ETH Trading Inside a Tight Range, Breakout Imminent? (Ethereum Price Analysis)

The cryptocurrency markets are experiencing a period of stagnation. Meanwhile, ETH has been trading inside a tight range for the last seven days.

Technical Analysis

By Grizzly

The Daily Chart

On the daily chart, we can see two descending lines since ETH had reached its all-time high, and right now, ETH is retesting the lower line (green), along with the 200-week moving average (in yellow).

From the bearish side, if the green support line doesn’t hold and the selling pressure increases, ETH is expected to break below the 200-week MA line and probably revisit the $1,000 area, where the horizontal support and descending support line intersect.

On the other hand, if ETH breaks above $1,550, it could aim for a retest of the last local high of around $1,800 – which is tangent to the 200-day moving average (in white). Such a move will probably trigger the end of the current bear market.

In the short term, a breach of either $1,280 or $1,550 may set the next direction for ETH.

Key Support Levels: $1280 & $1000

Key Resistance Levels: $1550 & $1800

Daily Moving Averages:

MA20: $1435

MA50: $1577

MA100: $1483

MA200: $1972

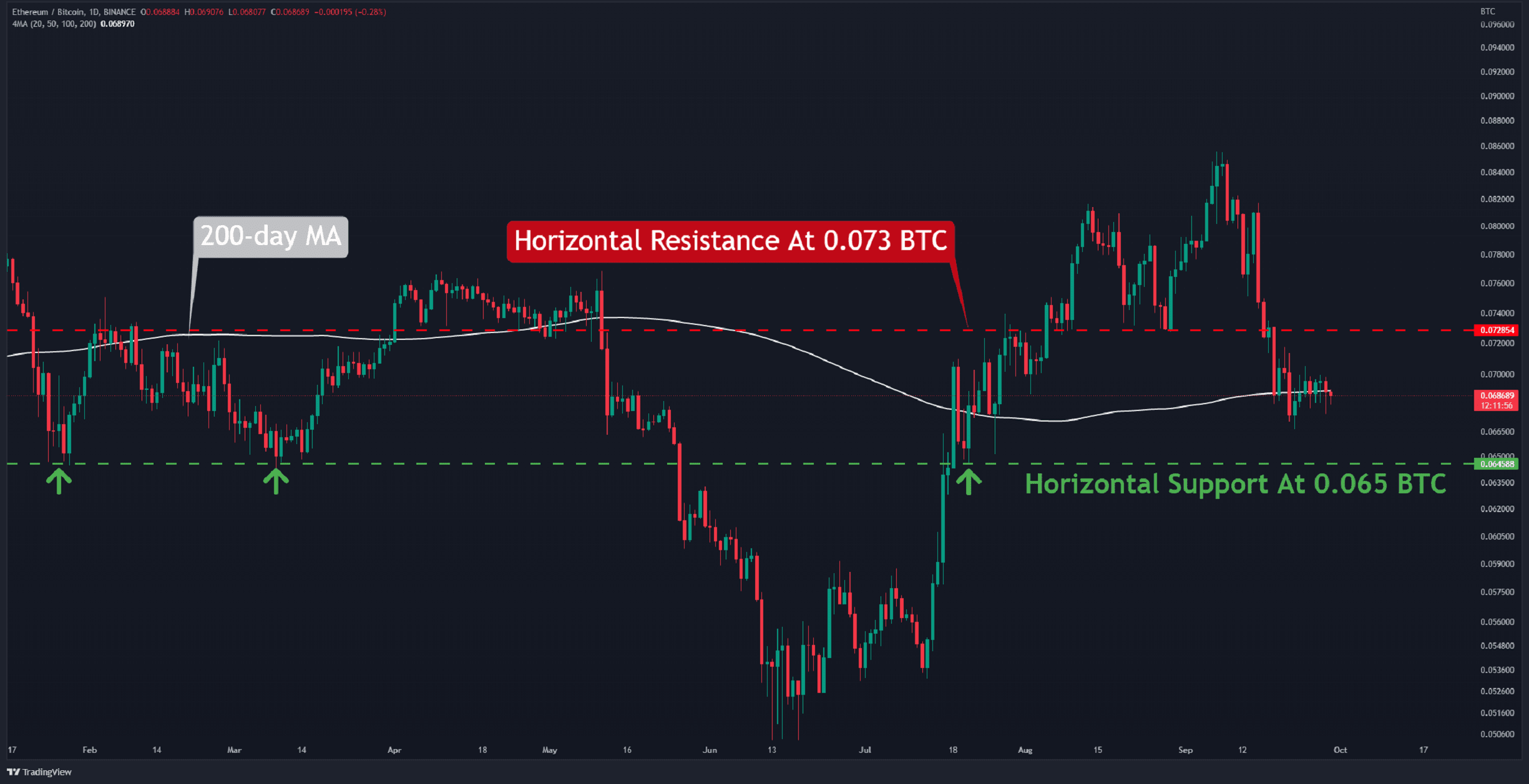

The ETH/BTC Chart

Against BTC, a serious effort is being made to reclaim the 200-day moving average line (in white). Although the pair made it for a short while, currently, it is back below it.

The candlestick structure indicates that the selling pressure continues in the market. This could cause the price to dip towards the horizontal support level of 0.065 BTC (in green).

Furthermore, a positive outlook cannot be obtained until the pair recovers above the horizontal resistance at 0.073 BTC (in red).

Key Support Levels: 0.067 & 0.065 BTC

Key Resistance Levels: 0.073 & 0.08 BTC

On-chain Analysis

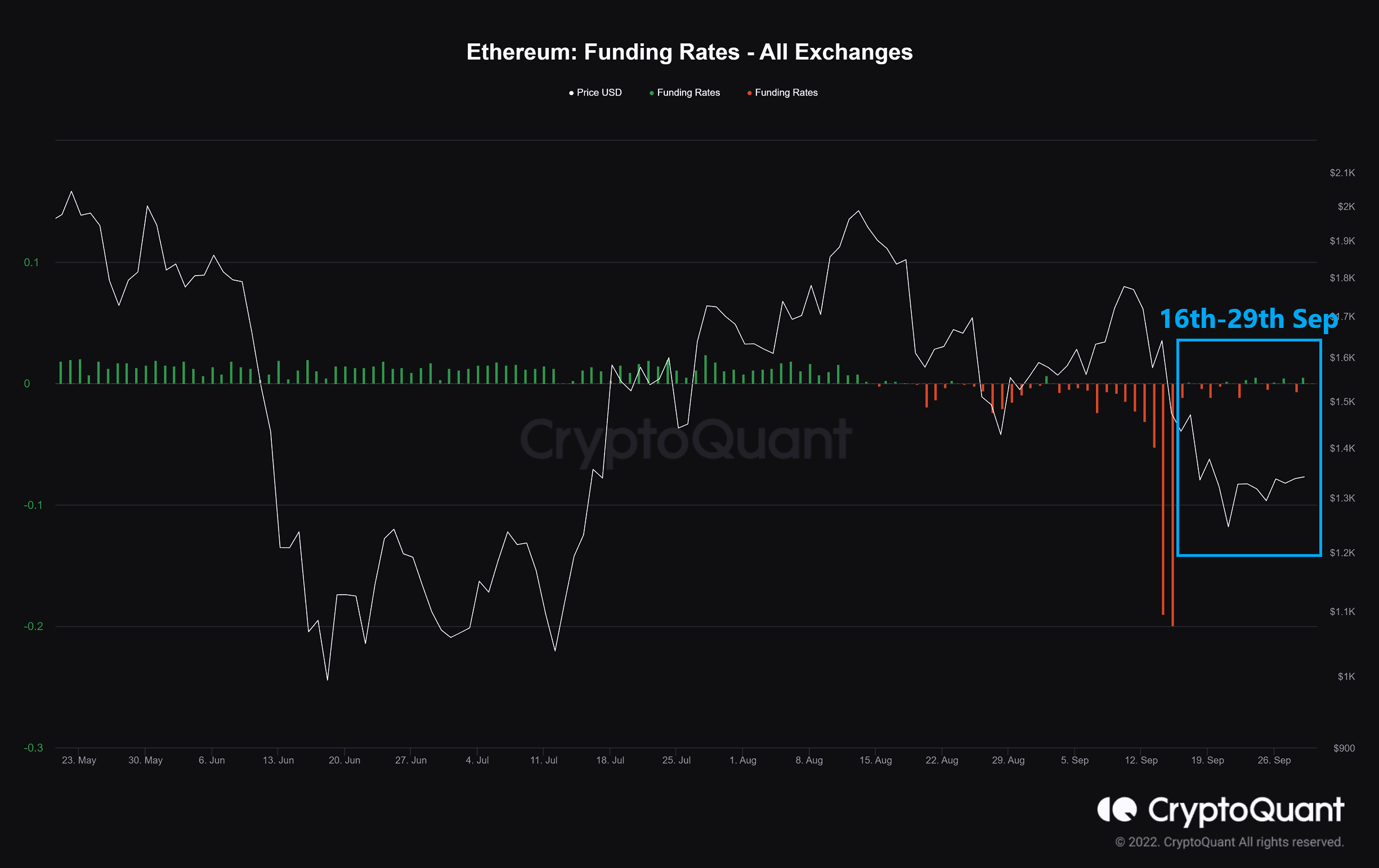

Funding Rates

Definition: Periodic payments made to short and long traders based on the difference between perpetual contract markets/spot prices.

Funding rates represent traders’ sentiment on the perpetual swaps market, and the amount is proportional to the number of contracts.

Positive funding rates indicate that long position traders are dominant and are willing to pay funding to short traders.

According to on-chain data by CryptoQuant, the sentiment in the derivatives market remains neutral, as the funding rate has not changed considerably since September 16. As a result, the market may form a sideways trend. Overall, on-chain data reveals a lack of investor activities on the network.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur