Eth May Beat BTC in the Near Future According to Influencer

The crypto influencer, Lark Davis (@TheCryptoLark), tweeted this morning that the number of Ethereum (ETH) holders and the number of Bitcoin (BTC) holders both increased in 2022. In the tweet, the influencer stated that the number of ETH owners had increased by 263%, while the number of BTC owners only increased by 20% – suggesting that ETH is better than BTC.

Although the number of ETH owners increased far more than the number of BTC owners in 2022, BTC attracts more instituional investment that ETH. This was pointed out by the Twitter user, Use your Gray Matter (@DaDeepThinker), who replied to the tweet made by Lark Davis today by stating that “263% kids trading dinos vs 20% corporate investors.”

At press time, the crypto market tracking website CoinMarketCap shows that both BTC and ETH experienced 24-hour price gains. Currently, BTC’s price is up 0.94% to trade at $23,219.69. Meanwhile, ETH’s price is only up 0.06%.

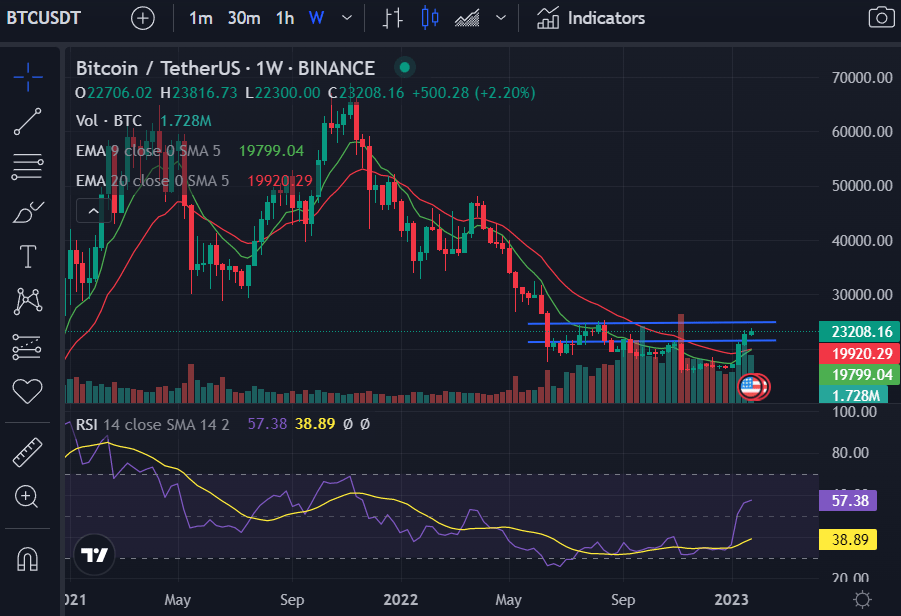

Weekly chart for BTC/USDT (Source: CoinMarketCap)

BTC’s price has been in a multi-week positive rally, as can be seen by its weekly chart. This has pushed the price of the crypto market leader above the resistance level at $21,420 – ultimately flipping the level into support.

A major technical flag that investors and traders need to keep an eye on is the 9-week EMA crossing above the 20-week EMA line. This will be a major bullish flag that will result in BTC’s price targeting $24,870.

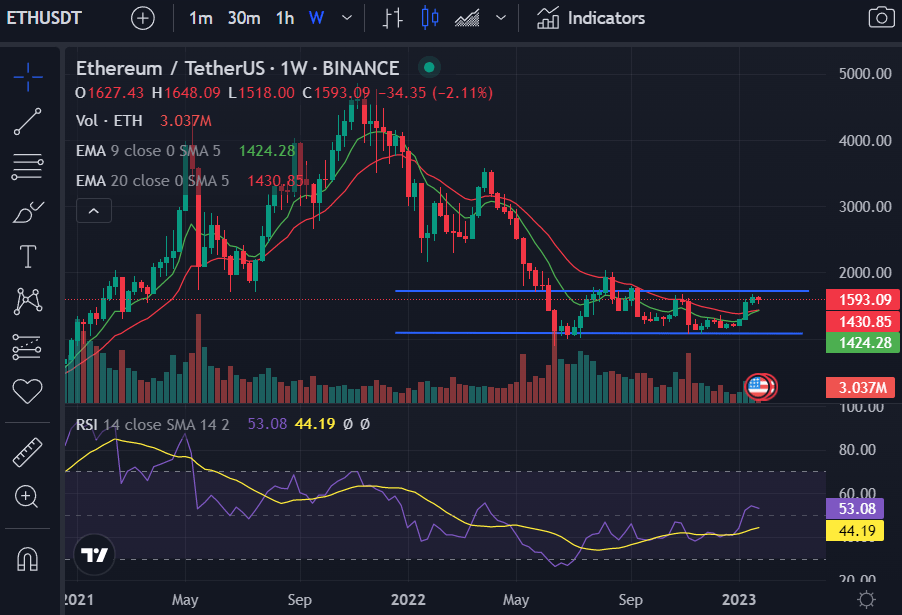

Weekly chart for ETH/USDT (Source: CoinMarketCap)

The 9-week EMA line is also looking to cross above the 20-week EMA line on ETH’s chart. This medium-term bullish cross will likely occur only once ETH’s price breaches the weekly resistance level at $1,740.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond