First Mover Americas: Celsius Network Accused of Running a Ponzi Scheme

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

CoinDesk Market Index (CMI)

1,073

−11.4 ▼ 1.0%

Bitcoin (BTC)

$22,885

−252.6 ▼ 1.1%

Ethereum (ETH)

$1,574

−9.5 ▼ 0.6%

S&P 500 futures

4,018.50

−14.0 ▼ 0.3%

FTSE 100

7,720.12

−64.8 ▼ 0.8%

Treasury Yield 10 Years

3.55%

▲ 0.0

BTC/ETH prices per CoinDesk Indices, as of 7 a.m. ET (11 a.m. UTC)

Top Stories

Bankrupt crypto lender Celsius Network used new customer funds to pay for other customers’ withdrawals, the definition of a Ponzi scheme, an independent examiner for the U.S. Bankruptcy Court in New York said in a Tuesday filing. “In every key respect – from how Celsius described its contract with its customers to the risks it took with their crypto assets –how Celsius ran its business differed significantly from what Celsius told its customers,” the independent examiner wrote.

Alameda Research, a trading firm affiliated with FTX, the bankrupt crypto exchange founded by Sam Bankman-Fried,wants to regain $446 million it transferred to bankrupt lender Voyager Digital prior to Alameda’s own bankruptcy filing, a new lawsuit says. According to a complaint filed Monday, Alameda repaid all of its outstanding loans to Voyager after Voyager filed for bankruptcy last July. Some of those loans had yet to mature at the time Voyager requested their repayment.

The price of virtual world The Sandbox’s SAND token is surging ahead of its token unlock scheduled for Feb. 14. Token unlocks are usually bearish because they increase supply. The Sandbox will be releasing 12% of the token’s supply, equivalent to around $273 million worth of SAND. The utility token’s price has increased 90% since the start of the year to 74 cents. Notably, however, the token is down 90% from its all-time high of $8 reached in November 2021.

Chart of the Day

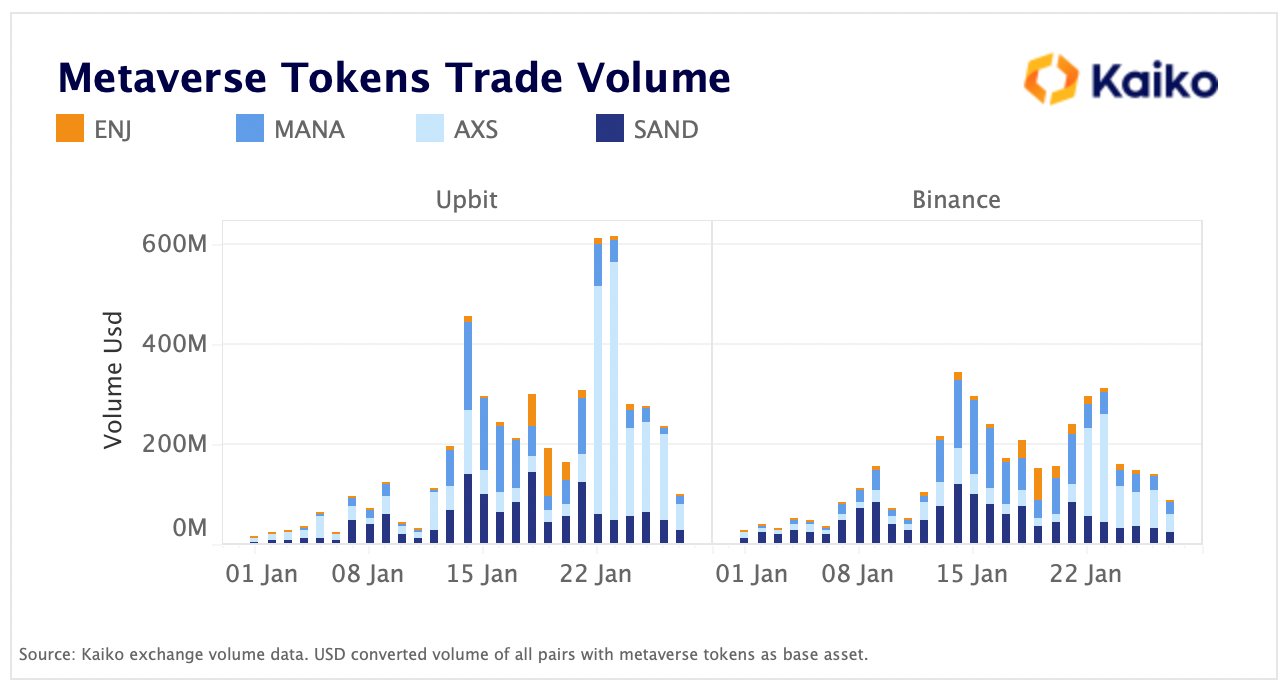

- The two charts show South Korea-based crypto exchange Upbit flipped Binance, the world’s largest crypto exchange by trading volume, last week in terms of trading volume for metaverse tokens.

- «Typically, Binance dominates trading activity across all sectors, thus the trend suggests that the Korean region has a particular affinity for the metaverse,» Paris-based Kaiko Research said.

- Metaverse tokens like AXS, MANA and ENJ have rallied sharply this month.

– Omkar Godbole

Trending Posts

- Bitcoin Community Erupts In Existential Debate Over NFT Project Ordinals

- Hong Kong to Require Stablecoin Licensing as Early as This Year

- UK Crypto Exchange Archax Launches FCA-Regulated Custody Service

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond