EOS Price Rallied By 10%, Coin To Retest $2?

EOS price has propelled by 10% and now is one of the top gainers over the 24 hours. This has pushed the coin quite close to its next price resistance. The bulls were back on the 24 hour chart and that depicted positive price action for the coin.

Despite Bitcoin falling on the chart and other major altcoins moving south EOS noted a considerable surge in price. EOS price also depicts a broad wedge pattern, this pattern is often tied to exhaustion of a trend. In this case, EOS price was reversing its previous bearish price momentum.

Technical outlook on the chart pointed towards bullish price action gaining strength. Buying strength on the 24 hour chart were substantially high.

In case buying strength holds its ground, a move to the immediate resistance becomes easy for the altcoin. Price of EOS needs to trade above its current price action for the coin to move and witness another possible rally.

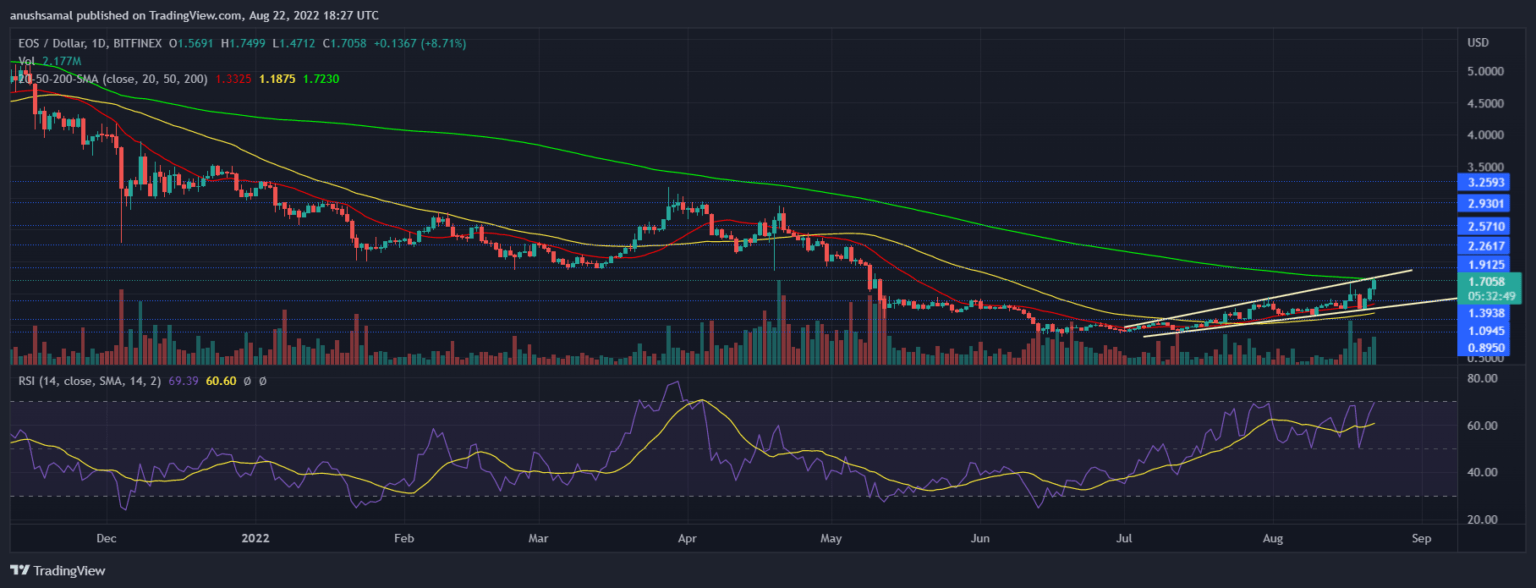

EOS Price Analysis: One Day Chart

The altcoin was trading at $1.70 at the time of writing. It secured double digit gains over the last 24 hours as the bulls surfaced. The coin has also formed a broad wedge pattern which meant that EOS’s previous bearish price thesis would be discontinued.

The overhead resistance for the coin stood at $1.90 and a move above that level will push EOS to $2. In case the sellers resurface in the market, the local support level for the coin awaited at $0.90. The amount of EOS traded over the last trading session increased as depicted by the green bar indicating that buying strength also mounted.

Technical Analysis

The bullish momentum flashed increase in demand for the coin. The technical indicator also reflected the increase in buying strength. The Relative Strength Index was positive as it was seen above the half-line denoting that EOS price was bullish.

RSI was hovering near the oversold zone and with an increase in demand, the coin would be overbought. Price of the altcoin was above the 20-SMA line which meant that buyers were driving the price momentum in the market. EOS was also above the 50-SMA which was a sign of bullishness.

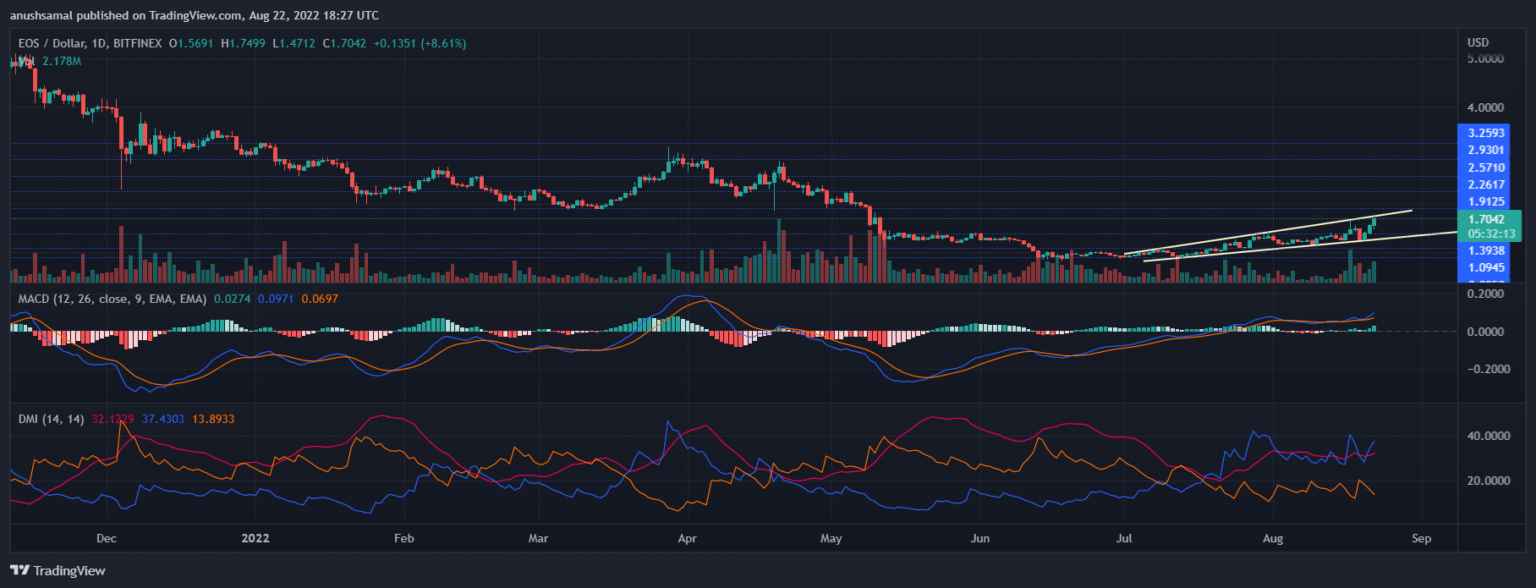

Increase in price and demand made EOS display buy signal on its technical indicator. Moving Average Convergence Divergence indicate the price momentum and reversal in the same. MACD underwent the bullish crossover and displayed green histograms which were essentially buy signal for the coin.

Directional Movement Index portray the price direction. DMI was positive as +DI was above the -DI line. Average Directional Index (red) was nearing the 40-mark, this indicated that the current price momentum was gaining strength. This also could be a sign of continued bullishness over the immediate trading sessions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Holo

Holo  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur