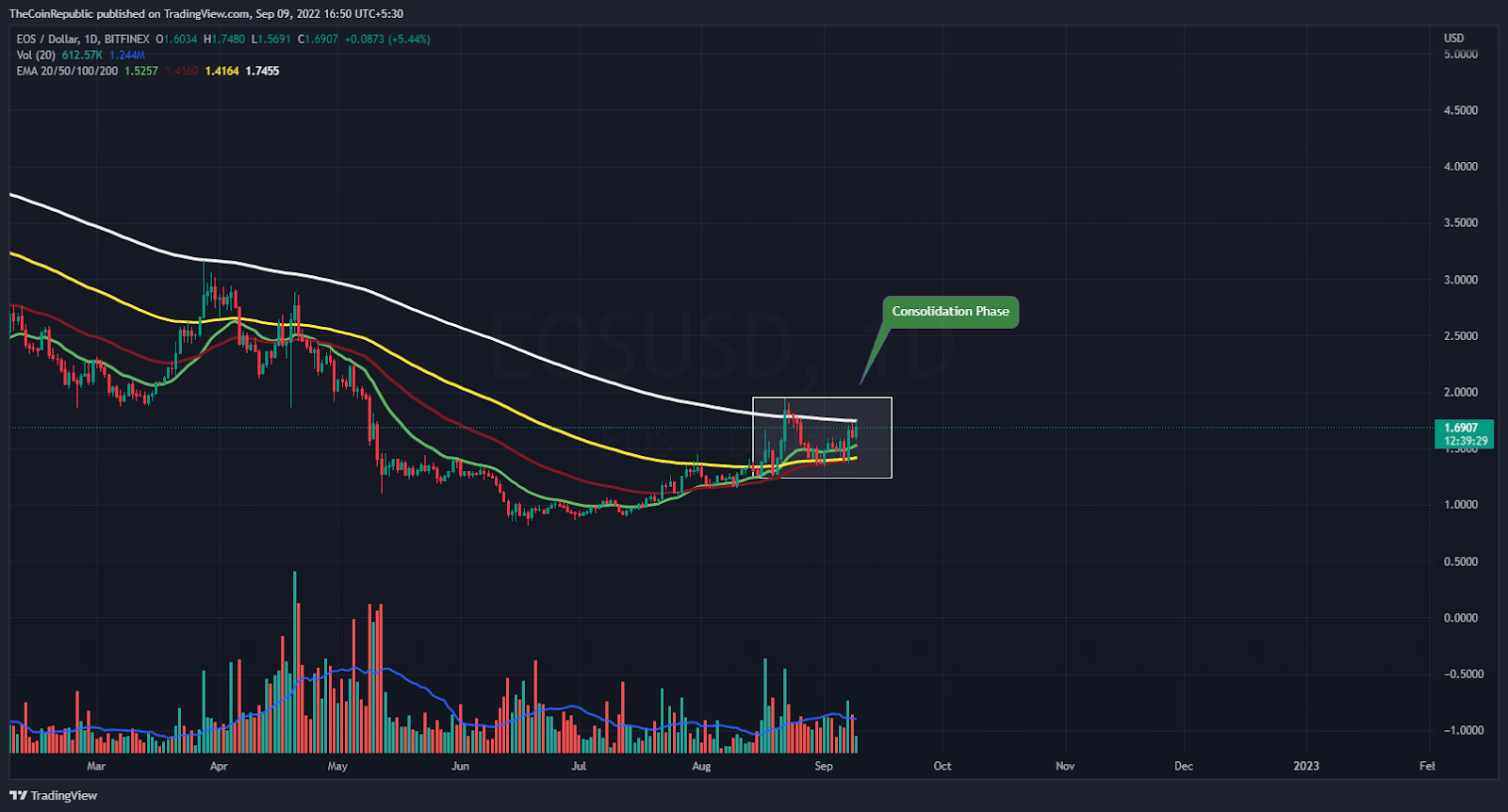

- EOS price is trying to recover towards the upper price range of the consolidation phase over the daily chart.

- EOS crypto is trading above 20, 50, and 100 DMA and is still below 200-day Daily Moving Average.

- The pair of EOS/BTC is at 0.00008058 BTC with an intraday drop of 4.31%.

The cost of the EOS has been locked inside a range-bound band ever since August 14th. This existential crisis led to panic selling on the cryptocurrency market. Despite the extreme volatility of the bitcoin market, investors are trying to hang onto their own holdings. EOS is one of the digital currencies experiencing an existential crisis as it teeters at a record low. During this turbulent moment, cryptocurrency investors need to be as rock-solid as those with diamond hands. Diamond hands won’t be as eager to sell their holdings as other players.

EOS is presently trading at $1.691, up 4.05% in market value from the day before. The volume of trades declined by 22.03% during intraday trading. This demonstrates that sellers are getting ready to short the EOS cryptocurrency market. The volume to market cap ratio is 0.3974.

Source: EOS/USD by TradingView

On the daily price chart, the price of the EOS coin is clearly declining. Due to the market’s ongoing drop, the cryptocurrency asset has reverted to the consolidation phase close to the 2020 lows. If the price of the EOS currency is to increase back to the upper price range of the consolidation period, more buyers must enter the market. The cost of EOS has been stable at $1.25 to $1.95. The volume movement, which is now minor in relation to the norm, must increase for EOS currency to cross the daily chart.

Will EOS Maintain this Bullish Momentum?

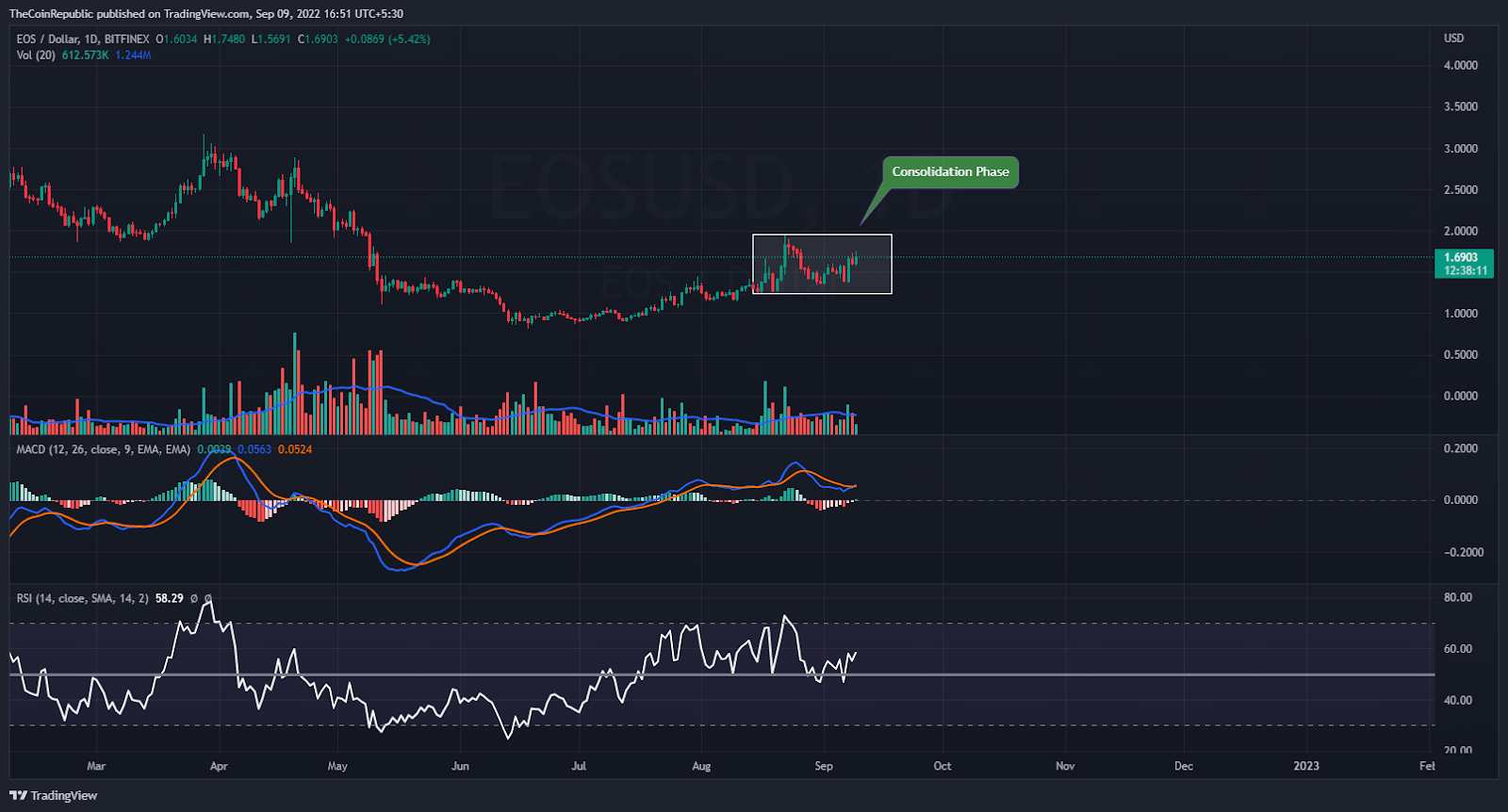

Source: EOS/USD by TradingView

On the daily price chart, the price of EOS is rapidly declining. In order to quickly advance toward the top price range of the consolidation phase, the EOS currency has to attract support from buyers. The strength of the present upward trend for the EOS coin is demonstrated by technical indicators.

The relative strength indicator indicates that the price of the EOS currency is rising (RSI). At 58, the RSI is above neutrality. The EOS cryptocurrency’s MACD displays a bullish momentum. A positive crossover will occur when the MACD line crosses the signal line upward. Investors in EOS should monitor the daily chart for any shifts in trendss.

Conclusion

The cost of the EOS has been locked inside a range-bound band ever since August 14th. This existential crisis led to panic selling on the cryptocurrency market. Despite the extreme volatility of the bitcoin market, investors are trying to hang onto their own holdings. EOS is one of the digital currencies experiencing an existential crisis as it teeters at a record low. During this turbulent moment, cryptocurrency investors need to be as rock-solid as those with diamond hands. The cost of EOS has been stable at $1.25 to $1.95. The volume movement, which is now minor in relation to the norm, must increase for EOS currency to cross the daily chart. The strength of the present upward trend for the EOS coin is demonstrated by technical indicators. A positive crossover will occur when the MACD line crosses the signal line upward. Investors in EOS should monitor the daily chart for any shifts in trend.

Technical Levels

Support Level: $1.35 and $1.30

Resistance Level: $1.80 and $1.95

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only, and they do not establish the financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Decred

Decred  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond